Enter a reverse charge—Accounts Payable

In some countries where VAT or GST applies, when you purchase goods and services from suppliers outside of your country, you can apply a reverse charge to shift the responsibility for the VAT from the supplier to yourself. The reverse charge is the amount of VAT that you would have paid if you had bought the good or service in your country. You add that amount to the VAT that you are going to pay and also to the amount you are going to reclaim. This effectively zeros out the amount of VAT you pay.

| Subscription | Accounts Payable |

|---|---|

| User type | Business |

| Permissions | AP supplier invoices: List, View, Edit, Add |

These directions step you through how to use the Multiple taxes on line checkbox to enter a reverse charge for an AP supplier invoice.

- If the AP supplier invoice is not already open, find the desired AP supplier invoice in the AP supplier invoices list and select Edit.

- Ensure the Supplier is based outside the UK.

- Enter a line item for the good or service that you are purchasing.

- Select the Account (or Account label).

- Enter the Amount.

- Select Multiple taxes on line.

- Open the Details area for the line item.

- Enter two lines in the Taxes table to record the amount of VAT.

For the first line, select a tax detail that reflects the VAT you would have paid if you had bought the good or service in the country in which you operate. For the second line, select a tax detail that reverses out that amount.

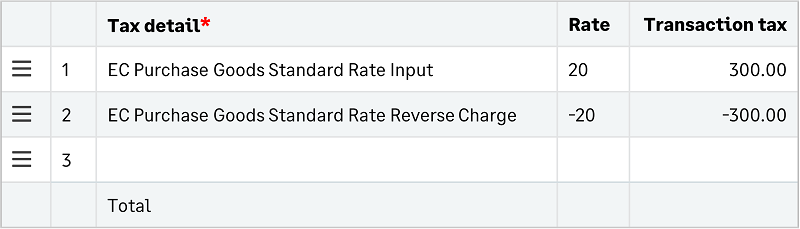

Example: Assume you are in the UK and buy a standard rate item from a supplier in Germany. The entry in the Taxes table for the line item would look like this:

In this example, the tax detail for the Line 1 is posted to an input tax liability account as a debit. The tax detail for Line 2 is posted to an output tax liability account as a credit. The two lines zero out your tax liability.