Cumulative Translation Adjustment accounts and translation rate methods

CTA accounts, or Cumulative Translation Adjustment accounts, are special accounts where currency conversion rounding transactions are posted for balance sheet accounts. They accumulate the gains and losses that result from varying exchange rates over a period that are not due to any business activity.

Typically, CTA accounts are balance sheet accounts that include the equity accounts on your chart of accounts. They are non-closing, credit-normal accounts, and are shared across multiple entities within the consolidation books.

Translation rate method and CTA

The CTA account is used to track how the value of accounts changes over time due to translation rate fluctuation, as opposed to the changes in value due to business activity.

The translation methods include:

Ending spot rate

Ending spot rate is generally used for all balance sheet accounts, unless overridden in the Accounts to override tab. The ending spot rate reflects values as a snapshot of a particular date and is not typically used with retained earnings or other types of accounts (for details, see Historical rate).

For accounts using the ending spot rate, Intacct calculates the CTA by finding the difference between the value at the end of the prior period and the end of the current period. The difference is the CTA, which is posted to the net asset account specified in the consolidation book.

An example is shown in Ending spot rate calculation and the effects on CTA.

Weighted average rate

Weighted average rate is typically used for all income statement accounts. All account activity for the reporting period is consolidated and translated using the weighted average rate. The weighted average rate is the average of daily exchange rates during a specific period. Intacct adds together the daily rate for each day in the period and then divides the sum by the total number of days in that period. For example, the weighted average rate for January 1-6 would include the daily rate for January 1, 2, 3, and so on, through January 6, summed up and divided by 6.

When consolidating using weighted average rate, Intacct posts the following:

- Balance sheet adjustment: This is the difference in exchange rates (prior month to current month spot rate) multiplied by the opening balance from the accrual book.

- CTA as a sum of:

- Net asset adjustment: This is the offset posting for the sum of all the balance sheet adjustments created for each net asset account balance sheet adjustment between the current and prior month spot rate. This generates a balance sheet adjustment for each asset account with balances and a corresponding CTA net asset adjustment.

- Net income adjustment: After all translations are done for all balance sheet account activity (using the spot rate), and income statement account activity (using the weighted average rate), the difference generates a CTA net income adjustment.

Historical rate

The historical rate is the currency exchange rate in effect at the time a transaction is performed, for example, when a fixed asset is acquired. The historical rate is typically used in the valuation of non-monetary accounts, including fixed assets, inventory, depreciation or amortization accounts for capital assets, goodwill, additional paid in capital, and retained earnings.

The Accounts to override tab enables you to lock in the historical rates for non-monetary asset accounts for transaction dates. These accounts are not revalued every month. Any accounts you want to translate consistently using the weighted average or ending spot rates should be left out of the Accounts to override tab for the book.

Sometimes an historical rate expires for an account listed in the Accounts to override tab. When this happens, Intacct continues to use the historical rate with the Intacct Daily Rate to translate all transactions for the account, rather than the weighted average or ending spot rates.

If you have a consolidation book in which you mistakenly included accounts that do not belong in the Accounts to override tab, inactivate that book and set up a new one with the correct accounts added to the Accounts to override tab.

An example is shown in Historical rate closeout.

About booking to a CTA account

Booking this type of gain or loss into a CTA account enables separating non-business activity when reporting and tracking changes.

Because consolidation books have dedicated journals, only one CTA account is required, even if there are multiple consolidation books. CTA journal entries are posted to the same GL account but different journals.

Best practice: Many find it useful to track CTA for net assets and net income in the same GL account.

If your company was set up using a QuickStart, you already have the CTA account category (Cumulative Translation Adjustment) and can assign an account with this category. After a CTA account is set up, Intacct automatically calculates the CTA for each period and posts that amount to the CTA account.

CTA is calculated for accounts that use the ending spot rate or weighted average rate.

Depending on the configuration, some accounts can be overridden by the historical rate. CTA net assets are calculated for subsequent months, but not CTA income.

| Translation rate method | CTA | CTA calculation |

|---|---|---|

|

Ending spot rate |

Yes |

The difference between the value at the end of the prior period and the end of the current period. |

|

Weighted average rate |

Yes |

The difference between the value on the transaction date and the calculated value using the average exchange rate for the period. |

|

Historical rate |

Depends |

Depending on the configuration, some accounts can be overridden by the historical rate. CTA net assets are calculated for subsequent months, but not CTA income. |

The following examples show different ways in which entries are booked to CTA accounts. These are simplified examples to show booking to CTA accounts. In reality, there would probably be other accounts affected by the currency change as well.

- Non-reciprocal exchange rates

- Gain or loss from exchange rate without activity

- Ending spot rate calculation and the effects on CTA

- Effects of currency translation and CTA on the consolidation book balance

- Historical rate closeout

Non-reciprocal exchange rates

In this example:

- A US entity has an inter-entity transaction of 1,000 GBP with a UK entity. The transaction appears on the US balance sheet as 1,100 ZAR, using an exchange rate of 1.1.

- On the income statement, the revenue is valued at an exchange rate of 1.15. The revenue is exchanged at 1,150 ZAR on the income statement.

In this case, the CTA is credited 50 ZAR to balance the difference.

| Acct | Balance sheet | Acct | Income statement | |

|---|---|---|---|---|

| Exch rate 1.1 (GBP to ZAR) |

Exch rate 1.15 (ZAR to GBP) |

|||

| AR (GBP) | 1,000 | Revenue (GBP) | 1,000 | |

| AR (ZAR) | 1,100 | Revenue (ZAR) | 1,150 | |

| CTA | 50 |

Gain or loss from exchange rate without activity

In this example, the asset amount in GBP does not change, but the exchange rate does. The top level is consolidating net assets from a UK entity (GBP) to the corporate entity (ZAR) for a two-month period.

- The spot exchange rate for January is 1.1.

- The spot exchange rate for February increases to 1.2.

Although there has been no business activity, the value of the net assets increases. To balance the accounts, 1,000 ZAR is added to the CTA net assets account. This is added to the consolidation book.

| Net assets | Jan | Feb | Added to CTA net assets |

|---|---|---|---|

| GBP | 10,000 | 10,000 | 0 |

| Exch rate | 1.1 | 1.2 | |

| CONS/ZAR | 11,000 | 12,000 | 1,000 |

Ending spot rate calculation and the effects on CTA

The following example shows the calculation of the CTA balance sheet adjustment for a balance sheet account that uses the spot rate. This example shows the calculation of the currency translation opening balance from CAD to ZAR.

In this example, the CTA balance sheet adjustment is calculated as follows. The difference in exchange rate, being the prior month spot rate minus the current month spot rate, is multiplied by the opening balance from the accrual book.

Or:

CTA balance sheet adjustment = Difference in exchange rates (prior month - current month spot rate) x Opening balance from the accrual book

The CTA balance sheet adjustment is highlighted in green.

| Calculating currency translation opening balance from CAD to USD | ||

| Description | Accrual book | Rate |

|---|---|---|

| Previous month exchange rate (November 30) | 0.7317 | Previous month's spot rate |

| Current month exchange rate (December 31) | 0.7462 | Current month's spot rate |

| Difference in exchange rate | 0.0145 | |

| Opening balance (accrual book) | 8201.40 | |

| Net asset CTA balance sheet adjustment | 118.92 | |

In this example, the previous spot rate is subtracted from the current spot rate (0.7462-0.7317) to produce the difference in exchange rate (0.0145). The difference is multiplied by the opening balance in the accrual book (8201.40) to produce a net asset CTA balance sheet adjustment of 118.92.

The difference between the current and previous exchange rates is positive, resulting in a debit to the source account. Conversely, a negative difference between the current and previous exchange rates produces a credit to the source account.

Effects of currency translation and CTA on the book balance

Continuing the example when converting currency from CAD to ZAR, the following table shows how the currency translation and cumulative translation account adjustment (CTA) affect the consolidation book balance.

When translating from the accrual to the consolidation book, the following happens:

-

Intacct adds the consolidation book opening balance to the product of the debit accrual activity and the exchange rate.

-

Then, Intacct subtracts the product of the credit accrual activity and the exchange rate.

-

Finally, Intacct adds or subtracts the balance sheet adjustment as calculated in the preceding example (in this case, 118.92).

The result is the ending consolidation book balance.

Or:

Consolidation book opening balance + (debit accrual activity x exchange rate) - (credit accrual activity x exchange rate) +/- balance sheet adjustment = ending consolidation book balance.

| Calculating currency activity from CAD to USD in consolidation book | |||

| Description | Accrual book | Current month spot rate | Consolidation book |

|---|---|---|---|

| Opening balance | 8201.40 | 6000.96 | |

| Debits (before and after translation) | 1315.00 | 0.7462 | 981.25 |

| Credits (before and after translation) | -100.00 | 0.7462 | -74.62 |

| Net CTA balance sheet adjustment | 118.92 | ||

| Ending balance | 9416.40 | 7026.51 | |

Balances are broken down into debits and credits by consolidated dimensions.

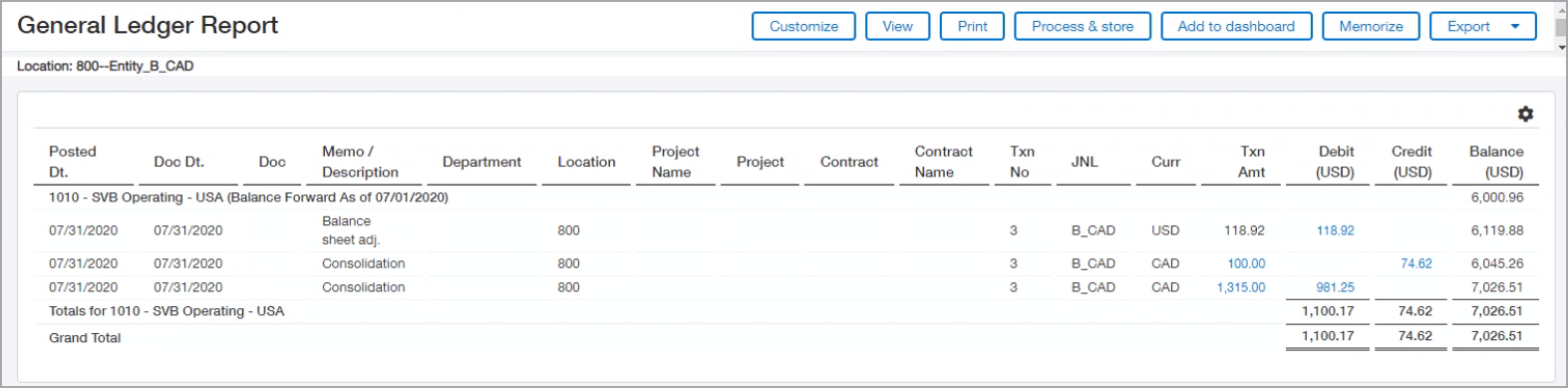

If you run a General Ledger report on the consolidation book, the journal entry looks like this:

Historical rate closeout

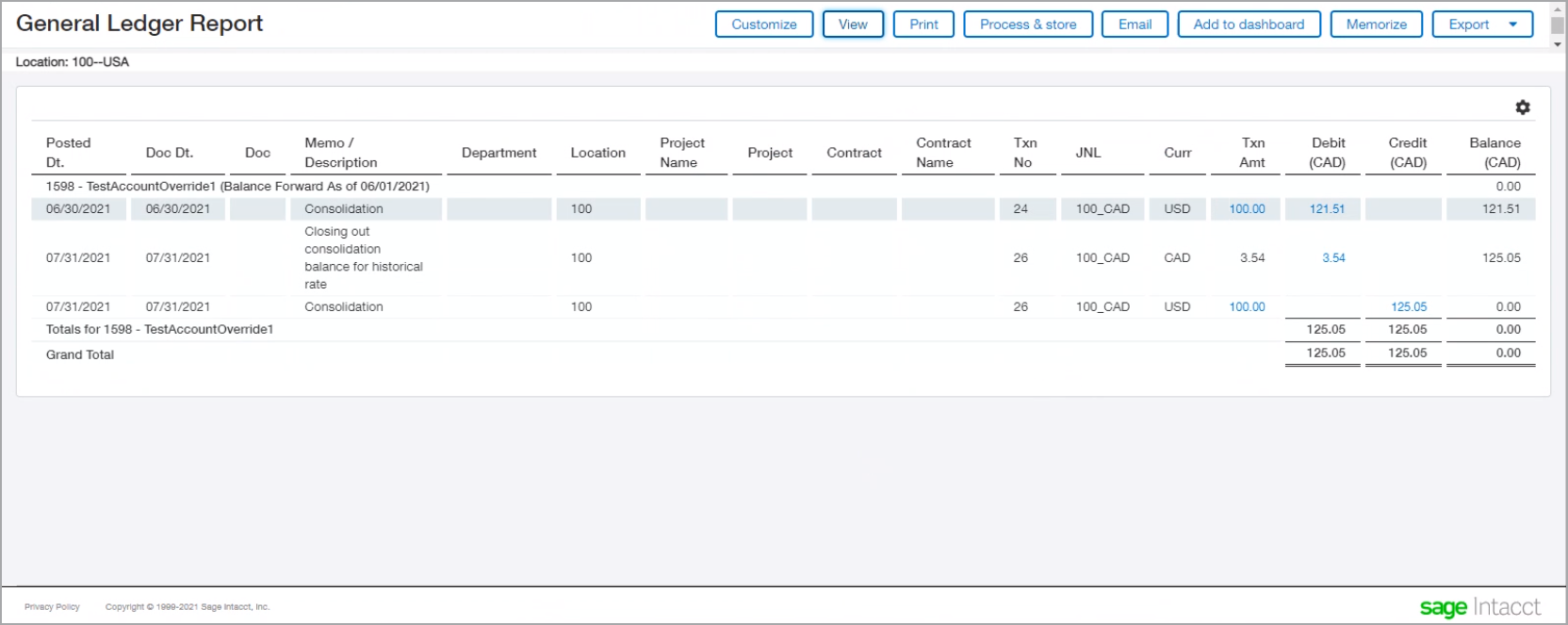

The following sample General Ledger report shows:

- a consolidation transaction,

- an accrual entry,

- and a closeout transaction.

If a historical rate override account has a remaining balance in a consolidation book, and the accrual account balance goes to zero, Intacct generates a historical rate closeout transaction on the consolidation book. This closeout transaction brings to zero the historical rate override account.

In the following example, the entity operates in ZAR, and the consolidation book translates the transaction currency into Canadian dollars. The General Ledger report shown here summarizes the historical rate closeout.

| Historical rate closeout from ZAR to CAD | |||

| Description | Accrual book | Historical rate | Consolidation book |

|---|---|---|---|

|

Opening balance |

100 ZAR |

1.2151 June 15 |

121.51 CAD |

|

Credit to close out the account balance in accrual |

-100.00 ZAR |

1.2505 July 15 |

-125.05 CAD |

|

Historical rate closeout |

3.54 CAD |

||

|

Ending balance |

0 |

0 |

|

The opening balance in the accrual book is 100 ZAR. The consolidation process for June generates a transaction in the amount of 121.51 CAD, using the historical rate for June 15 taken from the original accrual transaction.

In July, a credit to the accrual book for 100 ZAR brings to zero the account balance from June. The consolidation process for July generates a consolidation transaction of 125.05 CAD, using the historical rate for July 15 taken from the original accrual transaction.

The balance on the consolidation book does not net to zero. As such, the consolidation process generates a historical rate closeout of 3.54 CAD. The historical rate closeout brings to zero the accrual and consolidation books.

The offset to the historical closeout entry posts to the CTA net income account. This is the CTA net income account specified in the consolidation book.

Credit and debit

For details about credits and debits in the context of inter-entity transactions and inter-entity auto-eliminations, see Inter-entity auto-eliminations in Consolidation.

Inter-entity elimination CTA example

Global Consolidation uses the CTA adjustment to record the currency fluctuation for the inter-entity transaction (IET) balances across entities with different base currencies.

IET eliminations are recorded in the elimination entity only. Often the debit and credit won’t match due to differences of the base currencies among the two entities. But the elimination must balance, so a CTA account is used to equalize the debit and credit.

For example, suppose that:

- a US entity has an inter-entity receivable of $500,000 USD

- the associated UK entity has an invoice inter-entity payable of GBP 520,000 ($500,000 USD)

When eliminating the two, they don’t match because the exchange rate has changed. In this case, let's say there's a $20,000 difference. Because the difference isn't a direct business transaction, the difference goes to the CTA account of the elimination entity.

Inter-entity elimination in Domestic Consolidation

When you select an elimination adjustment account in an existing book, Intacct automatically posts elimination variances to the new elimination adjustment account. When consolidating a new book, you can select a different elimination adjustment account after creating the book.

You can select a separate elimination adjustment account for each book, whether it's a Global Consolidation or Domestic Consolidation book.

You can find the Elimination adjustment account drop-down list on the Entities to consolidate tab of any book, when you select Inter-entity auto-elimination.

The elimination adjustment GL account is set up as:

- Included in the equity accounts on your chart of accounts

- Balance sheet account

- Credit normal

- Non-closing