Joint checks overview—Accounts Payable

If your vendor agreement requires you to pay a bill to one or more joint payees, you can do this using the Joint check payment method. Using this payment method, you can assign amounts to joint payees at the bill level or line level.

Before you can pay joint payees, you need to enable joint checks in your Accounts Payable configuration. After you do so, Intacct allows you to add joint payees to existing bills. Then, in Pay bills, you can use the Joint checks payment method to filter for applicable bills and select the amounts to pay to each joint payee.

When to use the joint check payment method

Add joint payees to bills from vendors who subcontract work, ensuring both the primary vendor and subcontractor are paid. The vendor who submits the bill is the primary vendor and the subcontractor is a joint payee.

When you pay the bill using the Joint check payment method, you determine the amount to pay each joint payee, either at the bill level or at the line level. You can also make a payment to the primary vendor alone.

By default, Joint payee print as uses the format <primary vendor> AND <joint payee>. For example, if the vendor is All Pro Construction and the joint payee is Drywall Experts, the check is issued to "All Pro Construction AND Drywall Experts." You can override this value as needed.

Workflow

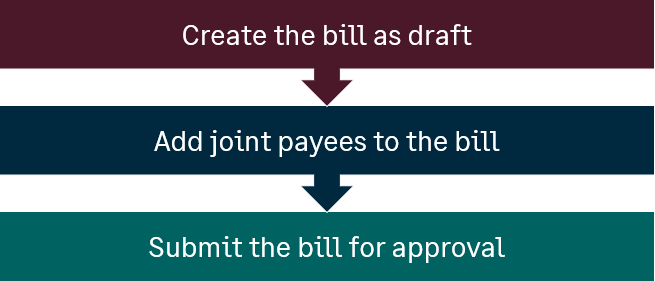

Creating a bill that includes joint payees

Before you can pay a bill with joint checks, you need to add joint payees to the bill. The easiest way to do this is as follows:

- Create the bill: Start by creating the bill as a draft.

- Add joint payees: Edit the draft bill to include joint payees on the Joint payees tab.

- Submit for approval: Submit the bill for approval. Note that adding joint payees after approval requires re-approval.

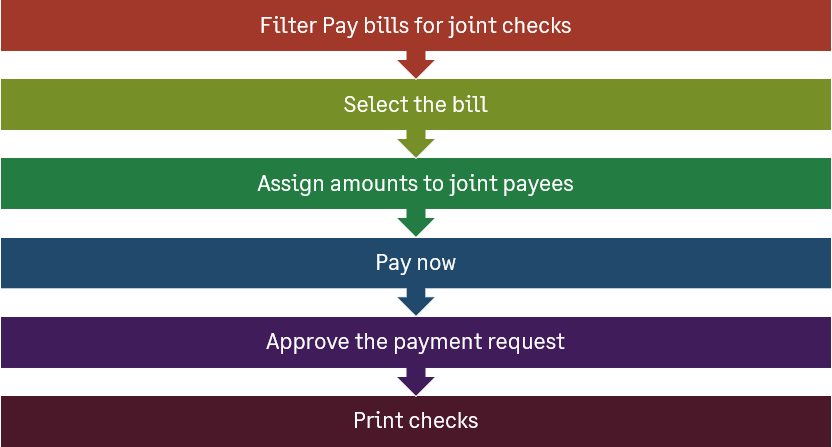

Paying a bill to joint payees

When you're ready to pay the bill, you can do so as follows:

- Filter the bills: In Pay Bills, filter for bills with joint payees by selecting the Joint check payment method.

- Select the bill: Choose the bill you want to pay.

- Enter payment amounts: Use Payee details or Payee line details to enter the amount for each joint payee.

- Process payment: Pay now or add the payment to the outbox for later submission.

- Print checks: After approval, print the checks.

Additional notes about joint checks

- Payment method: Ensure the payment method is set to Joint check. If you select a bill with joint payees without choosing the Joint check payment method, the amount is paid to the primary vendor only.

- One request per bill: Payments using the Joint check payment method generate one payment request per bill and these payments cannot be merged in the outbox.

- Credits and discounts: These cannot be applied to joint payments but can be applied to payments made to the primary vendor alone.

- Enter amounts through Payee details or Payee line details: Amounts that you enter in the Amount to pay field on Pay bills, instead of drilling down into Payee details or Payee line details, are made to the primary vendor only.

This applies only to amounts that you enter directly, as opposed to the total that Intacct calculates based on your entries in Payee details and Payee line details.

Adjusting the Amount to Pay on the Pay Bills page overrides joint payee settings and assigns the amount to the primary vendor only.

Regional availability

The joint check payment method generally available in the following regions:

All regions

Additional information or limitations

CSV import of bills does not support joint payees. Add joint payees after the bill is imported.

Joint checks are not available when using Pay by entity.

Joint checks do not support foreign-to-base currency transactions, where the bill currency is different from the bank currency.