Restrict a bank account

Prevent entities from paying AP purchase invoices out of the wrong bank account. Restrict cash accounts created at the top level to desired entities and locations. You can add or remove restrictions as needed for a cash account or entity location.

You can reconcile any cash account for which you have equal or greater entity restrictions as the account.

Before you begin

Enable bank account restrictions in your company. You can turn off restrictions at any time.

-

Go to Company > Admin > Subscriptions > Multi-Entity Management > Configure.

- In the Entity restrictions section, select Cheque accounts and Savings accounts.

Restrict a bank account

Implement restrictions at the top level. You can restrict a bank account to a specific location or you can restrict one or more entities or locations to a specific account. By default, accounts are unrestricted. An unrestricted account is available to top-level companies and all entity-level locations.

You cannot remove a location restriction if it's set as the owning location for the account, or if the account is configured as the default bank account at the entity level.

| Subscription |

Cash Management |

|---|---|

| User type |

Business user with admin privileges |

| Permissions |

Cheque accounts: Add, Edit, View, List Savings accounts: Add, Edit, View, List Credit card accounts: Add, Edit, View, List |

-

Go to Cash Management > All or Setup > Accounts and select the required account type.

- Find the account that you want to restrict.

-

Select Edit at the end of the row.

-

On the Restrictions tab, select one of the following options:

- Unrestricted: The account is available at the top level and all entities.

- Restricted to top level only: The account is available only at the top level of the multi-entity structure.

- Restricted: The account is only available for selected locations, location groups, departments, or department groups within the multi-entity structure.

-

Select Select under Locations or location groups to add or remove locations that can access the account.

-

Select Save.

-

Go to Cash Management > All or Setup > Accounts and select the required account type.

- Find the account and select Edit.

-

On the Restrictions tab, select one of the following options:

- Unrestricted: The account is available at the top level and all entities.

- Restricted to top level only: The account is available only at the top level of the multi-entity structure.

- Restricted: The account is only available for selected locations, location groups, departments, or department groups within the multi-entity structure.

-

Select Select under Locations or location groups to add or remove locations that can access the account.

-

Select Save.

User restrictions and bank restrictions

When restrictions are turned on, the bank account dropdown list in each transaction displays all bank accounts accessible to all locations to which the user has access:

- Unrestricted bank accounts

- Restricted bank accounts based on user and location restrictions

For example:

- Bank of America is unrestricted.

- Chase is restricted to entity Location A and entity Location B.

- Community Bank is restricted to Location B.

- Wells Fargois restricted to Corporate Entity.

- User 1 is restricted to Location A and Location B.

- User 2 is unrestricted.

| User type | At the top level | Corporate entity | Location A | Location B |

|---|---|---|---|---|

|

User 1 (restricted to Location A and Location B) |

Bank of America Chase Community Bank |

(restricted user does not have access to the corporate location) |

Bank of America Chase |

Bank of America Chase Community Bank |

|

User 2 (unrestricted) |

Bank of America Chase Community Bank Wells Fargo |

Bank of America Wells Fargo |

Bank of America Chase |

Bank of America Chase Community Bank |

Inter-entity transactions and bank restrictions

When you restrict a cash account to a location or location group, only that location or group has access to that account. But what if another location is paying the AP purchase invoices for the first location? The location cannot use the account to pay AP purchase invoices, because it does not own that account. If the locations are in different entities, an IET due-to/due-from transaction is created.

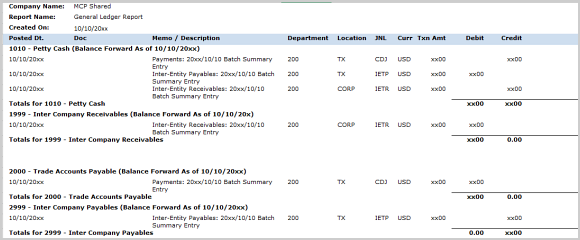

For example, suppose that a location for Texas receives an AP purchase invoice but a Corporate location pays it from an account owned by Corporate. In this case, an inter-entity transaction (due-to/due-from) is created between the two locations or entities. You can see the IET in the General Ledger report.

In a case where an account is restricted by location and another location within the same entity pays the AP purchase invoice, no IET is generated. This is because both locations are children of the same entity.

Field descriptions

The following table describes each option on the Restrictions tab on the Cheque account information and Savings account information pages.

| Field | Description |

|---|---|

|

Unrestricted |

Make this account available to the top-level company and all entity-level locations. This is the default. |

|

Restricted to top level only |

Make this account available to only the top-level company. |

|

Restricted |

Only locations or location groups that you specify can access this account. After you select this option you can add or remove locations that can access this bank account using the Locations or location groups option. You can't remove a location restriction if the location is set as the owner location for the account, or if this bank account is configured as the default bank account. |