Taxes

Tax detail enhancements for tax submission

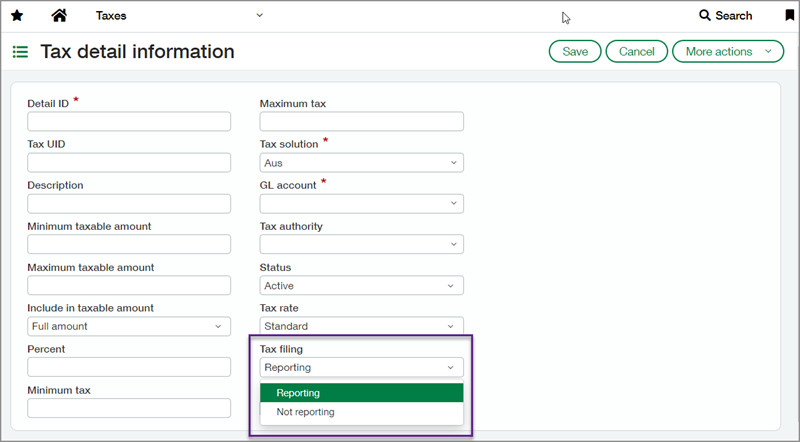

You can now set the tax detail filing state as Reporting or Not reporting. Transaction line items that use a tax detail set as Reporting will be included in tax submission calculations. Line items with tax details set as Not reporting will be excluded.

How it works

-

Go to Taxes > Setup > Details.

-

Enter the tax detail information. The Tax filing field will only appear after you have selected a Tax solution.

-

Under Tax filing, select Reporting or Not reporting.

Permissions and other requirements

| Subscription |

Taxes |

|---|---|

| Regional availability |

All regions |

| User type |

Business user with admin privileges |

| Permissions |

Taxes

|