Overview of inter-entity transactions

In multi-entity companies, it's common for one entity to have transactions with another entity in the same company. This is known as an inter-entity transaction (IET). To enable these transactions, you need to first set up inter-entity account mapping relationships, using the Inter-entity account mapping page (Company > Setup > Configuration > Inter-entity account settings > Inter-entity account mapping).

For details, see Inter-entity account mapping plans.

Entities in a multi-entity shared company

In a multi-entity shared company, entities represent a separate tax identification or a separately secured, fully balancing set of books. Entities typically represent divisions, franchises, affiliates, associations, locations, chapters, self-balancing funds or subsidiaries, with a shared chart of accounts.

A multi-entity shared company includes one or more entities under the top level. The company has a set of data lists that's shared among all entities. These shared data lists include users, chart of accounts, customers, suppliers, and employees. Administrators define the shared data lists once at the top level and use them throughout the entities in the company. Administrators use the top level to manage entities and their data.

Alternatively, administrators can restrict to working at the entity level only users and master data list members such as suppliers, customers, and employees. Administrators can even restrict users to working only in particular entities.

An example of a multi-entity shared company is a property management company. One entity represents the company's corporate headquarters and each managed property is represented by its own separate entity.

Inter-entity transactions

IETs can be generated when:

- You want to track when one entity pays AP supplier invoices on behalf of another entity.

- The top level is used to pay an AP supplier invoice whose cost is allocated across multiple entities.

- You're sending money from one entity to another as a loan.

- Collecting revenue from customers on behalf of an AR sales invoice from another entity.

- Two entities have a revenue-sharing arrangement.

- One entity sells inventory that belongs to another entity.

Inter-entity journal entries and dimensions

Inter-entity transactions are streamlined by:

- Booking IETs in one journal entry, rather than multiple.

- Preventing dimensions, other than the Location dimension, from flowing to IETs.

Inter-entity transaction entries are balanced by entity.

Inter-entity account mapping

Sage Intacct records inter-entity transactions separately from other types of receivable and payable transactions. An example of an inter-entity transaction is when one entity pays an AP supplier invoice on behalf of another entity. For each entity in your company, you can specify the payable and receivable accounts you want to use for inter-entity transactions.

You can set up inter-entity transaction (IET) accounts for all your entities on one central page. First, select an inter-entity account mapping plan, either Basic or Advanced. The Basic plan enables using two accounts per entity for IETs. The Advanced plan enables using four accounts per entity for IETs.

Inter-entity account mapping plans

The Basic plan enables you to use only one set of inter-entity accounts per entity for higher-level tracking, while the Advanced plan enables you to define separate sets of inter-entity accounts for each entity relationship, or entity pair, and takes a more granular approach. As the inter-entity receivable (IER) and inter-entity payable (IEP) accounts reflect an obligation for one entity to settle with another, separating these accounts among entity pairs enables you to report more specifically on how these obligations arise. Using the Advanced plan doesn't necessarily mean you need four accounts for each entity pair. You can re-use accounts if you have different requirements for granularity among your entities. For example, you might configure one IEP and one IER account for your UK and US entities, while using four different accounts for the Australia and France entities.

When considering which setup is right for you, it's important to understand how the inter-entity receivable and payable balances are ultimately settled, meaning how and when payment is to be made.

- Basic. The Basic inter-entity account mapping plan enables you to map entities to accounts used to post inter-entity transactions (IETs). For each entity, you can define a common receivable account and payable account to record all inter-entity transactions involving that entity. There's no need to settle separately balances among the entities involved, so you define one inter-entity receivable (IER) and one inter-entity payable (IEP) account per entity. You can share across multiple entities a single set of inter-entity receivable and payable accounts. Alternatively, you can settle these accounts directly through cash or investments as needed.

A sample Basic inter-entity account mapping plan is shown here:

Basic IET account mapping plan Entity

IER

IEP

E100-US

1901 Inter-entity receivable account

2901 Inter-entity payable account

E200-UK

1902 Inter-entity receivable account

2902 Inter-entity payable account

E300-AUS

1903 Inter-entity receivable account

2903 Inter-entity payable account

- Advanced. The Advanced inter-entity account mapping plan enables you to map pairs of transacting entities to up two four accounts used to record inter-entity transactions (IETs). This allows for greater granularity in tracking who owes whom, so you can settle between each entity pair individually, if necessary. The Advanced plan enables mapping each entity to a combination of directional accounts that record inter-entity receivables and payables using separate or common accounts. You can use any combination of receivable and payable accounts (IER and IEP).

A sample Advanced inter-entity account mapping plan is shown here:

Advanced IET account mapping plan Entity A

Entity B

Entity A IER

Entity A IEP

Entity B IER

Entity B IEP

E100-US

E200-UK

1911 Receivable account

2911 Payable account

1921 Receivable account

2921 Payable account

E100-US

E300-AUS

1912-Receivable account

2912 Payable account

1931 Receivable account

2931 Payable account

E100-US

E400-CAN

1913 Receivable account

2913 Payable account

1941 Receivable account

2941 Payable account

E100-US

E500-MEX

1914 Receivable account

2914 Payable account

1951 Receivable account

2951 Payable account

E400-CAN

E500-MEX

1942 Receivable account

2942 Payable account

1952 Receivable account

2952 Payable account

Inter-entity elimination

If you use Consolidation, you can choose to automatically eliminate the inter-entity receivables and payables for entities included in the consolidation.

Inter-entity transactions must be removed (eliminated) from consolidated financial statements. Elimination of inter-entity transactions is desirable for consolidated reporting because the purpose of consolidated statements is to present the results of operations and the financial position of a parent company and its subsidiaries essentially as if the consolidation group were a single company with one or more branches or divisions.

Typical transactions that require elimination are:

- Inter-entity payables and receivables. The due-from (source)/due-to (target) transactions that result from paying AP supplier invoices or receiving cash on behalf of another entity.

- Inter-entity debt. Any loans made from one entity to another within the consolidation group. These transactions result in offsetting notes payable and notes receivable, as well as offsetting interest expense and interest income.

- Inter-entity revenue and expenses. For example, the sale of goods or services from one entity to another within the consolidation group. The reason for these eliminations is that a company cannot recognize revenue from sales to itself; all sales must be to external entities. These issues most commonly arise when a company is vertically integrated.

- The transfer of inventory between entities. Inventory transfers are essentially the sale or purchase of assets between entities.

- Inter-entity stock ownership. Eliminates the ownership interest of the parent company in its subsidiaries.

For details on inter-entity auto-elimination, see Inter-entity auto-eliminations in Consolidation.

Auto-balance IET journal entries across base currencies

Intacct auto-balances IET General Ledger journal entries across entities with multiple base currencies. Using automated exchange rates ensures up-to-date currency conversions, and, in turn, accurate reconciliations for multi-entity, multi-currency companies.

General Ledger journal entries show the source and inter-entity transaction entries, which makes it easy to drill down and reconcile a given transaction.

Source

The Source entity field sets the context for the inter-entity transaction, in that it establishes whose shores you are standing on. Intacct uses the source to determine whether there is a credit or debit for the source entity, and then determines everything else. For example, if the source entity requires a credit, then all non-source lines in the transaction require a debit.

When examining an inter-entity transaction where the source entity is noted, Intacct does the following:

-

Reads the source entity from the header.

-

Finds the lines in the transaction that are coded to the source entity. For example, if the source entity is 100, Intacct finds all the transaction lines coded to the 100 source entity, or one of its locations.

-

Nets the debit and credit for the source entity lines.

- If the net of the source entity lines results in a debit, then the source entity will receive a "due-to".

- If the net of the source entity lines results in a credit, then the source entity will receive a "due-from".

-

For all other lines in the transaction (not source entity), Intacct finds the mapping for the entity pair for the source entity and the transaction line entity.

If the source entity is 100, Intacct finds the transaction lines that are not coded to 100, or one of its locations. For example, if a particular line is coded to 300, then the 100/300 or 300/100 mapped pair is found.

-

If the result is that the source entity is getting a due-from, Intacct selects the due-from account for the source entity, and the due-to account for the target entity. If the source entity is the entity A, then the due-from account is selected for Entity A in the mapping.

How it works

In the Multi-Entity Management, select Enable inter-entity transactions.

With this option selected, when you enter a manual journal entry that involves two or more entities, Intacct automatically adds offsetting transactions into the journals of each affected entity.

Include this option if you want Intacct to automatically record the inter-entity payables and receivables for you. The inter-entity accounts mapped in the inter-entity account mapping plan are used to record the inter-entity payables and receivables for inter-entity transactions.

Example: Cash Management fund transfer between accounts

A funds transfer is a transfer of funds from one cash account to another.

You can transfer between accounts with different currencies. Make sure you have the appropriate permissions for both entities.

When transferring funds from one cash account to another, the current account you're transferring funds from is the source. The target is the current account to which you're transferring funds.

The following tables show how an inter-entity funds transfer would work. In this example, the entity Corporate is transferring $500 to the entity Texas. The base currency for both entities is USD.

From current account

| Bank name | Citi checking |

|---|---|

|

GL account |

1000.02 |

|

Entity name |

Corporate |

|

Base currency |

USD |

To current account

| Bank name | Chase checking |

|---|---|

|

GL account |

1000.03 |

|

Entity name |

Texas |

|

Base currency |

USD |

Transfer of funds

| Transaction | GL account | Acct name | Location | Debit | Credit |

|---|---|---|---|---|---|

|

Transfer from |

1000.02 |

Citi checking |

CORP |

|

500.00 |

|

Transfer to |

1000.03 |

Chase checking |

Texas |

500.00 |

|

| Transaction | GL account | Acct name | Location | Debit | Credit |

|---|---|---|---|---|---|

|

|

1999 |

Inter-entity receivable |

CORP |

500.00 |

|

|

|

2999 |

Inter-entity payable |

TX |

|

500.00 |

Example: IET bill back

Another example of working with inter-entity transactions is inter-entity transaction bill back.

For more information, see:

Example: AR AR sales invoice

The Waterfall method is a simple way to apply payment to AR sales invoices, in which Sage Intacct applies payment to each line item of an AR sales invoice, until all line items have been paid. Waterfall is used in the application of credits to AR sales invoices.

How Intacct applies credits

Sage Intacct uses the Waterfall method to apply available credit automatically to one or more selected AR sales invoices.

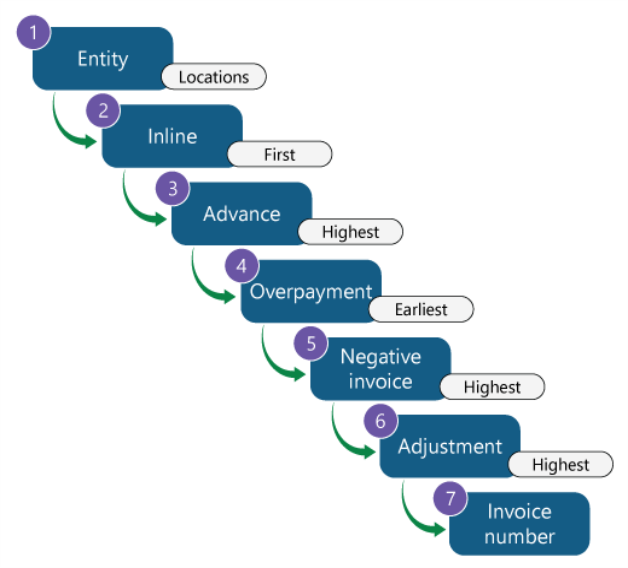

The Waterfall method flows multiple credits as shown in the following diagram:

When applying multiple credits to an AR sales invoice at the same time, Sage Intacct applies the credits in the following order:

- Matching entities: First, Sage Intacct applies the credits to lines in the AR sales invoice belonging to the same entity as the credits.

- Inline

- Advance payment

- Overpayment

- Negative AR sales invoice, or discount.

- Adjustment

Credits applied in full

Using the Waterfall method, Sage Intacct applies credits in full, beginning at the first line of the AR sales invoice until the credits are fully applied and the AR sales invoice is paid.

In the following example, a credit of 210 units is applied to an AR sales invoice whose total is also 210 units. Sage Intacct applies 100 units of credit to line 1 of the AR sales invoice, which matches the 100 unit amount for line item 1. Sage Intacct then applies 50 units of credit to the 50 unit amount on the second line, and 60 units of credits to the 60 unit amount on the third line.

| AR sales invoice line number | Amount |

|---|---|

| 1 | 100.00 |

| 2 | 50.00 |

| 3 | 60.00 |

| Total | 210.00 |

| Applied order | Line number | Amount | Balance |

|---|---|---|---|

| 1 | 1 | 100.00 | 0.00 |

| 2 | 2 | 50.00 | 0.00 |

| 3 | 3 | 60.00 | 0.00 |

Partial credit

Using the Waterfall method, Sage Intacct applies credits beginning with the first line of the AR sales invoice, until the credit is consumed. Any additional payments or credits are applied to the next line of the AR sales invoice with a balance.

In the following example, the same AR sales invoice has a balance of 210 units. One credit of 140 units is applied to lines 1 and 2, with a balance of 10 units remaining on line 2. A payment is then applied to the remaining balance of 70: first to the 10 unit balance remaining on line 2, and next to the 60 unit balance on line 3. The AR sales invoice is fully paid after the partial credit and payment are applied.

| AR sales invoice line number | Amount |

|---|---|

| 1 | 100.00 |

| 2 | 50.00 |

| 3 | 60.00 |

| Total | 210.00 |

| Applied order | Line number | Amount | Balance |

|---|---|---|---|

| 1 | 1 | 100.00 | 0.00 |

| 2 | 2 | 40.00 | 10.00 |

| Applied order | Line number | Amount | Balance |

|---|---|---|---|

| 1 | 2 | 10.00 | 0.00 |

| 2 | 3 | 60.00 | 0.00 |

Credit handling with the owning entity only

If your multi-entity company limits the application of credits to the owning entity only, then Sage Intacct applies credits to that entity only. If the entirety of the credit can't be applied, the credit remains outstanding until another transaction is recorded for that entity.

When you include negative inline credits in a transaction, all line items within the transaction must belong to the same entity..

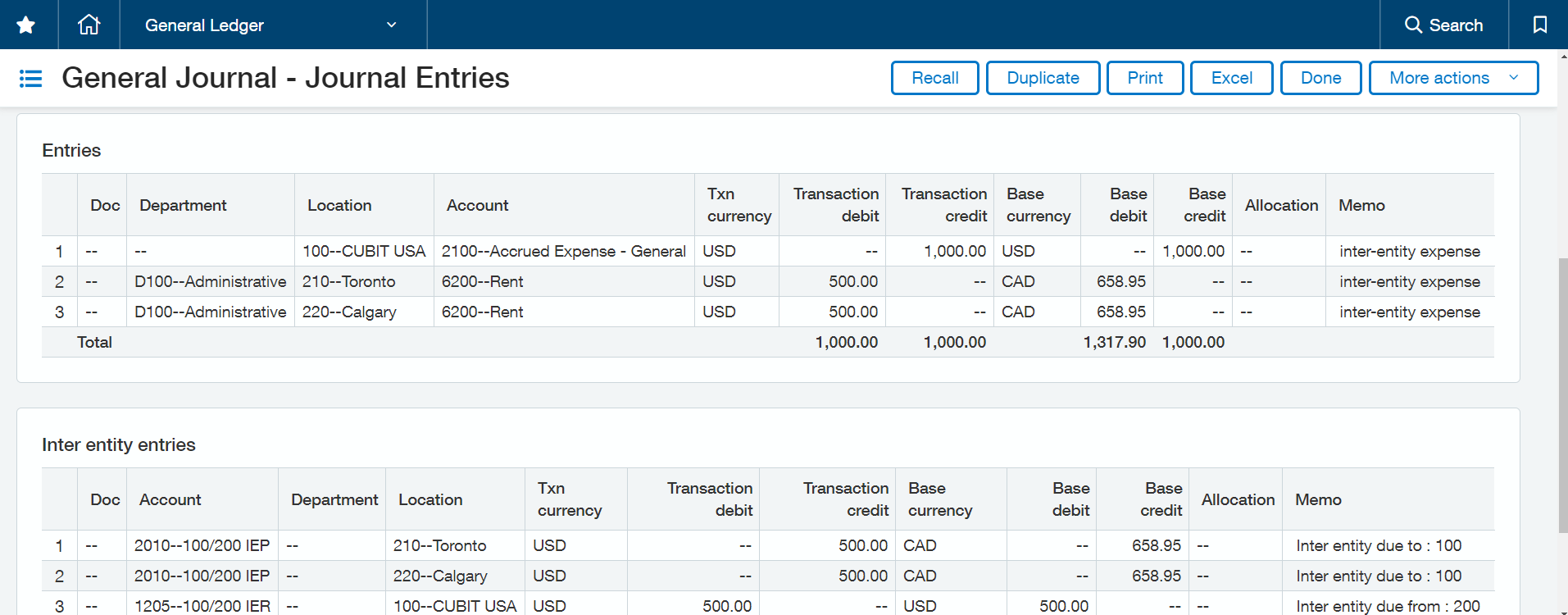

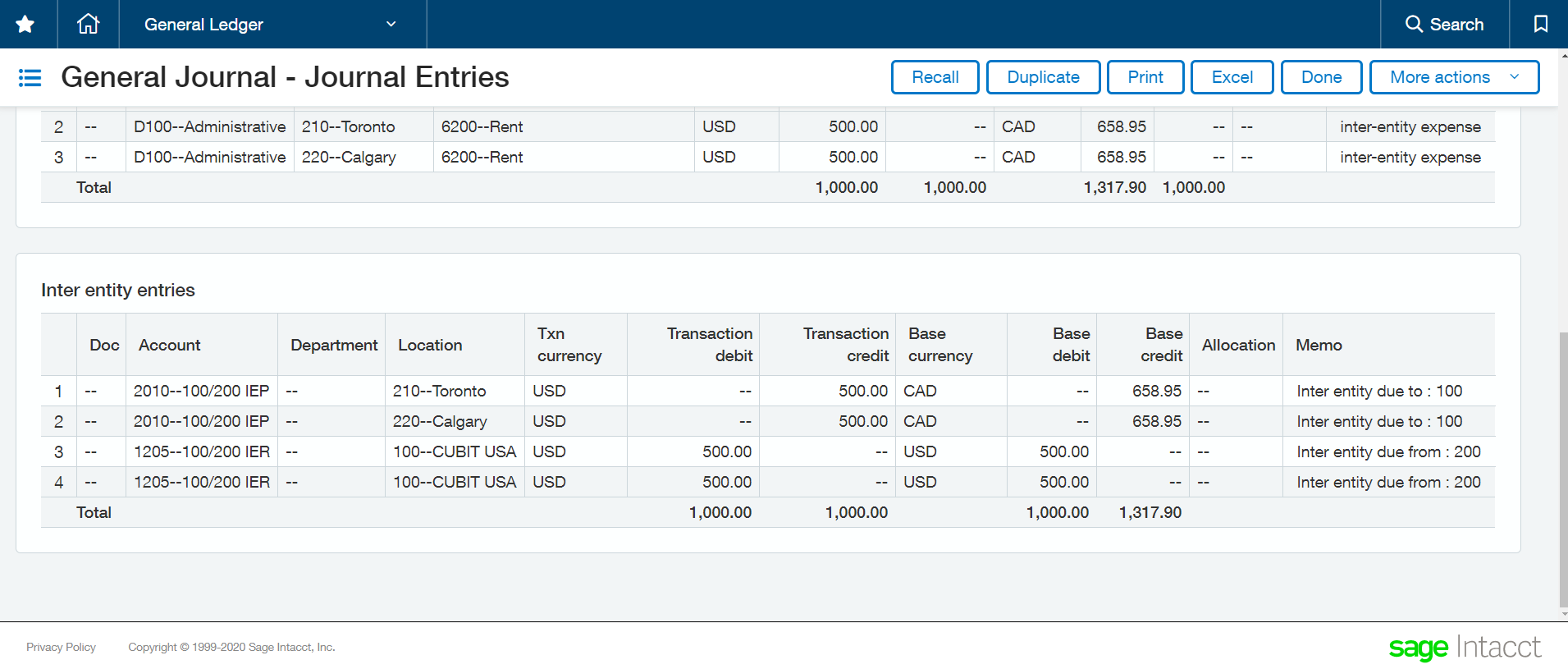

Example: auto-balancing a journal entry

In this example, rent expenses are allocated to specific entities. The US entity, CUBIT 100, has a credit for $1,000. The Toronto and Calgary entities have recorded expenses in rent for $500 each. Intacct automatically generates the relevant inter-entity receivable and payable lines in the IET grid.

The inter-entity transaction in this example is the accrued expense at location 100 (credit), and receivables at the Toronto and Calgary entities (debit).

Intacct uses the mapped IET accounts to automatically create the IET balanced entry. The mapped IET account balances the journal entry. The GL journal entry shows the two $500 credits associated with the 100 CUBIT entity, and the two $500 debits associated with the Toronto and Calgary entities.

Credits

The credits journal is used when credits are applied to AR sales invoices or AP supplier invoices that generate an inter-entity transaction (IET) with no source payment record. Use this journal for subledger transactions when enabling inter-entity transactions.

If you have a credit memo, you can use it to apply to a AP supplier invoice or AR sales invoice by entering a payment value of 0. If the application of the credit involves an IET, then Intacct generates this journal.

You do not need to use an IET credits journal when selecting the following options in the Multi-Entity Management page:

- Manually balance all subledger transactions

- Manually balance subledger credits only