Partial ownership of subsidiaries — Management Console Consolidation

Partial ownership occurs when the parent company owns less than 100% of a subsidiary. Partial ownership of a subsidiary is defined in the Subsidiary information page (

The number you enter there becomes the default percentage at which all the subsidiary's transactions are consolidated for all the consolidation periods. If there are changes in ownership for one or more specific periods, you can change the percentage ownership in the affected period(s) via parent consolidation records: Subsidiary periods [Continue] Subsidiary period mappings [Edit] Consolidation period editor.

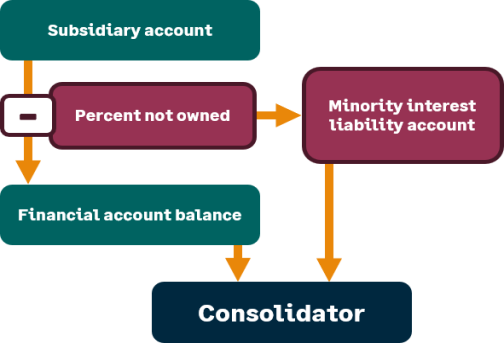

To compensate for ownership of less that 100%, the percentage you do not own is subtracted and placed in the minority interest liability account and offset in the minority interest Income or expense account (

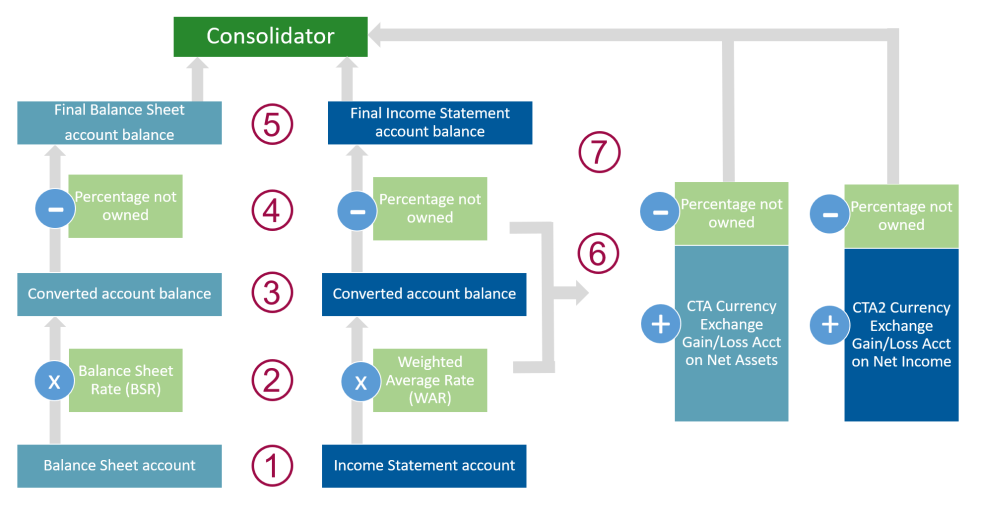

As shown in the illustration above, partial ownership in a consolidation where the parent and subsidiaries all use the same currency is relatively straightforward. However, in a multi-currency consolidation, the process becomes more complex. In this type of consolidation, balance sheet accounts are factored using the balance sheet exchange rate [1] while income statement accounts are factored with the weighted average rate [2], but in both cases the amount not owned is subtracted and placed in the minority interest liability account.

In addition, two currency translation adjustments [3] and [4] are made to compensate for fluctuations between the balance sheet rate which is usually the currency conversion rate at the end of the month and the weighted average rate which is usually the average conversion rate for the period. Consequently, the percentage you do not own is subtracted from CTA1 and CTA2 and placed in the minority interest liability account and offset in the minority interest Income or expense account.

For a more detailed explanation of how the system calculates a multi-currency consolidation, refer to Multi-Currency Consolidation Calculations.