cash management

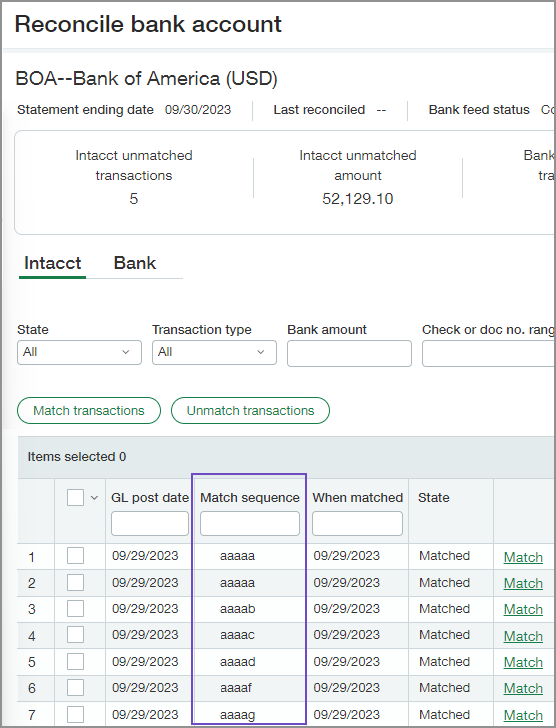

Easily identify matched reconciliation transactions with match sequences

Get visibility into your bank and credit card reconciliation matches with match sequences. You can set up a bank or credit card account to generate a sequence for matched, partially matched, and draft matched transactions. You'll know which transactions matched to which based on the generated sequence.

Details

Each time a transaction is matched, a unique sequence is assigned in the form of lower case letters to each transaction. When you reconcile, the letters become capitalized.

During reconciliation, a match sequence value is assigned for:

-

Automatically matched transactions from an import file or bank feed.

-

Manually matched transactions without a corresponding bank transaction.

All manually matched transactions receive the same match sequence.

-

Partially matched transactions.

-

Draft matched transactions.

If you unmatch transactions, the sequence value is removed. This sequence value will not be reused, so if you rematch the transactions a new value is used.

Use document sequencing to create your match sequence. Use an Alpha sequence type.

-

Go to Company > Document sequences > Add.

-

Select Alpha for the Sequence type.

-

Enter the required fields and any other information you want included in your sequence.

-

Select Save.

After a match sequence has been generated, you can view the sequence for the transaction on the following pages:

-

On the Bank transaction list

-

On the Reconciliation page

-

When you drill down to a transaction during reconciliation to see match information.

On the bank or credit card account record, look for the Reconciliation match sequence section.

-

Go to Cash Management > Accounts and select the account type.

-

Select Add or Edit.

-

In the Reconciliation match sequence section, select the Match sequence.

Only alpha sequences appear for selection.

How it works

You can configure match sequences to only apply to automatically matched transactions or manually matched transactions, or both. Sequences appear as alpha characters. The same sequence is assigned to all transactions in the same matching activity.

Examples

Say you automatically match a Sage Intacct transaction for $100 to a bank transaction credit of $100. Each of these transactions receive a match sequence of, say, aaab. Any subsequently auto-matched transactions receive a sequence lettering of aaac, followed by aaad, and so forth.

Or, say you manually match a Sage Intacct transaction of $50 without a corresponding bank transaction. A match sequence would still apply to this transaction, for example aaaa. Then, you manually match another Sage Intacct transaction without a corresponding bank transaction. This transaction receives the same match sequence, aaaa.

Requirements

| Subscription |

Cash Management |

|---|---|

| Regional availability |

All regions |

| User type | Business user with admin privileges |

| Permissions |

To create a document sequence Company permissions for Document sequence: List, View, Add, Edit |