Tax returns in a multi-entity shared company

In a multi-entity shared environment, the way that you set up the tax IDs (tax numbers such as ABNs, VAT registration numbers, and GST registration numbers) for the company and entities determines what's included in your tax returns.

Depending on your business needs, you might want to file taxes for each reporting period in:

- A single return that includes all the entities

- Separate returns for individual entities, groups of entities, or both

If you file your taxes using multiple returns, each return includes the information for a single VAT registration number.

Prerequisites

Depending on the characteristics of your entities, you need to decide whether you will file taxes for each reporting period in one return for all entities or separately for one or more entities or groups of entities. How you want to file taxes helps determine how you will set up your entities and the tax IDs you'll need from your tax authorities.

For example, if your entities represent vastly distinct businesses, you might want to file taxes separately for each entity. If three of your entities represent franchises in the same line of business, you might choose to register those three entities as a VAT group with your tax authority and file the taxes for them together.

One tax return for all entities

To use one tax return for all your entities including the top level, you specify VAT registration number at the company level and then specify the same VAT registration number for each entity.

To set up for one tax return:

- Navigate to the top level of the company.

- Go to Company > Setup > Company.

- Click Edit.

- Enter the VAT Reg No. Then, click Save.

- Go to Company > Setup > Entities. The Entities page appears.

- Review the VAT Reg No for each entity. If it is not blank or the same as the VAT Reg No for the company, enter the same number as the company's.

When your company is set up for filing taxes in one return, you create the tax return from the top level of the company.

Separate tax return for an entity

To use separate tax returns for one or more entities, you specify a unique VAT registration number for each entity.

To set up a separate tax return for an entity:

- Navigate to the top level of the company.

- Go to Company > Setup > Company.

- Click Edit.

- Enter the VAT Reg No for the company. Then, click Save.

- Go to Company > Setup > Entities. The Entities page appears.

- Click Edit next to the entity you want file taxes for separately. Enter a unique VAT Reg No for the entity. Then, click Save.

- Repeat Step 6 for each entity that you want to file taxes separately for.

When an entity is set up for using a separate tax return, you can create the tax return from the top level or from the entity.

Separate tax return for a group of entities

To use a separate tax return for a group of entities that doesn't include the top level, you specify the same VAT registration number for each entity in the group, using unique tax IDs across groups.

To set up a separate tax return for a group of entities:

- Navigate to the top level of the company.

- Go to Company > Setup > Company.

- Click Edit.

- Enter the VAT Reg No for the company. Then, click Save.

- Go to Company > Setup > Entities. The Entities page appears.

- For each entity you want in the same group:

- Click Edit next to the entity.

- Enter the same VAT Reg No.

- Click Save.

- Repeat Step 6 for each group of entities that you want to file taxes separately for. Use a unique VAT registration number for each group, assigning the same VAT Reg No to each entity in the same group.

When your company is set up for filing taxes in one or more groups, you create the tax return from the top level of the company. You are prompted to select which entity in the group is the reporting entity. The tax return is created using the business information for the contact in the reporting entity.

Example of how taxes will be filed

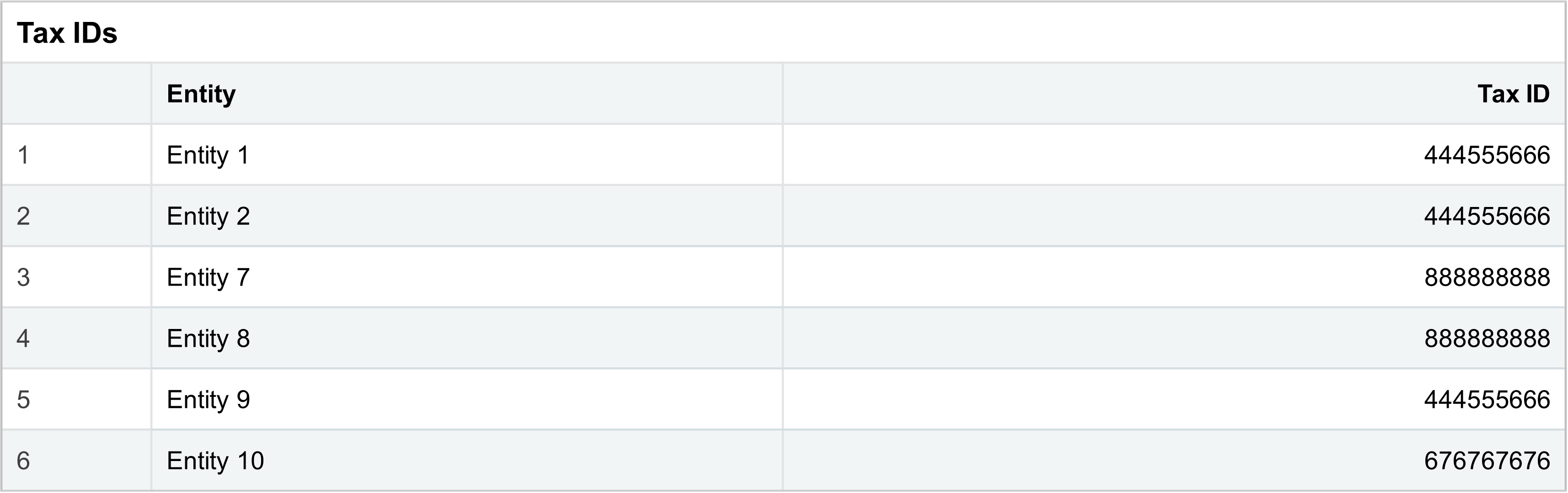

The list of entities that use a tax solution are displayed on Entities tab of the Tax Solution Information page for the tax solution along with the list of associated tax IDs.

For the above example, assume that VAT registration number for the company (the top level) is 444555666. The following entities would be in the same tax return:

- Top level, Entity 1, Entity 2, and Entity 9. They all have the same VAT registration number.

- Entity 7 and Entity 8. They have the same VAT registration number that is different from the top level.

- Entity 10. It has a unique VAT registration number that is different from the top level.