Inter-entity sales of inventory

When an entity sells inventory that belongs to a warehouse in a different entity, you want your accounting records to reflect that the selling entity owes the other entity for the value of inventory.

About inter-entity sales of inventory

Multi-entity companies track what they owe each other in the form of payables and receivables between entities when one entity creates transactions on behalf of another entity. When an entity sells inventory that is fulfilled by a warehouse in another entity, the selling entity owes the entity that provided the inventory for the value of that inventory. This is the cost of goods sold (COGS). goods sold).

When Order Entry is configured with the Enable inter-entity COGS journal entries option turned on, the journal entries to balance the inter-entity receivable and payable accounts for the COGS are automatically created for you when the sales transaction is posted. If the option isn't turned on, you have to manually create those journal entries.

How it works

Inter-entity COGS journal entries are automatically created on inter-entity sales transactions for inventory items. Inter-entity COGS journal entries are automatically created when the transaction definition for the sales transaction has these attributes.

- Decreases ONHAND inventory: Quantity & value or Value-only

- Posts to AR or GL

The journal for the COGS posting is the inventory journal to which the transaction definition is mapped on the Order Entry configuration page (Documents configuration tab).

The IET account mapping that is set up for your company determines which inter-entity receivable and inter-entity payable accounts are used in the inter-entity balancing journal entry. The balancing journal entry is posted to the inventory journal to which the transaction definition is mapped.

In addition, inter-entity COGS journal entries are automatically created for Inventory Control adjustments that are linked back to a purchase in which the units were sold in a cross-entity sale. Similar to Order Entry transactions, the Inventory Control adjustment transaction definitions need to have these attributes:

- Decreases ONHAND inventory: Quantity & value or Value-only

- Posts to GL

Example

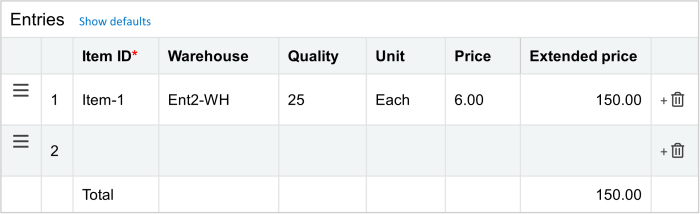

Assume a sales invoice is created at the top level in Entity-1 to sell Item-1. However, Entity-1 doesn't have inventory of the item, but a warehouse in Entity-2 does. Instead of moving the inventory, the warehouse in Entity-2 (Ent2-WH) is selected to fulfill the invoice. The valuation of the inventory is $20.

When the transaction is posted, assuming the invoice and COGS posting are both generated from the transaction, 3 GL journal entries are created.

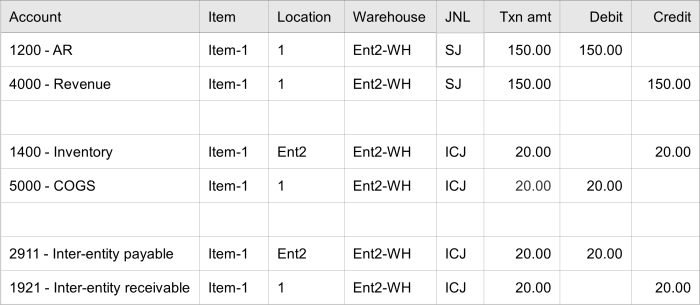

The AR accounts mapping table in the transaction definition determines which accounts receivable and revenue accounts are debited and credited.

The COGS accounts mapping table in the transaction definition determines which GL accounts are debited and credited, the same as it would if the Enable inter-entity COGS journal entries option weren't enabled. The credit for the Inventory account uses the location for Entity-2 instead of for Entity-1 because the option is enabled. The debit for the COGS account uses Entity-1, the same as it would if the option weren't enabled.

And because the option is enabled, a third journal entry is automatically created to balance the inter-entity accounts. This journal entry records the amount that Entity-1 owes Entity-2 for the value of the inventory.

Set up automatic inter-entity COGS journal entries

You can use inter-entity COGS journal entries if your company:

- Is multi-entity shared

- Has inter-entity account mappings defined—Basic or Advanced

To enable automatically created COGS journal entries for inter-entity sales of inventory:

- Go to Order Entry > Setup > Configuration.

- In the Enable functionality section, select Enable inter-entity COGS journal entries. Then, click Save.Turning the option on is permanent.

- Ensure that Order Entry transaction definitions that post to AR or GL and decrease ONHAND Quantity & value or Value-only exist.

- If you link Inventory Control transactions back to purchase transactions, ensure that Inventory Control adjustment transactions definitions that post to GL and decrease ONHAND Quantity & value or Value-only exist.