Example: Affiliate entity with basic IET entity plan for automated eliminations

You can use the basic or advanced plan for IET entity pair mappings combined with the affiliate entity dimension to determine elimination entries for automated IET accounts. When eliminating, Intacct gets the entity pair and affiliate entity list from the reporting book entities.

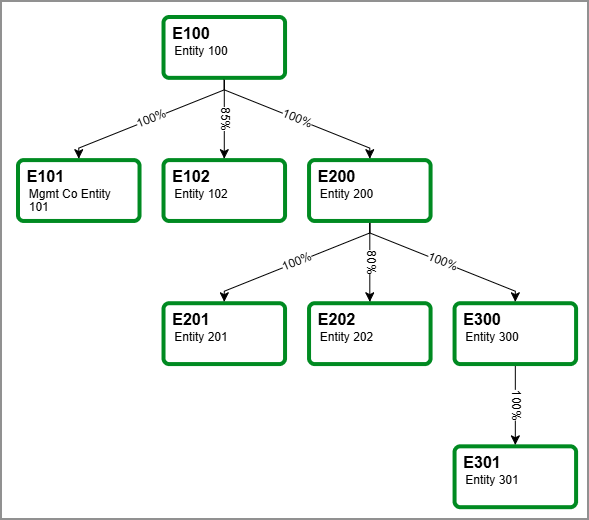

The following consolidation example shows a tiered consolidation that uses Advanced Ownership Consolidation.

The following table lists a simplified IET entity pair mapping plan with accounts for automated IETs from this example reporting book:

| Entity | Receivable account | Payable account |

|---|---|---|

| E100 | 1250 Inter-entity receivable | 2060 Inter-entity payable |

| E101 | 1250 Inter-entity receivable | 2060 Inter-entity payable |

| E102 | 1250 Inter-entity receivable | 2060 Inter-entity payable |

| E200 | 1250 Inter-entity receivable | 2060 Inter-entity payable |

| E201 | 1250 Inter-entity receivable | 2060 Inter-entity payable |

| E202 | 1250 Inter-entity receivable | 2060 Inter-entity payable |

| E300 | 1250 Inter-entity receivable | 2060 Inter-entity payable |

| E301 | 1250 Inter-entity receivable | 2060 Inter-entity payable |

Using the table and the affiliate entity dimension, eliminations will take place as follows:

- E300: Eliminate amounts in IET 1250 and 2060 for affiliate entities, including E300 and E301.

- E200: Eliminate amounts in IET for 1250 and 2060 for affiliate entities, including E300, E201, and E202.

- E100: Eliminate amounts in IET for 1250 and 2060 for affiliate entities, including E200, E101, and E102.

Intacct eliminates only the amounts with matching entities and affiliate entities from the reporting group.

Subset eliminations

For more information about subset eliminations with the affiliate entity dimension, see Example 2: Use the affiliate entity dimension in a subset consolidation book.

Regional availability

The affiliate entity dimension is generally available in the following regions:

- Australia

- Canada

- South Africa

- United Kingdom

- United States