Introduction to account groups

Account groups are the fundamental building blocks of financial reporting in Intacct. Account groups simplify reporting by organizing accounts into re-usable structures, such as "Assets" and "Expenses". These re-usable structures are separate from the reports, graphs, and performance cards that use them.

Account group structures:

- Roll up and organize accounts.

- Create the headings and subtotals in reports.

Although every company's account groups will be different, your account groups will likely contain groupings related to assets, expenses, revenue, and more. To review your existing account groups,

What are account groups?

Account groups are re-usable structures that form the backbone of financial reporting in Intacct.

The most basic types of account groups contain either individual accounts or other account groups.

- Account groups of type Accounts, Statistical accounts, Category, or Statistical category are used to select individual accounts.

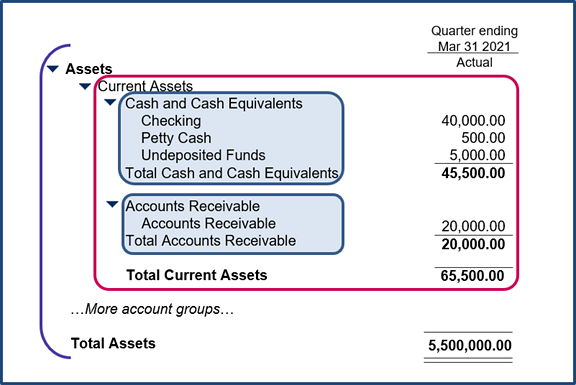

For example, "Cash and Cash Equivalents" might contain some bank accounts and petty cash. Learn more about the different types of account groups. - An account group of type Group of account groups contains other account groups.

For example, "Assets" might contain other account groups, such as "Current Assets" and "Fixed Assets," which in turn contain other account groups.

By nesting groups, you can create a hierarchy of groupings for reporting purposes, with the lowest level containing individual accounts.

Reusable building blocks

Account groups are maintained separately from the financial statements that use them, so they’re easy to manage and update.

- Account groups (such as Assets) can be used in multiple reports.

- As you add or modify accounts, you need only make sure that they're in the right account groups.

- Changes to the account group affect all reports that use the account group.

Role in financial reports, graphs, and performance cards

Account groups can be used across any number of reports, graphs, and dashboard performance cards.

When you create a financial report or graph, you select the account group or groups that you want to include. For example, the rows in a balance sheet report are formed by adding two account groups: Assets, and Liabilities and Equity.

Reports and graphs

When these top-level account groups are included in a report, Intacct automatically includes all subgroups and accounts. On the report, each account group gets a heading row and a total row, with indentation used to depict the hierarchy. Additionally, each top-level account group (such as Assets and Liabilities and Equity) receives a grand total.

When you design your account groups, keep in mind where you want headings and totals to appear, and where you want your grand totals. On income statements, it's typical to have only one account group (Net income), which contains other account groups. That way, your income statements contain a grand total for Net income.

Performance cards

Performance cards, often included at the top of dashboards, are also based on account groups. Each performance card is based on a single account group, which determines the value that users see. Although you can use any account group as the basis for a performance card, it's common to use a computation account group, which consist of a mathematical equation. For example, "Net Profit Margin" can be constructed as "Net Income" divided by "Total Income."

Account groups and the calculation method

When using account groups in reports, you'll want the report to calculate only the amounts in the period you select. Every account group has a default method of calculating amounts on reports.

For example, account groups that contain income or expense accounts are typically calculated "For the period." Calculation methods can be:

- For period: calculate only the amounts in the period you selected

- Start of period: calculate the amounts cumulatively up to the start of the selected period

- End of period: calculate the amounts cumulatively up to the end of the selected period

The latter is useful, for example, in a balance-forward situation. For example, say your fiscal year runs from January 1 to December 31. If you run a report in March, choosing Start of period totals the data from January 1 to March 1.

| 13,000 | 400 | 13,400 |

|

||

| Start of period | For the period

Typical for income and expense accounts |

End of period

Typical for balance sheet accounts |

Organize accounts and create hierarchy

Groups of accounts

The simplest account group is 1-level deep, and consists of member accounts. When you’re establishing an account group hierarchy, start by creating groups of member accounts.

- To create a group of GL accounts, select Accounts as the structure type.

- To create a group of statistical accounts, select Statistical accounts as the structure type.

If your company was configured using a setup template, you already have a set of predefined account groups based on the Category or Statistical category. These work the same way as groups of accounts or statistical accounts, except that they’re based on the category assigned to accounts rather than a specific list of accounts. Learn more about category-based account groups.

Groups of groups

After you've created a group of member accounts, you can build the next level of the hierarchy, which consists of groups that contain other groups.

For example, you might create a "Current Assets" account group that contains other account groups.