cash management

Improve your workflow with Bank transaction assistant

Streamline your Accounts Receivable receive payments workflow while accelerating your reconciliation process with the Bank transaction assistant workflow.

Details

Easily and quickly assign customers to bank transactions and then receive multiple payments for multiple customers, all from the Bank transaction page. After you receive payments, the posted payments in Sage Intacct and the bank transactions automatically match for reconciliation.

For multi-entity, multi-currency companies, receive advances and payments at the entity level.

How it works

Before you begin, go to Configure Cash Management and select to Enable Bank transaction assistant.

Step 1: Assign customers to bank transactions

To receive a payment, first assign a customer to bank transactions. You can automate this process by creating an assignment rule.

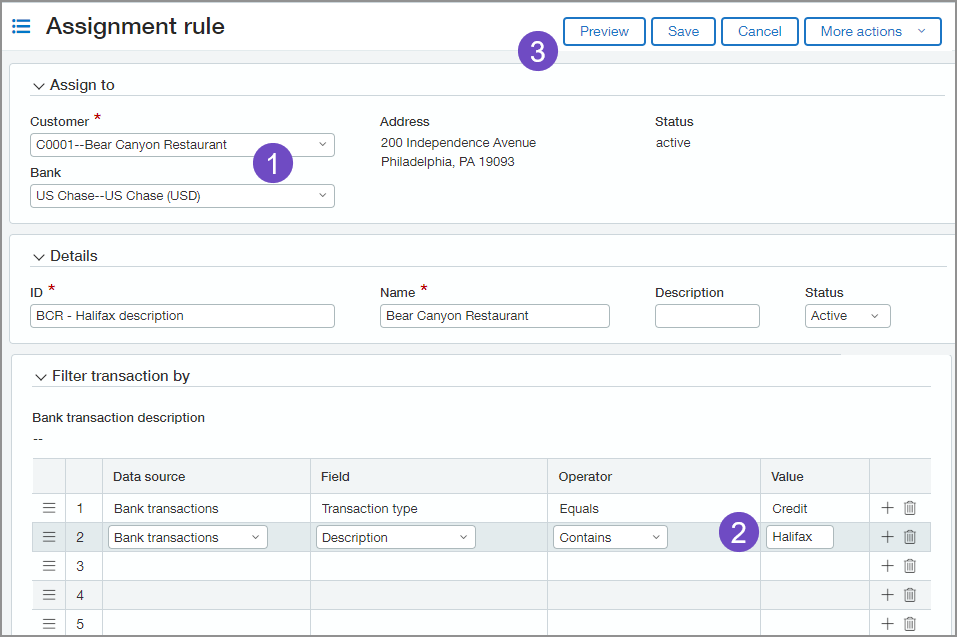

Use information from the bank transaction description to create a rule and automatically assign customers to bank transactions. For example, you might want all bank transactions with a description of "ABC" to be assigned to the customer "ABC inc."

Assignment rules are similar to matching and creation rules in that you need to filter for the transactions you want to act on, but assignment rules are not included in rule sets. Just associate the assignment rule with the bank account of your choice.

Assignment rules run when the following events happen:

-

A bank feed brings in new bank transactions.

-

You import bank transactions using the new Bank transaction import Early Adopter experience.

-

You save the rule.

-

Select the Customer and Bank account.

-

The first two filters default for you. The first filters for only credit type transactions that you can receive payments for. The second filter is where you enter the Description from the bank transaction.

-

When you have your filters in place, select Preview to preview the accuracy of your assignment rule.

You can also assign customers to bank transactions manually from the Bank transaction page.

- Go to Cash Management > All > Transactions > Bank transactions.

- From the View menu, select Cash in.

The Bank transactions list refreshes with payment transactions.

-

Select transactions that do not have a customer and choose Assign to customer.

The Assign transactions to customers page appears.

-

For each transaction, select a Customer.

You can also create an assignment rule on-the-fly when you are manually assigning customers by entering an Assignment mapping value. For example, if you have a customer, ACME customer, you can enter identifying data from the bank transaction description here. The rule is automatically created when you Save. -

Select Save.

Step 2: Receive payments in bulk

When a bank transaction has a customer assigned, you can receive a payment or create an advance. You can also receive payments in bulk. If there's no invoice for the customer, you can create an advance using the new AR advances template.

You'll need the new Cash Management permission to Receive payments from bank transactions.

-

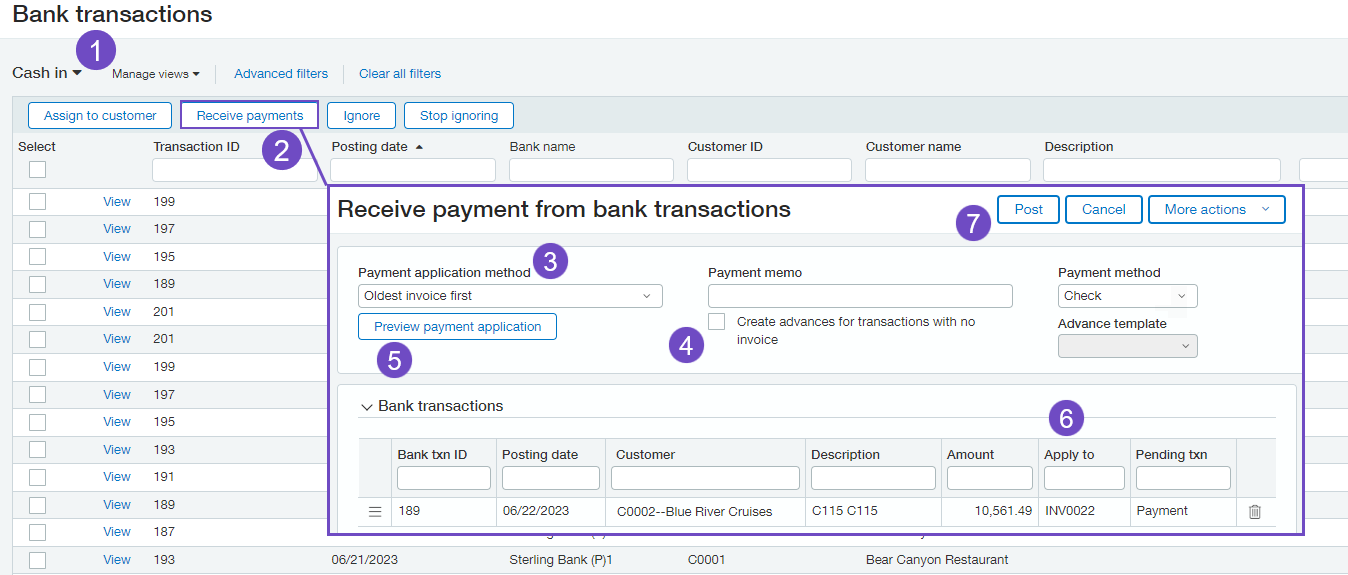

Select the Cash in view to view only unmatched bank credits.

-

Select transactions that are assigned to a customer and select Receive payments.

-

The Payment application will vary depending on your business needs.

For example, you might want to target oldest invoices first and then search for more recent invoices. Or, you might want to match by amount.

-

You can Create advances for transactions with no invoice.

You might want to do this after you already previewed results and found no available invoices for which to receive a payment.

To create an advance, select or create an Advance template.

What's an Advance template?AR advance templates are only available for this Early Adopter program.

AR advance templates enable you to quickly create advances based off bank data during the receive payment workflow. However, unlike the other reconciliation transaction templates, AR advance transaction templates are only used in this workflow and cannot be used in creation rules.

- Select Preview payment application to preview whether there are invoices available to match to the bank payment.

-

If there are invoices available, they appear in the table.

-

Select Post to create a posted payment and match transactions for reconciliation.

Requirements

| Subscription |

Cash Management Accounts Receivable |

|---|---|

| Regional availability |

|

| User type | Business user with admin permissions |

| Permissions |

To assign a customer to a bank transaction Bank Transactions: List, View To create an assignment rule Bank transaction assignment rules: List, View, Add To receive a payment for a bank transaction Receive payment from bank transaction: Add |

| Restrictions |

Not available for the following use cases:

Credits and negative invoices are not applied during the payment application process. |