About 1099 e-filing powered by TaxBandits

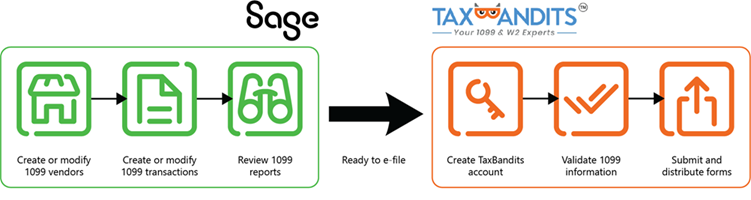

E-file 1099s with our trusted partner, TaxBandits, without having to export files or manipulate spreadsheet data. Our seamless integration allows you to share 1099 data with a click of a button, then continue to the TaxBandits site to file the forms.

Begin the process in Sage Intacct where you create a batch of files that you send to TaxBandits. There, you complete the e-filing process and file forms with the IRS.

In TaxBandits, you can:

-

file state and federal forms.

-

mail forms.

-

grant online access to recipients.

Prepare to e-file

- Verify that you have the right setup.

To e-file with TaxBandits, you need the following.

In Sage Intacct:

Subscribe to Sage Cloud Services.

Go to Company > Admin > Subscriptions > Sage Cloud Services and toggle the switch. Then, select Subscribe.

You do not need to enable any of the features within Sage Cloud Services, just a subscription to the module is enough.

Select Enable 1099 e-filing powered by TaxBandits on the Configure Accounts Payable page.

Verify that you have Accounts Payable permissions for Form 1099: Run.

If you are filing at the entity level, or are filing at the top level and have suppliers that were created at the entity level, enable Issue a separate 1099 per entity in Multi-Entity Management.

If E-file submissions is available in the Accounts Payable menu when you are in an entity, this means that Issue a separate 1099 per entity is already enabled.

In TaxBandits:

Create a TaxBandits account. How you create the account is important, so make sure to read the Help topic.

- Run the 1099 report and export the 1099 file.

Verify that suppliers and employees:

are set up with the correct 1099 default form and box.

have the correct 1099 name.

have expected amounts.

Verify total reportable 1099 amounts.

- Update 1099 information, as necessary.

TaxBandits further validates information after you submit a batch for processing.

Create a batch of 1099 files to send to TaxBandits

Begin the e-filing process in Sage Intacct, where you create a batch of 1099 forms to send to TaxBandits. You can filter by supplier, entity or location, and form type to create a batch. Before you send the batch to TaxBandits, you have the opportunity to download a file to verify information. You can send multiple batches to TaxBandits for processing.

To get a head start, create batches of 1099 forms in Sage Intacct, send them to TaxBandits. Then, review and adjust the data in preparation for e-filing.

Send the batch to TaxBandits

After you create the batch, you can send it to TaxBandits. Depending on how many forms are in the batch, it can take a few minutes for the batch to arrive in your TaxBandit account. You can refresh the page to view the most recent status.

When the batch status changes to "Submitted", click the Batch ID link on the 1099 e-file submission log. This directs you to TaxBandits where you can complete the e-filing process.

-

Submitted: TaxBandits received the batch of 1099 forms. You should see a link in the Batch ID column on the 1099 E-file Submission page.

-

In progress: The batch is being sent to TaxBandits but hasn't yet arrived. This can take a few minutes. Refresh the page to view up-to-date statuses.

-

Failed: Sage Intacct found errors in supplier or transaction data. Select the Action dropdown and select View errors.

Verify and correct 1099 information in TaxBandits

TaxBandits validates 1099 supplier information. After you submit a batch of 1099 files to TaxBandits, if you discover that you need to update information, you can either:

-

Change the information in Sage Intacct and resubmit the batch with the correct data.

-

Change the information in TaxBandits and update information in Sage Intacct at a later time.

This option does not require you to resubmit a batch of updated forms.

E-file in TaxBandits

After 1099 information is correct and accurate in TaxBandits, submit the batch to the IRS. You have the option to mail paper copies to recipients or grant them online access to view forms. You also have the option for state

TaxBandits will email you when the IRS receives your 1099 forms. Check the status of your e-file submission in your TaxBandits account. You can view and manage submitted forms from the Dashboard area.

For information about your TaxBandits e-filing experience, contact TaxBandits support at (704) 684-4751 or support@taxbandits.com.