Manage project revenue recognition by budgeted cost

Revenue recognition based on budgeted, or projected, project cost calculates revenue based on the date of the actual cost transactions for a given period. The revenue recognition templates for cost automatically calculates cost versus budget as of a desired date. Intacct includes all applicable GL transactions that post on or before that date.

For more information on revenue recognition, see Project revenue recognition.

Key benefits

- Ensures that revenue is recognized using only the applicable actual costs posted within the same reporting period.

- Improves financial accuracy and auditability by eliminating cost blending across periods.

- Reduces timing-related discrepancies in revenue recognition due to late cost transaction postings.

How project revenue recognition by cost works

Revenue recognition by cost determines the project revenue based on actual cost versus budgeted costs.

Actual Cost / Budgeted Cost * Budgeted Billing Amount = Revenue

Actual cost calculation example

A project has a contract amount (budgeted billing amount) of $10,000 and a cost budget of $6,000. In the first month of operation, June 2025, the total costs (labor + materials) equals $1200. This includes $200 of June costs entered during the first week of July. By July 14th, $600 of additional costs have been posted with a July posting date. Revenue recognition is run later in July for revenue costs on or before June 30. Revenue is calculated as 1200/6000 * $10,000 = $2,000, and posted to June 30, 2025 after all June transactions have been posted. The end of June was used as the manage revenue recognition date.

Only June revenue is posted due to the 6/30 date entered in the Revenue posts on or before field. Any transactions posted in the first part of July to the month of June are also be included. Transactions posted to the July period, are not considered, because of the 6/30 Revenue posts on or before that date.

Project revenue recognition by cost workflow

| Subscription |

|

|---|---|

| Regional availability |

|

| User type |

|

| Permissions |

Order Entry or Accounts Receivable

|

| Configuration | Projects must be configured with Track time by = "Project and task" or "Customer, project, and task" to use project data for Percent completed or Milestone templates. |

| Restrictions |

Business users can Add, Edit, Delete, or View revenue recognition templates. Project Manager users can List revenue recognition templates. |

Accurate revenue recognition based on project budgeted (or projected) cost follows this process:

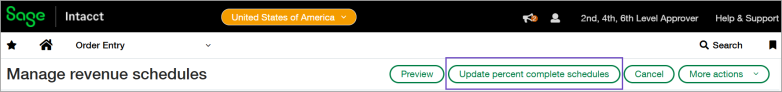

- For project revenue line items, Manage revenue schedules and Update percent complete schedules.

The calculations are performed as a bulk action offline. - When the offline bulk action completes, select Preview to review the revenue line items that need to be recognized as of the prescribed date.

- Select the lines to be recognized and Post.

Perform revenue recognition for budgeted project cost

You can calculate the revenue based on project cost and budget, then display the resulting revenue schedules for review before posting. This feature allows you to effectively manage revenue schedules in Order Entry when using revenue recognition on budgeted cost templates.

For information on creating and managing project revenue recognition schedules, see Project revenue recognition FAQs.

Step 1. Perform bulk action calculations

In this step, you create accurate revenue schedules to post project cost amounts.

- Go to Order Entry > All > Revenue recognition and select Manage revenue schedules.

- Select an Entity level, if you haven't already.

The Update percent complete schedules bulk action feature for revenue recognition is available only at the Entity level. - Under Filters, select the Include unscheduled project revenue checkbox.

This filter includes revenue recognition schedules that contain one or more rows without scheduled posting dates, and is applicable to revenue schedules that use the Percent completed. - Make your selections for other filter options and select Preview.

- Select Update percent complete schedules at the top of the page to perform the calculations as a bulk offline process.

- Select View run to monitor the progress on the Bulk action runs page..

When the bulk action run finishes, you can continue with previewing the results.

Step 2. Review results

- Select Preview.

- Review the revenue for line items to be recognized as of the prescribed date before posting the results.

Step 3. Post

- Select the revenue line items to be recognized.

- Select Post, to post the results for the selected lines.