Accounts Receivable

New warning when reversing a reconciled advance

This idea came from you

We're introducing a new warning feature to enhance your control over

When you try to

This alert helps you maintain the integrity of your bank reconciliations while giving you the flexibility to manage those transactions effectively.

How it works

- Go to Accounts Receivable > All > Advances.

- Select Reverse next to an advance that has been reconciled against the bank.

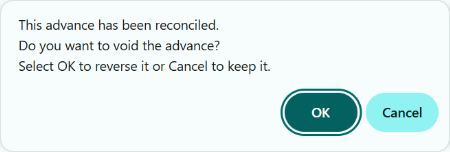

The new warning message appears, alerting you to the transaction's cleared state.

This warning is the same notification that you currently see when you try to reverse a reconciled posted payment or manual deposit. We've expanded the notification to include cleared customer advances. - If you want to reverse the transaction despite its reconciled state, select OK.The reversal date you provide must be in an unreconciled period.

| Subscription |

Accounts Receivable |

|---|---|

| Regional availability |

All regions |

| User type |

Business |

| Permissions |

Accounts Receivable

|