Exchange rate dates—Contracts

This topic contains information on how Contracts uses exchange rate dates in multi-currency companies. When the transaction currency of the contract differs from the location's base currency, the applicable exchange rate date determines the exchange rate used for journal entries associated with a given posting event.

Contract line exchange rate date

When you add a contract line to a contract, you specify an exchange rate date:

Sage Intacct uses the contract line exchange rate date to determine the exchange rate for all activity that posts to Unbilled accounts. This includes when you post (book) the contract line, when Intacct reclassifies Unbilled amounts, and so on.

Invoice exchange rate date

Invoices generated from the contract line use the exchange rate associated with the invoice posting date for Billed and Paid activity.

Journal entries for payments associated with a contract invoice will use the invoice's exchange rate date as the Billed and Paid accounts must use the same exchange rate.

Revenue exchange rate date

The exchange rate date used for revenue depends on whether a contract invoice posts before or after the revenue posts.

- If the revenue posts before the invoice—the Unbilled revenue uses the contract line exchange rate date.

- If the revenue posts after the invoice—the Billed and Paid revenue use the invoice exchange rate date. A single revenue schedule could recognize revenue at multiple exchange rates if it is associated with multiple invoices. In fact, if multiple invoices occur during a single month of revenue recognition, the recognition amount would be split into multiple postings, each using the applicable exchange rate.

MEA allocation exchange rate dates

For Unbilled Deferred Revenue and Unbilled Sales Revenue, the MEA allocation calculation uses the exchange rate of the contract line being allocated in the base amount allocation calculation. For example, say the exchange rate for contract line 1 is 0.60 and the exchange rate for contract line 2 is 0.65 and 50.00 from line 1 is being allocated to line 2. The MEA calculation will use 0.60 for the 50.00 being allocated to line 2.

For Billed Deferred Revenue and Billed Sales Revenue, the calculation uses the applicable invoice exchange rates.

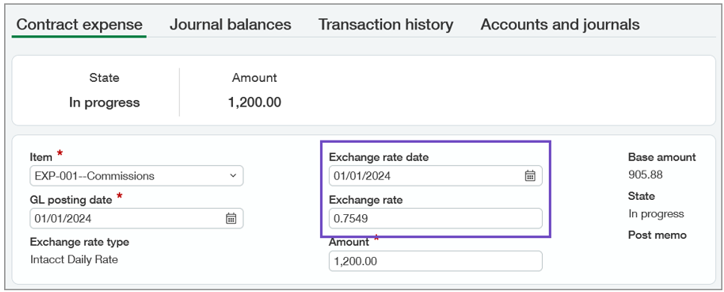

Expense recognition exchange rate date

Expense journal entries will always use the exchange rate date specified on the expense.