Taxes

Enhancements for Canadian Sales Tax

Use our streamlined Canadian Sales Tax solution to calculate and submit taxes for Federal and Harmonized Sales Tax. Exclude transaction line items from being included in tax submissions using tax detail reporting.

Tax solution setup changes

To streamline Canadian tax reporting and reduce configuration hurdles, we made several changes to the Canadian Sales Tax solution setup. We revised the tax solution to only include tax details and schedules and added new tax details and schedules to cover additional tax situations. We eliminated redundant and expired tax codes, and we added functionality that lets you make a tax schedule inactive.

Review the specific changes and refresh your standard tax setups with the available updates on the Tax Solutions page.

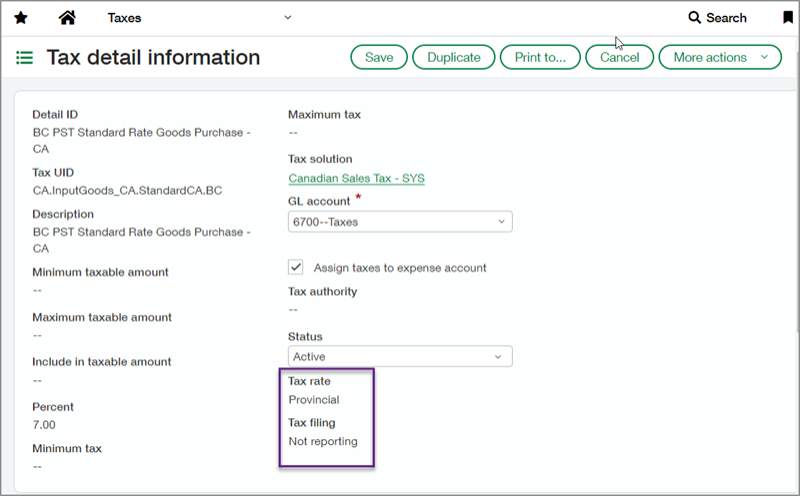

Set tax filing state for tax details

To support tax submissions for Harmonized Sales Tax, we introduced a new setting for tax details. You can now set the tax detail filing state as Reporting or Not reporting. Transaction line items that use a tax detail set as Reporting are included in tax submission calculations. Line items with tax details set as Not reporting are excluded.

We migrated all existing federal tax details in the Canadian Sales Tax solution to Reporting. Additionally, we migrated all existing provincial tax details to Not reporting.

Permissions and other requirements

| Subscription |

Taxes |

|---|---|

| Regional availability |

Canada |

| User type |

Business user with admin privileges |

| Permissions |

Taxes

|