Accounts Payable

AP Automation support for tax solutions

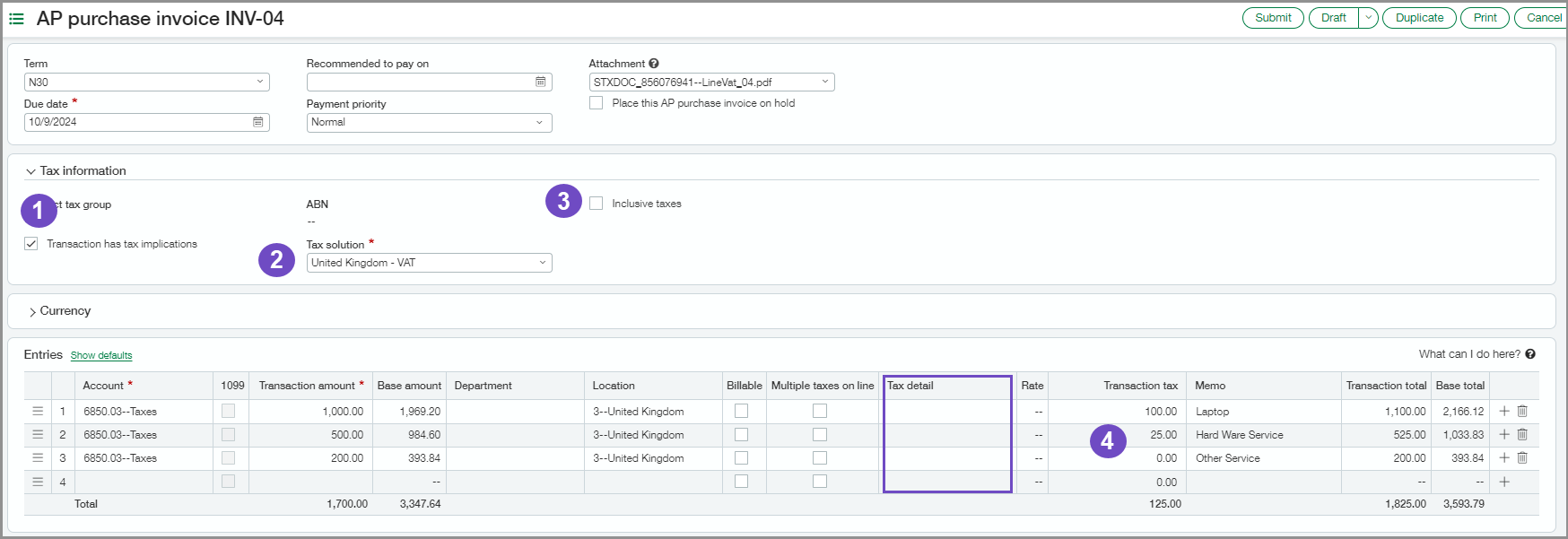

AP Automation now populates tax information for companies that use the Taxes application. This means that less manual data entry is needed before posting in order to capture the transaction tax.

AP Automation, an add-on feature to Accounts Payable, streamlines your data entry process to save you time and money. Intacct automatically creates draft AP supplier invoices from AP supplier invoice documents that you email or upload to Sage Intacct. AP supplier invoice details are automatically populated for you, using data from the original document and the supplier information record.

Details

When you upload or email an AP supplier invoice and the predicted location is a taxable location, AI determines the header-level tax information for the transaction.

How it works

Tax-related fields are populated in the following way:

-

The Transaction has tax implications option is selected when the predicted location has an assigned tax solution.

-

Tax solution is derived from the predicted location.

-

The Inclusive tax option is selected when the previous AP supplier invoice for the supplier had inclusive tax.

-

Line entries display the Transaction tax when the original document has tax information for each line.

When you review the automated transactions, verify the line entries and tax information, then select the Tax details for each line before you post.

Permissions and other requirements

| Subscription |

Accounts Payable Taxes |

|---|---|

| Regional availability |

All regions |

| User type | Business |

| Permissions |

Accounts Payable

|

| Configuration |

Contact your account manager or Channel Executive to start using AP Automation. |