Inter-entity auto-eliminations in Consolidation

Inter-entity transactions are transactions that occur between entities, such as payment by one entity to another for shared services. It's a best practice to select the Inter-entity auto-elimination option for your consolidation book. During consolidation, Intacct automatically eliminates inter-entity receivable and payable balances in the single reporting currency of the consolidation book. These elimination entries are netted out in the elimination entity in the consolidation book, thus avoiding overstatement of the consolidated financial statements.

The basic principle of multi-currency consolidation is to factor the entity balances by the relevant translation rate, and then make the translated journal entries in the consolidation book. Intacct performs a set of calculations to compensate for fluctuations in exchange rates. Intacct then adjusts the source GL account balances to reflect the fluctuation in exchange rates, while offsetting these changes with a CTA (Cumulative Translation Adjustment) account.

An example of inter-entity elimination with 3 currencies

Say that you have three entities: a US entity, a Canadian entity, and an Australian entity, each operating in their own currency. You want to consolidate these entities into USD for consolidated reporting.

The companies share information technology services that create receivable and payable financial obligations in AUD and in CAD. Because all entities must report in USD, all inter-entity transactions must be converted to USD and netted out at the time of consolidation. The consolidation process translates all AUD and CAD transactions into USD in the consolidation book for their respective entities.

At the end of the period, the inter-entity receivable and payable balances for Australia and Canada are shown here:

| Account | Australia | Canada |

|---|---|---|

| 1999 – Inter-entity Receivable | AUD 1,071.37 | 0 |

| 2999 – Inter-entity Payable | 0 | CAD 1,000 |

We are going to consolidate both entities into USD consolidation currency at the end of the period, using the appropriate exchange rate for the currencies:

- Canada balance = CAD 1,000 x 0.8028 = 802.80 USD

- Australia balance = AUD 1,071.37 x 0.7369 = 789.49 USD

The exchange rates vary between CAD-to-USD and AUD-to-USD, but the journal entries themselves use a CAD-to-AUD or AUD-to-CAD exchange rate at the time of the transaction. Here is where the elimination variance account comes in.

| Account | Australia | Canada | US elimination entity |

|---|---|---|---|

| 1999 – Inter-entity Receivable | USD 789.49 | 0 | USD -789.49 |

| 3550 - Elimination variance account | 0 | 0 | USD - 789.49 |

| 2999 – Inter-entity Payable | 0 | USD 802.80 | USD -802.80 |

| 3550 – Elimination variance account | 0 | 0 | USD 802.80 |

To eliminate the inter-entity receivable and payable balances, offset journal entries will be recorded into the US elimination entity for the inter-entity receivable and payable accounts.

The first consolidation period has no balance, whereas the next consolidation period carries the balance from the previous period. Any difference in exchange rates between currencies from one period to the next will result in a currency translation adjustment. These differences are recorded into a cumulative translation adjustment (CTA) account in the applicable consolidated entities where the base entity and consolidation book currencies differ.

Revaluation when transaction currencies differ from the base entity currency

Accounts may be understated or overstated at the end of the period due to exchange rate fluctuations. Revaluation reports calculate unrealized gains and losses associated with open transactions in a foreign currency.

You need to perform a revaluation when either:

- You have an outstanding transaction (commonly in AR and AP) in a foreign currency.

- You have a bank account in a currency different from the base currency of the entity.

Or,

The revaluation process affects the basis on the account balance. You only need to revalue balance sheet accounts, because they're incomplete.

- Realized gain/loss: The effect of changes in the exchange rate between the posting date of a transaction and the date on which the transaction is settled. These are posted to the Income Statement in the Net Income Section. If you have a bill that comes in on one date and is paid on another date, the realized gain/loss is the difference between each day's exchange rate.

- Unrealized gain/loss: The difference between the exchange rate on the posting date of a transaction and the exchange rate at the end of the period. This is used for unsettled (open) transactions. It is posted to the Balance Sheet in the Shareholder Equity Section.

For more information about revaluation, see About the GL Revaluation report.

Inter-entity auto elimination enabled or disabled

Inter-entity auto elimination enabled or not enabled refers to how inter-entity activities will be eliminated between entities during consolidation.

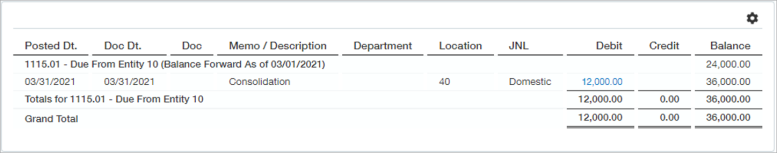

If auto elimination is enabled, all entities in the book are consolidated at the same time, and all inter-entity receivable and payable balances between entities are automatically consolidated and eliminated. The offset to the elimination is the variance posting. The inter-entity activity for the consolidated period is shown here as a debit with a value of 12,000 USD for Location 40.

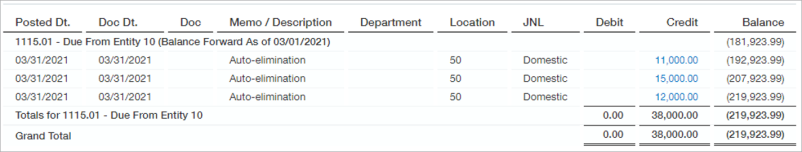

The inter-entity activity for the period is auto-eliminated in the elimination entity, as shown in the following image. The 12,000 USD debit is now eliminated with a 12,000 USD credit for Location 50, the elimination entity. The report also shows other auto-eliminations for inter-entity activity in other entities for the same period.

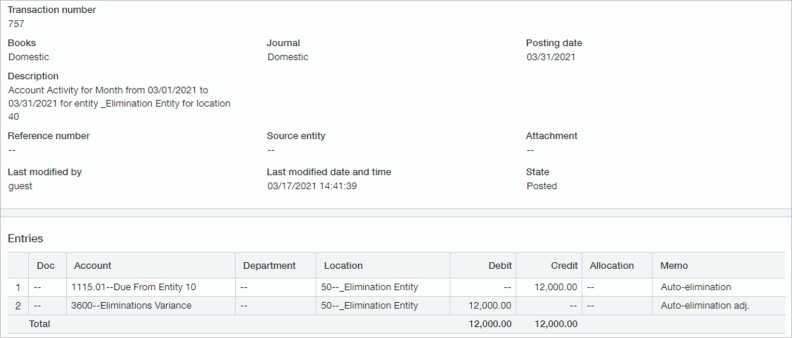

Drilling down into the specific journal entry, notice the 12,000 USD elimination variance offset for the 12,000 USD elimination of the inter-entity activity for Location 40 during the period of March. Location 50 is the elimination entity.

You can use reports to examine inter-entity eliminations and offset adjustments, such as the Balance sheet report with the Financial report writer, General Ledger, and Trial balance standard reports.

If auto-elimination is not enabled, each entity in the book can be consolidated separately or consolidated at the same time. The inter-entity receivable and payable balances are translated into the reporting currency. You must manually post journal entries to eliminate any inter-entity balances.