About tracking financial transactions by affiliate entity dimension

Automatically track activity by the affiliate entity dimension on all automated inter-entity entries. Intacct still uses inter-entity account mapping to determine the due to and due from accounts for inter-entity transactions. Intacct then automatically applies the affiliate entity dimension to all automatically generated inter-entity entries.

For example, consider an inter-entity loan with a source entity of E101 and target entities E102 and E103. Intacct automatically applies the affiliate entity dimension to the inter-entity entries, as follows:

| Account | Location | Affiliate entity |

|---|---|---|

| IET Receivable | E101 | E102 |

| IET Receivable | E101 | E103 |

| IET Payable | E102 | E101 |

| IET Payable | E103 | E101 |

General Ledger journal entries tagged with the affiliate entity dimension

You can use the affiliate entity dimension to tag manually created General Ledger entries that record inter-entity, investment, and equity transactions.

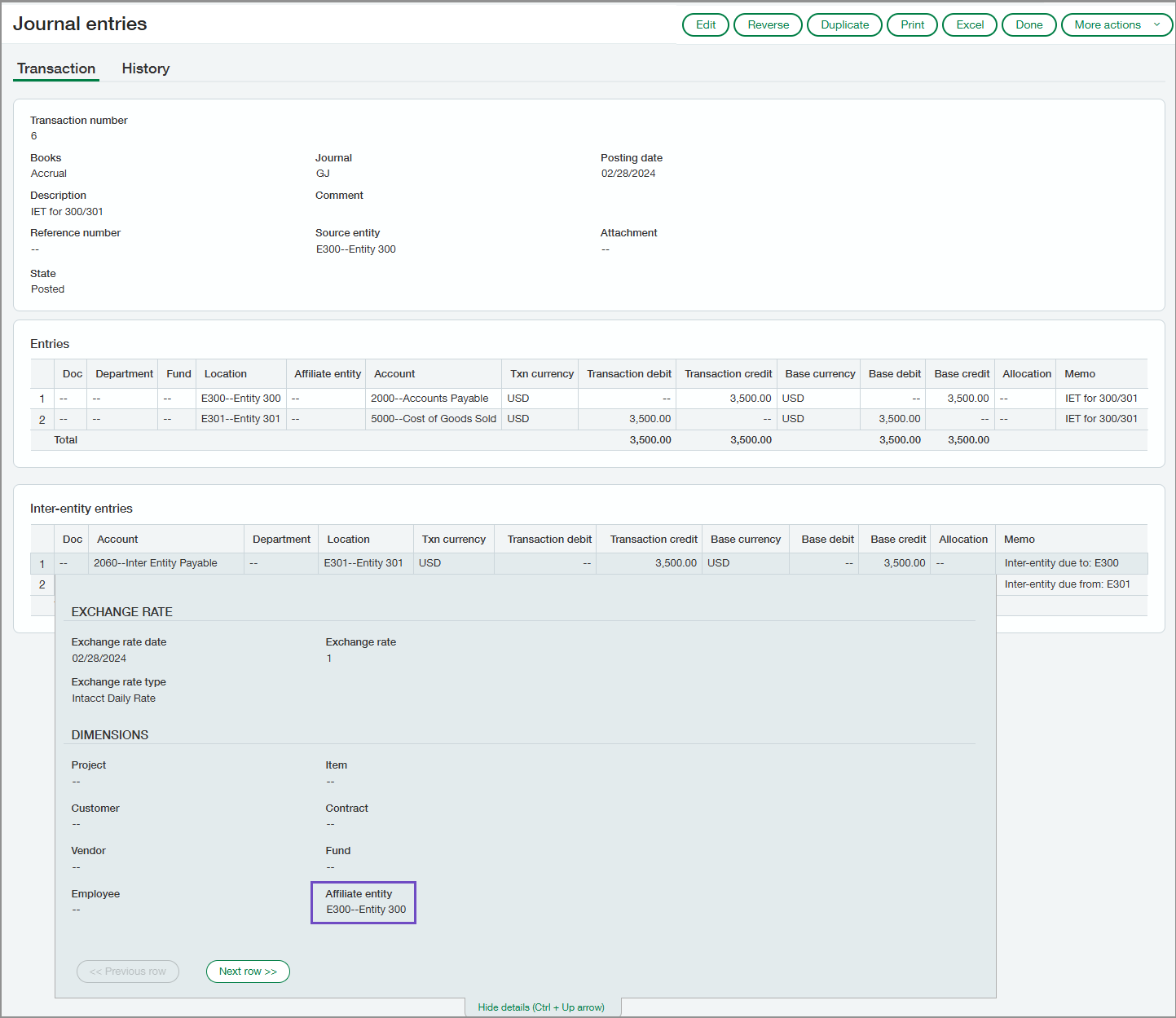

Automatically tagged GL journal entries

The following is an example of a General Ledger journal entry with inter-entity entries that Intacct automatically tagged with the affiliate entity dimension:

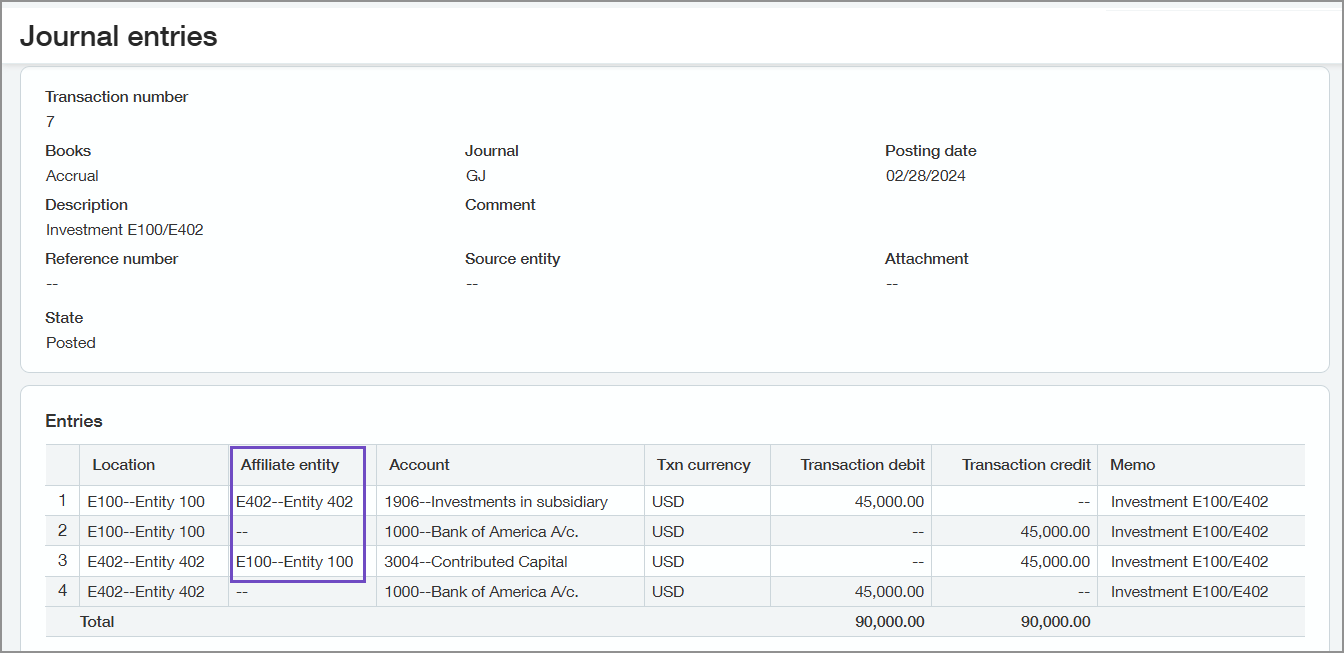

Manually tagged GL journal entries

You can also use the affiliate entity dimension to tag manually created General Ledger entries that record inter-entity, investment, and equity transactions.

The following is an example of a General Ledger journal entry that's manually tagged with the affiliate entity dimension:

Regional availability

The affiliate entity dimension is generally available in the following regions:

- Australia

- Canada

- South Africa

- United Kingdom

- United States