About the revenue recognition process—Accounts Receivable or Order Entry

Intacct's Revenue Management subscription for Accounts Receivable or Order Entry allows your company to defer income and amortize the revenue over time as you deliver goods or services.

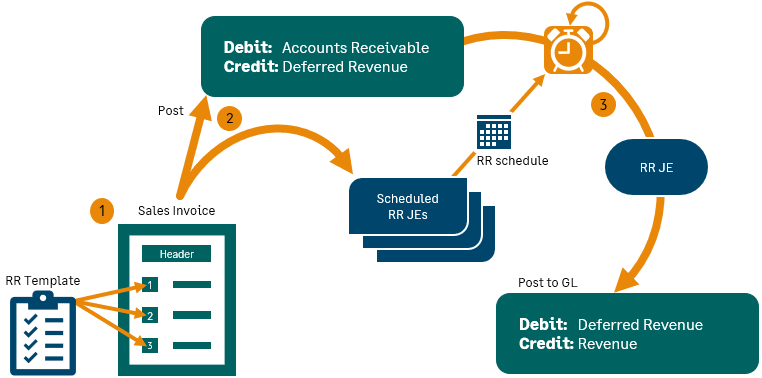

Revenue Recognition with a single invoice

The following illustration shows a simple scenario where there is only one invoice for the full contract amount and the revenue recognition posts monthly.

- In this example, a user creates an OE sales invoice, associates a revenue recognition template and start and end dates with a line item, and then posts the OE sales invoice.

- Intacct debits AR, credits the deferred revenue account associated with the Item GL group, and creates a schedule of potential journal entries based on the revenue recognition template definition.

- If the template is defined with automatic posting, Intacct creates the next revenue recognition journal entry on the next scheduled posting date.

If the template is defined with manual posting, the user can post the next scheduled journal entry when desired. These entries debit the specified deferred revenue account and credit the applicable revenue account.

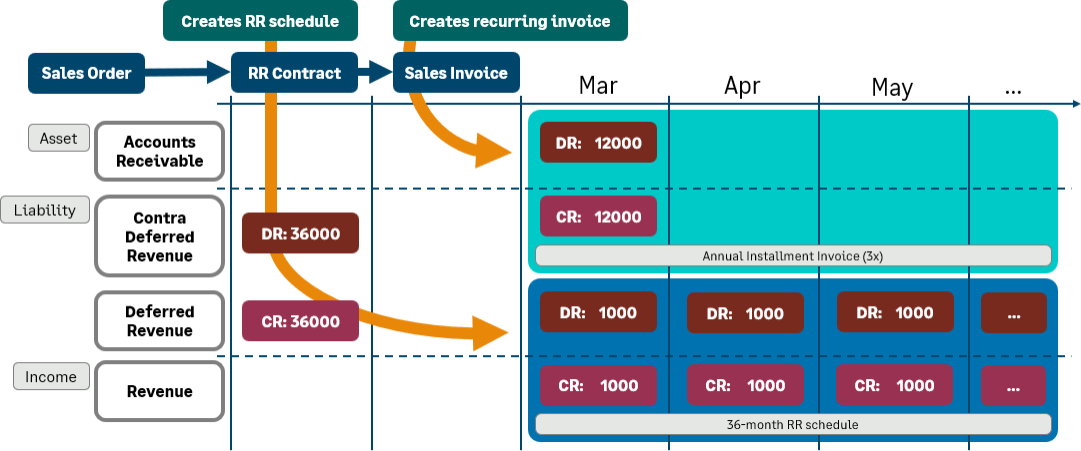

Revenue Recognition with installment invoicing

If your company is using installment invoicing with revenue recognition, the workflow will include at least three transaction documents and the use of a contra deferred revenue account to offset the deferred revenue account. This enables the Deferred Revenue Forecast report to more accurately forecast revenue in the process of being recognized.

The following example shows a workflow with a sales order, revenue recognition contract (which acts as the revenue recognition activation document), and an OE sales invoice. The example shows a 36-month support contract for 36,000. There are 3 annual installment invoices.

- In this example, a user creates a sales order, associates a revenue recognition template and start and end dates with a line item, and then posts the sales order.

Nothing posts to the GL (there is no accounting impact) and no revenue recognition schedule is created.

- The user converts the sales order to a revenue recognition contract.

The system credits the deferred revenue account and debits the contract deferred revenue account for the full contract amount. It creates a revenue recognition schedule for the full contract amount using the revenue recognition template associated with the sales order.

- The user converts the revenue recognition contract to an OE sales invoice.

The user attaches a recurring schedule for installment invoicing to the invoice and the system divides the full contract amount into installments. For each installment, the system debits AR and credits the contra deferred revenue account.

Learn more about revenue recognition schedules.

Learn how to set up revenue recognition with installment invoicing.