Other options—Financial Report Writer

Use the Columns tab to specify the number of report columns, the type of value you want to in each column, and the reporting periods for which you want data.

The order in which the tabs appear in the Financial Report Writer can’t be changed.

| Subscription |

Company |

|---|---|

| Regional availability |

All regions |

| User type | Business |

| Permissions | Reports: List, View, Add, Edit, Delete |

Amount type

Every account group has a default method of calculating amounts on reports. For example, account groups that contain income or expense accounts are typically calculated "For the period" so that reports show the income or expense incurred during that reporting period.

You can stick with the default amount type, or you can override this calculation method for a column in your report. If you've already set up an amount type for the rows in your report, Use Rows tab settings uses the amount type that you selected on the Rows tab.

Expand by

Using the Expand by dropdown menu, you can expand 1 column into multiple columns to:

- Break down data by time period (for example, splitting a quarter into individual columns by month).

- Create columns that compare data by dimension (such as department, location, or project) for side-by-side reporting.

- For certain reports, create columns that show the hierarchical structure of a dimension structure or account group.

Learn how to expand a column by time period, dimension, or account group.

Show As

Select a Show as option to change how a value is displayed. For example, you can display an Actual or Budget value as-is, using the Number option. Or, you can display it as an average over time. Additional options are available for computations.

The options that you see in the dropdown menu vary depending on the column type and other factors.

| Options | Description |

|---|---|

|

Number |

Shows the value as a number (such as 10,000). By default, a currency symbol isn't displayed, except on totals and subtotal rows. However, you can use the Format > Rows and totals options to show or hide currency symbols for particular rows. |

|

Daily average |

For actual or budget amounts, displays the amount as an average for an amount of time. For example, if your reporting period is the current month, you can display the amount as a daily or weekly average. |

|

Annualize by days |

Takes the amounts for the current-year-to-date and extrapolates the period to an entire year. This allows you see, for instance, what your estimated expenses would be for the year based on what you've spent so far. Appears only for columns where the reporting period is Current Year To Date. Here's how it works:

|

| Options for computed values |

|

|

Number |

Shows the value as a number (such as 10,000). By default, a currency symbol isn't displayed, except on totals and subtotal rows. However, you can use the Format > Rows and totals options to show or hide currency symbols for particular rows. |

|

Amount with currency |

Displays amounts with a currency symbol. In this case, the currency symbol is displayed for the entire column, even if the Format > Rows and totals tab is set to hide currency symbols for particular rows. To avoid cluttering reports displayed in HTML, the currency symbol appears only on the first row of an account group. When output as a PDF, the currency symbol appears on each row. |

|

Ratio with decimals Ratio without decimals |

Displays the computed value as a ratio relative to 1, with or without decimals. Most often used when 1 value is divided by another value. For example, dividing 100 by 400 would result in a 1:4 ratio, which is displayed as 4. |

|

Percent |

Applies only to columns of type Computation on actual and Computation on budget. For computations that result from division, the result is converted to a percentage and displayed with a percent sign. For example, .25 is displayed as 25%. |

|

Percentage: convert to % |

Applies only to columns of type Summary on columns. Commonly used for computations that divide 2 columns, this option converts the result of the calculation to a percentage, for example, turning .25 into 25%. |

|

Percentage: append % sign |

Appends a percentage sign, without multiplying by 100 to convert to a percentage. For example, .25 is displayed as .25%. Although less commonly-used, this option is available for columns of type Summary on columns and is the default option for period and budget variance columns (which are by definition already percentages). |

Precision

The default precision is 2 decimal places; however, you can override this setting to customize the number of decimal places, if the column is used in a calculation that is displayed as percentages or ratios that can be rounded.

If this feature is available, select the column to set the precision digits and choose the level of precision from the dropdown list. If precision isn't valid for the column selections the selection dropdown isn't available.

Reporting book (compliance, tax, or user-defined)

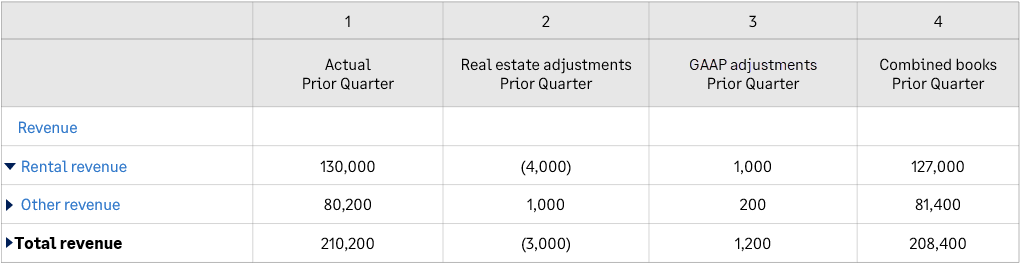

In Intacct, you can create other reporting books for entering transactions that are outside of your actual books. These might include compliance adjustments, Tax adjustments, or other types of transactions that you track in user-defined books.

You can then include these reporting books as needed, on a column-by-column basis, by selecting options in the Reporting book section of the column. By default, amounts from all books are combined together. For example, if you include your compliance book with your accrual book, the report will show accrual amounts with the compliance adjustments applied. However, you can choose to exclude the main reporting book to show only the adjustments. Learn more about reporting on other books.

For example, in a particular report, you might want to include columns for your accrual book, a user-defined book named "Real Estate," and the compliance book. In a final column, you might want to show amounts from all books combined together.

- Column 1: Accrual book

- Column 2: User-defined book; in this example, Real Estate book

- Column 3: GAAP book

- Column 4: Combined books; in this example, accrual + Real Estate + GAAP

Next: Computations tab