Waterfall payment method and credits

| Subscription |

Accounts Receivable |

|---|---|

| Regional availability |

All regions |

| User type | Business |

| Permissions |

Manage payments: List, View, and Add |

The Waterfall method is a simple way to apply payment to AR sales invoices, in which Sage Intacct applies payment to each line item of an AR sales invoice, until all line items have been paid. Waterfall is used in the application of credits to AR sales invoices.

To view this page, go to Accounts Receivable > All > AR sales invoices and select Add (circle) next to Receive payments-New!.

Sage Intacct uses the Waterfall method to apply available credit automatically to one or more selected AR sales invoices.

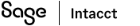

The Waterfall method flows multiple credits as shown in the following diagram:

When applying multiple credits to an AR sales invoice at the same time, Sage Intacct applies the credits in the following order:

- Matching entities: First, Sage Intacct applies the credits to lines in the AR sales invoice belonging to the same entity as the credits.

- Inline

- Advance payment

- Overpayment

- Negative AR sales invoice, or discount.

- Adjustment

Using the Waterfall method, Sage Intacct applies credits in full, beginning at the first line of the AR sales invoice until the credits are fully applied and the AR sales invoice is paid.

In the following example, a credit of 210 units is applied to an AR sales invoice whose total is also 210 units. Sage Intacct applies 100 units of credit to line 1 of the AR sales invoice, which matches the 100 unit amount for line item 1. Sage Intacct then applies 50 units of credit to the 50 unit amount on the second line, and 60 units of credits to the 60 unit amount on the third line.

| AR sales invoice line number | Amount |

|---|---|

| 1 | 100.00 |

| 2 | 50.00 |

| 3 | 60.00 |

| Total | 210.00 |

| Applied order | Line number | Amount | Balance |

|---|---|---|---|

| 1 | 1 | 100.00 | 0.00 |

| 2 | 2 | 50.00 | 0.00 |

| 3 | 3 | 60.00 | 0.00 |

Using the Waterfall method, Sage Intacct applies credits beginning with the first line of the AR sales invoice, until the credit is consumed. Any additional payments or credits are applied to the next line of the AR sales invoice with a balance.

In the following example, the same AR sales invoice has a balance of 210 units. One credit of 140 units is applied to lines 1 and 2, with a balance of 10 units remaining on line 2. A payment is then applied to the remaining balance of 70: first to the 10 unit balance remaining on line 2, and next to the 60 unit balance on line 3. The AR sales invoice is fully paid after the partial credit and payment are applied.

| AR sales invoice line number | Amount |

|---|---|

| 1 | 100.00 |

| 2 | 50.00 |

| 3 | 60.00 |

| Total | 210.00 |

| Applied order | Line number | Amount | Balance |

|---|---|---|---|

| 1 | 1 | 100.00 | 0.00 |

| 2 | 2 | 40.00 | 10.00 |

| Applied order | Line number | Amount | Balance |

|---|---|---|---|

| 1 | 2 | 10.00 | 0.00 |

| 2 | 3 | 60.00 | 0.00 |

Credit handling with the owning entity only

If your multi-entity company limits the application of credits to the owning entity only, then Sage Intacct applies credits to that entity only. If the entirety of the credit can't be applied, the credit remains outstanding until another transaction is recorded for that entity.

When you include negative inline credits in a transaction, all line items within the transaction must belong to the same entity..