About reversing posted payments—Accounts Receivable

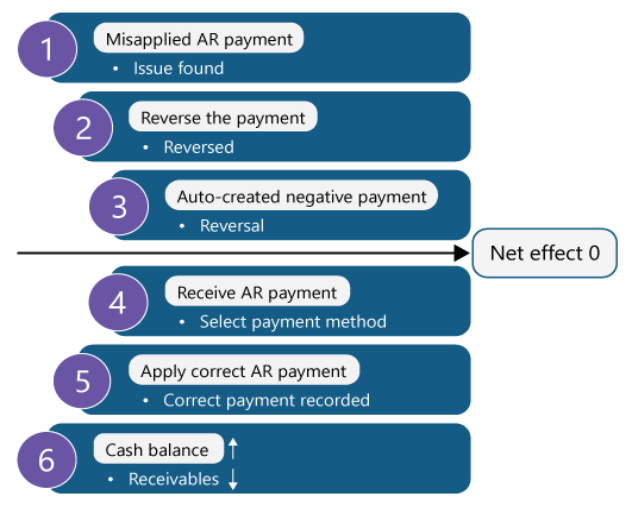

Reversing posted payments is useful in cases where you apply a payment to the wrong customer, or perhaps you apply it on the wrong date. To correct your error, you would reverse the payment, and then apply a new payment to the invoice.

After you reverse a transaction, you cannot undo the reversal. However, you can create another transaction to replace the original.

When reversing a payment, Sage Intacct keeps an audit trail of the reversal. The old transaction is marked as Reversed, and a reverse of the old transaction is created called Reversal. These two transactions create a net effect of zero.

After you reverse a payment, that payment is gone and the invoice is available in Receive Payments again. You can now receive and apply a correct payment to the relevant invoice.

Best practice: Reverse the payment on the same date you applied it so that you get the immediate net effect of zero for that transaction.

How do I access the invoice again to apply the correct payment?

After you reverse a payment against an invoice, that payment is no longer available to apply. Except for the record of its reversal, the payment is gone from Intacct. The invoice amount reverts to the original amount owed.

Because you applied a payment to the invoice, you can't edit the line item details for that invoice. Even though you reversed the payment, you still can't edit the invoice line item details. In this case, you'll need to reverse the original invoice and create a new one.

For example, you receive a $100 payment for Invoice INV_001 that had a balance of $200, then reverse it because you applied the wrong amount. The invoice still carries a balance of $200 owed. You can now receive and apply the correct amount to INV_001.

You can't edit a posted invoice under any of the following conditions:

- Period. The period is closed.

- Permissions. You don't have the relevant permissions.

- Top level. The posted invoice was created at the top level, and you're working at the entity level.

- Accounts Receivable configuration. Your company is set up to not allow you to edit an invoice after it's printed or emailed.

You can make limited edits to a posted invoice under any of the following conditions:

- Payment and allocations. If cash or an allocation has been applied to a posted invoice, then you can only edit the following fields in the invoice:

- Reference number

- Description

- Term

- Due date

- Attachment

- Memo

- Order Entry. If the posted invoice originates in Order Entry, then you can only edit the invoice in Order Entry.

- Entity level. You can edit an invoice created at the entity level, regardless of whether you're working at the entity or top level.