Consolidation methods

Consolidated reports enable you to combine the financial information of a parent company with its subsidiary entities to produce consolidated financial statements. These consolidated statements give you a big picture view of your company's finances.

Consolidated statements are useful under circumstances where your company has the following:

- A complex organizational structure with multiple levels of subsidiaries.

- Or partially owned subsidiaries where you must account for non-controlling interest, or minority interest, in a subsidiary.

Advanced Ownership Consolidation supports consolidated reporting for companies with complex organizational structures by using the Full consolidation, Consolidation, Equity, and Proportional methods to produce accurate consolidated reports.

Full consolidation method

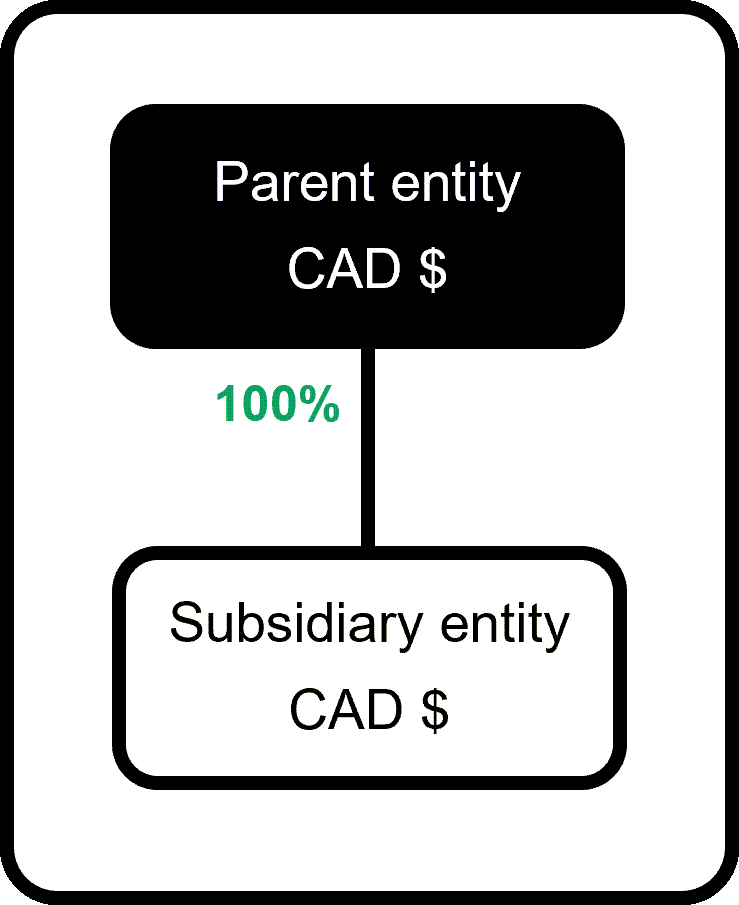

Use the Full consolidation method to consolidate all of the subsidiary’s account activity at 100% of the subsidiary's equity. You use this method when the parent entity fully controls the subsidiary entity. This method combines the financial statements of the parent entity and subsidiary entity to produce a comprehensive consolidated financial statement.

Example posting using the Full consolidation method

You can examine the Full consolidation method in action by running a trial balance report on accrual data for the first period, and then for the consolidation book. Then, you can compare and contrast the reports. You can run the reports for both the parent and subsidiary entities.

You select the Full consolidation method here because the parent entity fully owns the subsidiary entity 100%.

Select the headings to explore examples of trial balance reports that illustrate Consolidation postings using the Full consolidation method:

This report validates that this is the first period with activity. In this example, we run a trial balance report on the accrual reporting book for entity E100. The reporting period is set to the current month and as of Date is December 2023.

The details of the trial balance report are summarized as follows:

- Report name: Trial balance report

- Reporting book: Accrual

- Reporting period: Current month

- As of date: 31 December 2023

- Location: Entity E100

The trial balance report is shown here:

| Account number | Account name | Opening balance on 1 Dec 2023 CAD | Debit CAD | Credit CAD | Closing balance on 31 Dec 2023 CAD |

| 1000 | Bank account | 0.00 | 65,000.00 | 0.00 | 65,000.00 |

| 1200 | Accounts Receivable | 0.00 | 40,000.00 | 0.00 | 40,000.00 |

| 2000 | Accounts Payable | 0.00 | 0.00 | 25,000.00 | -25,000.00 |

| 4000 | Sales | 0.00 | 0.00 | 105,000.00 | -105,000.00 |

| 5000 | Cost of Goods Sold | 0.00 | 25,000.00 | 0.00 | 25,000.00 |

| Totals | blank | 0.00 | 130,000.00 | 130,000.00 | 0.00 |

The trial balance report on the accrual data for the first period of activity shows:

- No opening balance.

- No retained earnings entries as there's no prior period close.

This trial balance report shows consolidation data for the first period with activity. In this example, we run a trial balance report on the Consolidation reporting book for entity E100. The reporting period is set to the current month and as of date is December 2023.

The details of the trial balance report are summarized as follows:

- Report name: Trial balance report

- Reporting book: Consolidation book

- Reporting period: Current month

- As of date: 31 December 2023

- Location: Entity E100

| Account number | Account name | Opening balance on 1 Dec 2023 CAD | Debit CAD | Credit CAD | Closing balance on 31 Dec 2023 CAD |

|---|---|---|---|---|---|

| 1000 | Bank account | 0.00 | 65,000.00 | 0.00 | 65,000.00 |

| 1200 | Accounts Receivable | 0.00 | 40,000.00 | 0.00 | 40,000.00 |

| 2000 | Accounts Payable | 0.00 | 0.00 | 25,000.00 | -25,000.00 |

| 4000 | Sales | 0.00 | 0.00 | 105,000.00 | -105,000.00 |

| 5000 | Cost of Goods Sold | 0.00 | 25,000.00 | 0.00 | 25,000.00 |

| Totals | blank | 0.00 | 130,000.00 | 130,000.00 | 0.00 |

The trial balance report on the Consolidation book for the first period of activity shows:

- No opening balance.

- No retained earnings entries as this is the first period. Retained earnings only appear from the second period onward.

Consolidation method

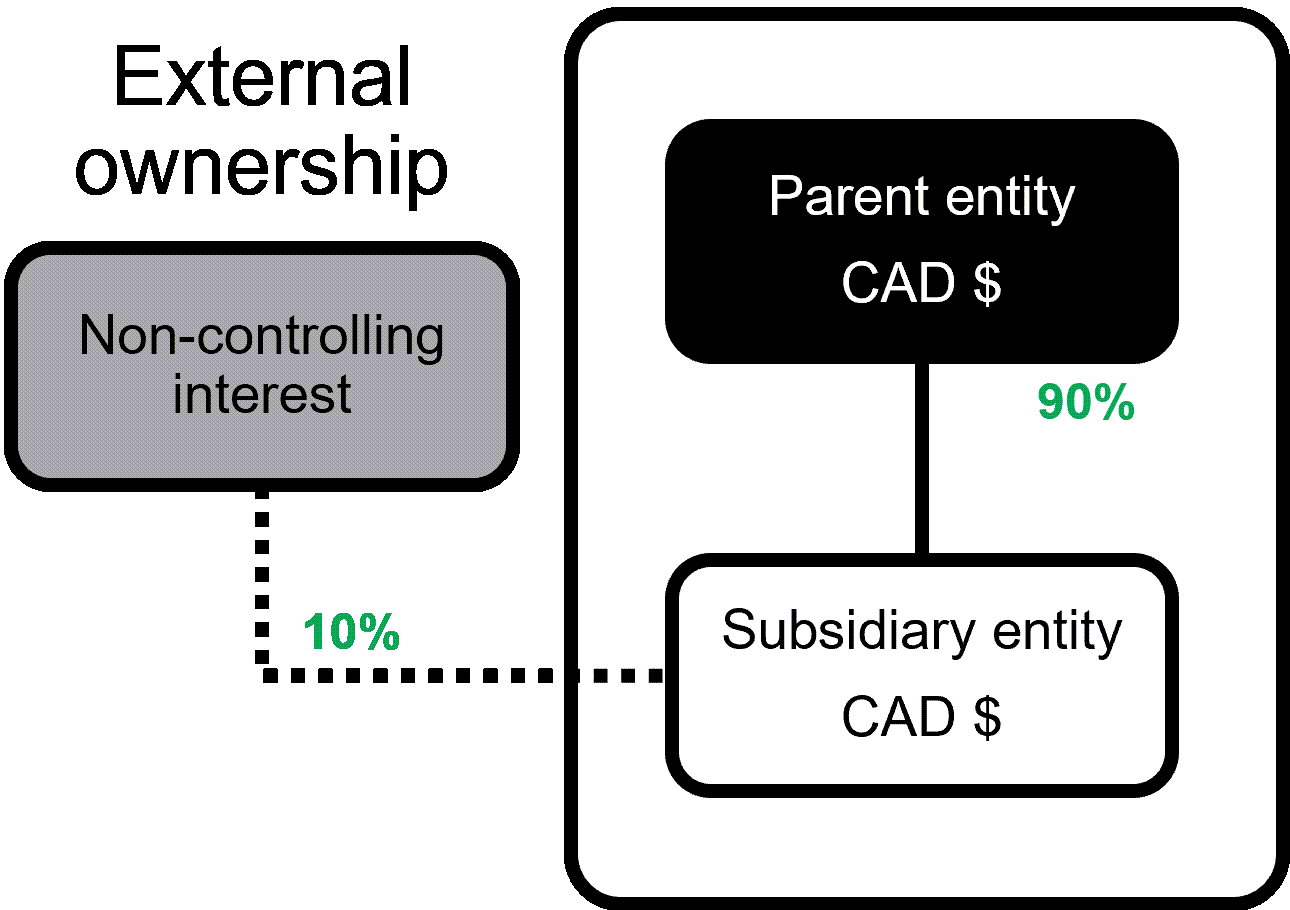

Use the Consolidation method when the parent entity has controlling interest of the subsidiary with ownership less than 100%.

The Consolidation method records 100% of the subsidiary's account activities. Intacct determines the net income or loss for the subsidiary and multiplies that amount by the non-controlling interest percentage (NCI). The NCI percentage is expressed as the portion of the entity that the parent entity does not own, or 100% minus the percent owned.

Or:

NCI percentage = 100% ownership - percent owned

Intacct posts this calculated amount to the net income attributable to NCI account. Intacct posts the offset amount to the NCI equity account.

Example posting using the Consolidation method

For example, suppose that a parent entity owns 90% of a subsidiary. Intacct allocates 10% of the subsidiary's income to non-controlling interest. When consolidating, Intacct automatically generates a non-controlling interest entry to record these amounts. This prevents overstatement.

Select the headings to explore examples of net gain and net loss NCI postings.

Let's say the subsidiary income in this example is 100,000 CAD. The portion that's allocated to non-controlling interest is 10%, or 100% minus 90% ownership of the subsidiary entity. Multiplying the 10% allocated to NCI by the subsidiary income of 100,000 CAD, we get 10,000 CAD.

100% ownership of the subsidiary entity - 90% ownership of the subsidiary entity = 10% allocated to NCI

100,000 CAD x 10% allocated to NCI = 10,000 CAD

Intacct posts 10,000 CAD to the net income attributable to NCI account and posts an offset amount of 10,000 CAD to the NCI equity account.

The following condensed example General Ledger report shows the equity attributed to NCI and the net income attributable to the subsidiary NCI as a net gain:

| Account | Date posted | Memo | Location | Transaction amount | Debit | Credit | Balance |

|---|---|---|---|---|---|---|---|

| 3501 - NCI equity | Jan. 1 | Equity attributed to NCI for entity E200 | E200 elimination | 10,000.00 | 0.00 | 10,000.00 | -10,000 |

| 8000-Net income attributable to subsidiary NCI | Jan. 1 | Income attributed to NCI for entity E200 | E200 elimination | 10,000.00 | 10,000.00 | 0.00 | 10,000 |

Let's say that the subsidiary entity records a loss of 100,000 CAD. The portion that's allocated to non-controlling interest is 10%, or 100% minus 90% ownership of the subsidiary entity. Multiplying the 10% allocated to NCI by the subsidiary loss of income of -100,000 CAD, we get -10,000 CAD.

100% ownership of the subsidiary entity - 90% ownership of the subsidiary entity = 10% allocated to NCI

-100,000 CAD x 10% allocated to NCI = -10,000 CAD

Intacct posts -10,000 CAD to the net income attributable to NCI account and posts an offset amount of -10,000 CAD to the NCI equity account.

The following condensed example General Ledger report shows the equity attributed to NCI and the net income attributable to the subsidiary NCI as a net loss:

| Account | Date posted | Memo | Location | Transaction amount | Debit | Credit | Balance |

|---|---|---|---|---|---|---|---|

| 3501 - NCI equity | Jan. 1 | Equity attributed to NCI for entity E200 | E200 elimination | 10,000.00 | 10,000.00 | 0.00 | 10,000 |

| 8000-Net income attributable to subsidiary NCI | Jan. 1 | Income attributed to NCI for entity E200 | E200 elimination | 10,000.00 | 0.00 | 10,000.00 | -10,000 |

Equity consolidation method

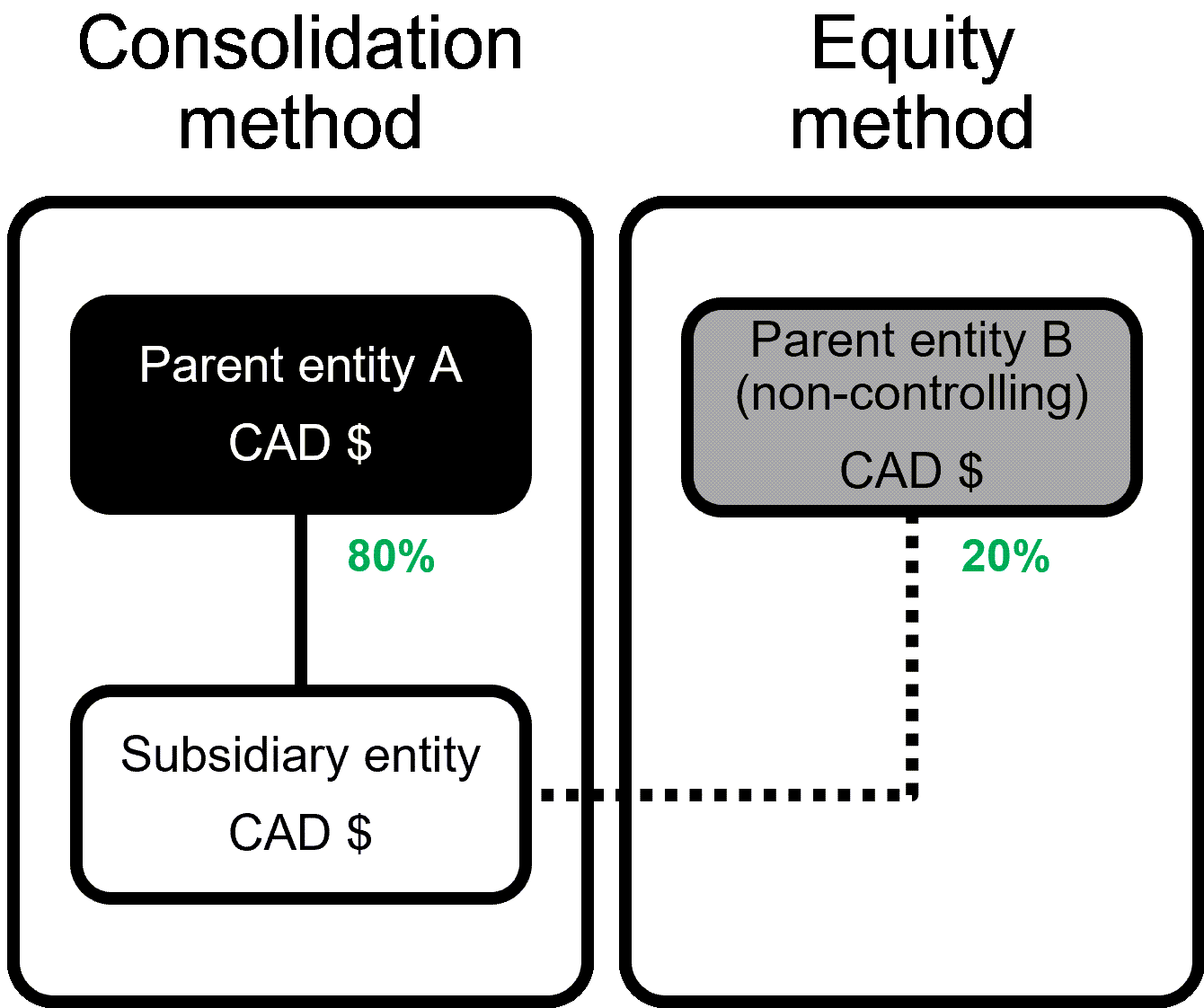

Sage Intacct Advanced Ownership Consolidation supports the equity consolidation method in ownership structures. Use the equity consolidation method to automatically record a subsidiary's net income to the parent entity based on ownership percentage.

The equity consolidation method can be useful when a subsidiary has more than one parent entity and one parent entity or more owns a non-controlling percentage of the subsidiary entity.

Example posting using the Equity consolidation method

Let's say that you have a subsidiary entity E300 with two parent entities that own 80% and 20% of the subsidiary, respectively. Apply the Consolidation method to parent entity A (E100, that owns 80%) and the Equity method to parent entity B (E200, that owns 20%).

- E100 (parent entity A): Given a subsidiary income of 100,000, we can calculate the investment in subsidiary current income as 100,000 x 80% and post the remainder to parent entity E100 as 20,000.00. 100% ownership of the subsidiary entity - 80% ownership of the subsidiary entity = 20% posted to the parent entity. Intacct uses the consolidation method here.

- E200 (parent entity B): We can calculate the subsidiary income for entity E300 as 100,000 x 20%, which we post to the user-defined book. Intacct uses the equity consolidation method here.

| Account | Date posted | Memo | Location | Transaction amount | Debit | Credit | Balance |

|---|---|---|---|---|---|---|---|

| 1908 Investment in subsidiary | Jan. 1 | Investment in subsidiary current income | E100 | 20,000.00 | 20,000.00 | 0.00 | 20,000 |

| 4002 Subsidiary income | Jan. 1 | Subsidiary income for entity E300 | E300 | 20,000.00 | 0.00 | 20,000.00 | -20,000 |

Proportional method

Use the Proportional consolidation method for management reporting only. Select to consolidate by recording the percentage of ownership you define. The proportional consolidation method distributes the account activity of an entity based on the percentage defined.

Regional availability

Advanced Ownership Consolidation is generally available in the following regions:

All regions