Construction

Pay your two-party Construction bills with the new joint checks payment method

You spoke and we listened!

You can now use the new joint check payment method to pay your downstream two-party Construction vendors.

Details

Construction companies can use multiple subcontractors to complete some or all of their project. On occasion, those subcontractors can hire another company to complete their contracted work on a project. To avoid unexpected liens against their project for unpaid secondary and tertiary vendors, companies create joint checks to pay their downstream subcontractors.

With the new joint check payment method, Construction contractors can now create and track joint checks for joint payees on Accounts Payable (AP) AP purchase invoices without using a complicated workaround.

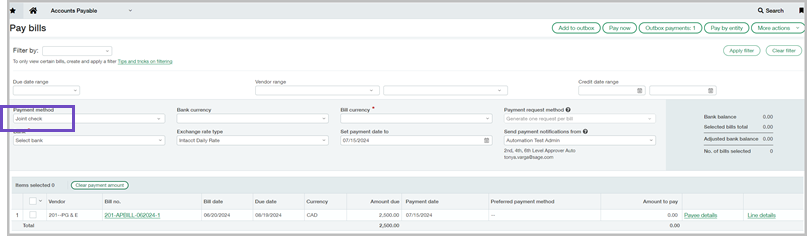

You can now allocate the AP bill to joint payees by selecting the joint payee at the bill level using the Payee details to add the amount. Or, use the Payee line details link on each AP bill entry line to allocate the pay amount for that joint payee.

-

Enable at the top level only when you configure AP (you can turn off at any time).

-

Enabling the joint check feature adds joint payee columns to lists and reports.

-

You can add one or more joint payees on the bill after you save the AP purchase invoice.

-

You cannot delete joint payees from an AP bill after a creating a joint payee payment.

-

Each joint payee on the bill must be unique (case and spaces matter!).

When using the Joint check payment method:

-

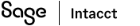

Only AP AP purchase invoices with joint payees display in the Pay bills list.

-

Intacct creates only one check per bill per joint payee.

-

No merge payments in Outbox are created for joint payees.

-

Joint payee does not support credits or discounts.

Example

How it works

Enabling Joint checks is easy.

When you configure AP, select the joint check feature for eligible AP bills.

- Go to Accounts Payable > All > AP purchase invoices. Edit the AP bill to add joint payees.

- Go to Accounts Payable > All > Pay AP purchase invoices.

- Select a joint check Payment method to pay Construction AP purchase invoices. If your company has not created any joint checks, you can delete joint payees on the AP AP purchase invoice until you post a check for the joint payee.

- Select the Construction AP AP purchase invoice you want to pay.

- Use Payee details to enter an amount to pay to the joint payee on the AP purchase invoice. Or use Payee line details to enter an amount to pay on the line of the AP purchase invoice. After assigning amounts to joint payees at the line level or the bill level, the amounts are summarized upstream. Editing an upstream amount removes the detail that you entered on the payee line detail or payee details and assigns the pay amount only to the primary vendor.

Permissions and other requirements

| Subscription |

Accounts Payable Construction |

|---|---|

| Regional availability |

Australia Canada United States United Kingdom (EA) |

| User type |

Business |

| Permissions |

AP purchase invoices: Run Pay bills: Edit |