Apply a transaction allocation in Purchasing

Use transaction allocations to automatically distribute amounts across a standard combination of dimensions that are routinely used when entering Purchasing transactions.

About transaction allocations

In Purchasing, transaction allocations can only be applied to line items with non-inventory items, and the amounts can only be spread to the dimensions defined in the transaction allocation template by percentage.

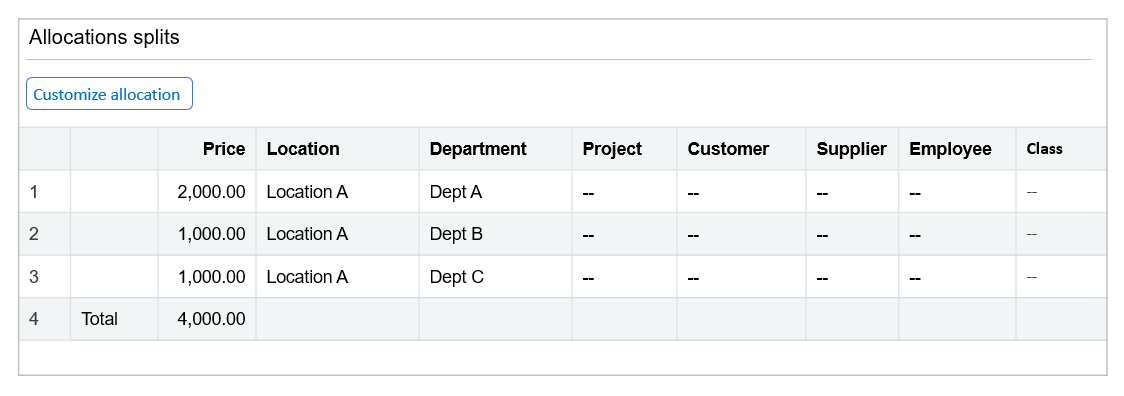

For example, you can create a transaction allocation definition that distributes costs across several departments. When a user enters a line item in a transaction and selects that allocation, the amount of the expense is automatically spread across the appropriate departments in the General Ledger. The following table shows how a single line for $4,000 in rent is automatically spread across three departments based on the selected allocation:

| Transaction allocation definition | Allocated amount |

| 50% to Dept A | R2,000 to Dept A |

| 25% to Dept B | R1,000 to Dept B |

| 25% to Dept C | R1,000 to Dept C |

To learn more about transaction allocations, which are also supported in Accounts Payable, Accounts Receivable, and the General Ledger, see Transaction allocations overview.

Apply a transaction allocation to a line item

When you enter a Purchasing transaction and the transaction definition is configured so that the Allocation dropdown menu appears in the Entries table, you can apply transactions allocations to the line items with non-inventory items.

To apply a transaction allocation to a line item in a standalone Purchasing transaction:

- Select a non-inventory item from the Item ID dropdown list.

- Enter 1 for Quantity.

- Select a transaction allocation definition from the Allocation dropdown list, then enter a Price.

- Select Show details to see the Allocations Splits table and review how the amount in the Extended price field was spread across dimensions according to the percentages in the selected transaction allocation definition. The values in the table cannot be edited or overridden. When you select an Allocation, Sage Intacct removes any dimension values that are specified in the line item that are included in the transaction allocation definition and populates those dimension values in the Allocations Splits table.

- Optional. Select Customize allocation to change how the allocation was distributed, change dimension values, or add dimension values.If you make any changes, the allocation definition is reset to Custom. If the transaction is converted into another transaction, only the amounts in the allocation can be edited.

To apply a transaction allocation to a line item in a converted Purchasing transaction:

When a transaction has been converted from another transaction (the parent transaction), the process to apply a transaction allocation depends on whether an allocation has been applied in the parent transaction.

- If a transaction allocation has been applied in the parent transaction, you can select Customize allocation to change the allocated amounts but not the dimensions.If a transaction with allocated lines is converted to a purchasing return, the transaction definition for the return needs to be configured for transaction allocations. The return will use the same transaction allocation.

- If a transaction allocation has not been applied in the parent transaction, the process to apply an allocation to a line item is the same as for a standalone transaction.

However, a line can only be allocated if the value of the Quantity field in the parent transaction is 1. If you want to allocate the line, first edit that line in the parent transaction and change the Quantity to 1 and the Price accordingly.

Restrictions on applying transaction allocations

Although each transaction allocation you create is available anywhere allocations are available for use, Intacct prevents you from applying transaction allocations that violate certain transaction rules:

- The dimension used by the transaction allocation must be turned on for the corresponding application.

For example, the Project dimension must be turned on in Accounts Payable Configuration to be able to allocate an AP supplier invoice across projects. - The transaction allocation must be compatible with the transaction entry rules for the application area.

- When assigning the transaction allocation value, there’s a maximum allowable value of eight total characters. This includes those characters before and after the decimal point. The number of characters after the decimal point is relative to the number of pre-decimal digits. For example if the allocation is set before the decimal to 15, you could include a decimal.

- If you use revenue recognition, you cannot allocate line items for which you’re deferring revenue.

Additional restrictions for Purchasing:

- You can only allocate line items for non-inventory items.

- The quantity for an allocated line item needs to be 1. If a transaction has been converted from another transaction (the parent transaction), the line can only be allocated if the quantity of the line in the parent transaction is 1.

- Only transaction allocation definitions that allocate by percentage can be applied to a line item.

- If a transaction with allocated lines is converted to a purchasing return, the transaction definition for the return needs to be configured for transaction allocations. The return will use the same allocation.

- Line items using conversion type of price cannot be allocated.

Additional restrictions for organizations with more than one entity:

- You can use transaction allocations across entities only if they have the same base currency.

- You can use transaction allocations to allocate an AP supplier invoice or AR sales invoice across entities only if the entities receiving an allocated share have access to the related customer or supplier.

For example, you cannot allocate an AP supplier invoice to the Chicago and New York locations if the supplier is restricted to only the New York location.