Example: Equity method with affiliate entity in Advanced Ownership Consolidation

Suppose that an ownership structure has a parent entity E100 with subsidiary entities E200, E300, E400, and E401.

The ownership structure in this example has:

- Three levels of parent and subsidiary entities.

- Different ownership percentages per subsidiary entity.

- A subsidiary entity at the lowest level that rolls up to multiple parent entities.

The ownership percentages in this ownership structure are as follows:

- E100 is the top parent entity.

- E100 owns 100% of E200 and E300, and 40% of E400.

- E200 owns 40% of E401.

- E300 owns 30% of E401.

- E400 owns 30% of E401.

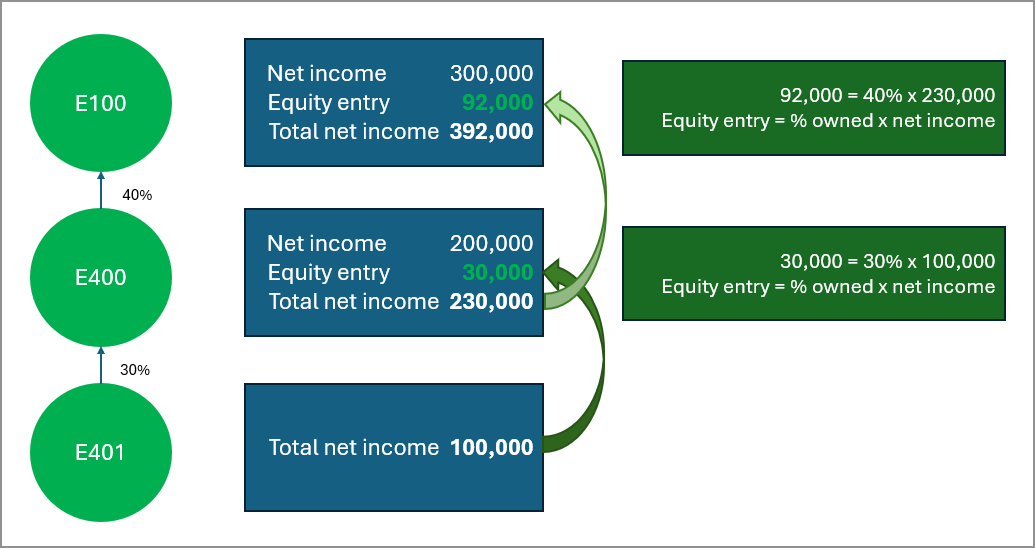

In this example, we're looking specifically at the rollup from E401 to E100, by way of E400. Intacct records the net income of subsidiaries E401 and E400 using equity consolidation method. Examining this rollup on its own enables looking more closely at the impact of using equity consolidation method.

The equity entries roll up from E401 to E100 as shown in the following table:

|

Entity |

Parent entity |

Percentage owned |

Net income |

Total net income |

|---|---|---|---|---|

|

E401 |

E400 |

30% |

100,000 |

100,000 |

|

E400 |

E100 |

40% |

200,000 |

230,000 |

|

E100 |

None |

parent entity |

300,000 |

392,000 |

Equity method during consolidation

In this example, Intacct uses the equity method to consolidate multi-level ownership structures from the bottom up, beginning with E401. The equity entry is calculated as the percent ownership of the subsidiary multiplied by that entity's net income, or Equity entry = % owned x net income.

The equity method entries for subsidiary entity E401 rolling up to E400 and E100 are as follows:

- E401: The parent entity for E401 in this example is E400. Intacct calculates the equity entry and posts it to parent E400. This is 30% x 100,000 = 30,000. Intacct posts 30,000 as equity income to E400.

- E400: Parent entity E100 owns 40% of E400. The total net income for E400 is 230,000. This includes the E400 net income plus the equity income from E401 that Intacct posts to E400 (200,000 + 30,000 = 230,000).

- E100: The parent entity is E100. Intacct calculates the equity entry and posts it to parent E100. This is 40% x 230,00 = 92,000. Adding the equity income from E400 to E100 net income, we get the total income for E100 (92,000 + 300,000 = 392,000).

Report for equity consolidation method

You can run a General Ledger report on the consolidation book and user-defined book to confirm the equity method entries. You can use the affiliate entity dimension to tag automatically equity entries with the relevant affiliate entity, in this case E401.

This General Ledger report includes the following parameters:

- Time period

- Reporting period: Current month.

- As of date: 31 January

- Filters

- Reporting book: Accrual.

- Other books (adjustment and user-defined): User-defined book name for the ownership structure, let's call it Equity UDB.

- Include reporting book: No.

|

Posted date |

Account |

Memo |

Location |

Affiliate entity |

Journal |

Transaction amount |

Debit |

Credit |

Balance |

|---|---|---|---|---|---|---|---|---|---|

|

01 Jan |

1908 Investment income |

Balance forward as of 01 Jan |

None |

None |

None |

None |

None |

None |

0.00 |

|

31 Jan |

1908 Investment income |

Equity entries with consolidation |

E400 |

E401 |

Equity UDB |

30,000.00 |

30,000.00 |

None |

30,000.00 |

|

31 Jan |

1908 investment income |

Totals |

None |

None |

None |

None |

30,000.00 |

0.00 |

30,000.00 |

|

01 Jan |

4002 Subsidiary income |

Balance forward as of 01 Jan |

None |

None |

None |

None |

None |

None |

0.00 |

|

31 Jan |

4002 Subsidiary income |

Equity entries with consolidation |

E400 |

E401 |

Equity UDB |

30,000.00 |

None |

30,000.00 |

-30,000.00 |

|

31 Jan |

4002 Subsidiary income |

Totals |

None |

None |

None |

None |

0.00 |

30,000.00 |

-30,000.00 |

|

None |

None |

Grand total |

None |

None |

None' |

None |

30,000.00 |

30,000.00 |

0.00 |

Using our example, you can run a General Ledger report on the consolidation book for entity E400 that includes entries from the user-defined book for the ownership structure. You can use the affiliate entity dimension to tag automatically equity entries with the relevant affiliate entity, in this case E401.

This General Ledger report includes the following parameters:

- Time period

- Reporting period: Current month.

- As of date: 31 January

- Filters

- Reporting book: Consolidation book for E400.

- Other books (adjustment and user-defined): User-defined book name for the ownership structure, let's call it Equity UDB.

- Include reporting book: No.

|

Posted date |

Account |

Memo |

Location |

Affiliate entity |

Transaction amount |

Debit |

Credit |

Balance |

|---|---|---|---|---|---|---|---|---|

|

01 Jan |

1908 Investment income |

Balance forward as of 01 Jan |

None |

None |

None |

None |

None |

0.00 |

|

31 Jan |

1908 Investment income |

Equity entries with consolidation |

E400 |

E401 |

30,000.00 |

30,000.00 |

None |

30,000.00 |

|

31 Jan |

1908 investment income |

Totals |

None |

None |

None |

30,000.00 |

0.00 |

30,000.00 |

|

01 Jan |

4002 Subsidiary income |

Balance forward as of 01 Jan |

None |

None |

None |

None |

None |

0.00 |

|

31 Jan |

4002 Subsidiary income |

Equity entries with consolidation |

E400 |

E401 |

30,000.00 |

None |

30,000.00 |

-30,000.00 |

|

31 Jan |

4002 Subsidiary income |

Totals |

None |

None |

None |

0.00 |

30,000.00 |

-30,000.00 |

|

None |

None |

Grand total |

None |

None |

None |

30,000.00 |

30,000.00 |

0.00 |

Regional availability

Equity consolidation method is available to customers with a subscription to Advanced Ownership Consolidation in the following regions:

-

Australia

-

Canada

-

South Africa

-

United Kingdom

-

United States