Fixed Assets Management

Custom declining balance depreciation methods

We added two new depreciation methods to help you comply with financial and tax regulations in Australia, Canada, South Africa, and the United Kingdom:

-

Custom declining balance with true-up (CDBT)

-

Custom declining balance without true-up (CDB)

These methods allow you to customize the depreciation rate applied to assets under a declining balance method, providing greater flexibility when managing your assets.

Details

-

User-defined depreciation rate: When using a custom method, a new field called Depreciation rate is available on depreciation rules. You can select a rate from 1.00% to 100.00%.

-

Calculation: In general, depreciation amounts are calculated using the following formula:

(Asset cost − Salvage value − Accumulated depreciation) × Depreciation rate -

With true-up: For the custom declining balance with true-up method, the remaining depreciation is applied in full in the final period, instead of being multiplied by the depreciation rate. This ensures that the entire depreciable cost is trued up and accounted for in the schedule.

-

Without true-up: For the custom declining balance without true-up method, the depreciation rate is applied throughout the asset's entire useful life. Any remaining depreciation at the end of the asset’s life is treated as a loss upon disposal.

Scenario:

-

Depreciation rate: 66.67%

-

Useful life: 36 months

-

Convention: Full month

-

Asset cost: R55,000.00

-

Salvage value: R5,000.00

-

Depreciable cost: R50,000.00

-

In-service date: 01/25/2024

-

First fiscal month: March

-

Use salvage value = True

Schedule:

| Period | Scheduled posting date | Depreciation amount (R) | Calculation |

|---|---|---|---|

| 1 | 01/31/2024 | 2,777.92 |

(50,000.00 depreciable cost − 0.00 accumulated depreciation) × .6667 depreciation rate × (12-11+1) ÷ 12 ÷ 2 months |

| 2 | 02/29/2024 | 2,777.92 | (50,000.00 depreciable cost − 0.00 accumulated depreciation) × .6667 depreciation rate × (12-11+1) ÷ 12 ÷ 2 months |

| 3 | 03/31/2024 | 2,469.24 | (50,000.00 depreciable cost − 5,555.83 accumulated depreciation) × .6667 depreciation rate ÷ 12 months |

| ... | ... | ... | ... |

| 14 | 02/28/2025 | 2,469.24 | (50,000.00 depreciable cost − 5,555.83 accumulated depreciation) ×.6667 depreciation rate ÷ 12 months |

| 15 | 03/31/2025 | 823.00 | (50,000.00 depreciable cost − 29,630.93 accumulated depreciation) × .6667 depreciation rate ÷ 12 months |

| ... | ... | ... | ... |

| 26 | 02/28/2026 | 823.00 | (50,000.00 depreciable cost − 29,630.93 accumulated depreciation) × .6667 depreciation rate ÷ 12 months |

| 27 | 03/31/2026 | 493.73 |

(50,000.00 depreciable cost − 9,875.99 accumulated depreciation) ÷ 10 months In the final year, the depreciation rate is not applied to allow for true-up. |

| ... | ... | ... | ... |

| 36 | 12/31/2026 | 493.73 |

(50,000.00 depreciable cost − 9,875.99 accumulated depreciation) ÷ 10 months In the final year, the depreciation rate is not applied to allow for true-up. |

Scenario:

-

Depreciation rate: 66.67%

-

Useful life: 3 years

-

Convention: Half year

-

Asset cost: R55,000.00

-

Salvage value: R5,000.00

-

Depreciable cost: R50,000.00

-

In-service date: 01/25/2024

-

First tax month: January

-

Use salvage value = True

Schedule:

| Period | Scheduled posting date | Depreciation amount (R) | Calculation |

|---|---|---|---|

| 1 | 12/31/2024 | 16,667.50 |

(50,000.00 depreciable cost − 0.00 accumulated depreciation) × .6667 depreciation rate ÷ 2 The first period is divided by 2 because of the half year convention. |

| 2 | 12/31/2025 | 22,222.78 | (50,000.00 depreciable cost − 16,667.50 accumulated depreciation) × .6667 depreciation rate |

| 3 | 12/31/2026 | 11,109.72 |

50,000.00 depreciable cost − 38,890.28 accumulated depreciation In the final period, the depreciation rate is not applied to allow for true-up. |

Scenario:

-

Depreciation rate: 30.00%

-

Useful life: 60 months

-

Convention: Full month

-

Asset cost: R210,000.00

-

Salvage value: R10,000.00

-

Depreciable cost: R200,000.00

-

In-service date: 03/31/2024

-

First fiscal month: January

-

Use salvage value = True

Schedule:

| Period | Scheduled posting date | Depreciation amount (R) | Calculation |

|---|---|---|---|

| 1 | 03/31/2024 | 5,000.00 |

(200,000.00 depreciable cost − 0.00 accumulated depreciation) × .3000 depreciation rate × (12 − 3 + 1) ÷ 12 ÷ 10 months |

| 2 | 04/30/2024 | 5,000.00 | (200,000.00 depreciable cost − 0.00 accumulated depreciation) × .3000 depreciation rate × (12 − 3 + 1) ÷ 12 ÷ 10 months |

| 3 | 05/31/2024 | 5,000.00 | (200,000.00 depreciable cost − 0.00 accumulated depreciation) × .3000 depreciation rate × (12 − 3 + 1) ÷ 12 ÷ 10 months |

| ... | ... | ... | ... |

| 10 | 12/31/2024 | 5,000.00 | (200,000.00 depreciable cost − 0.00 accumulated depreciation) × .3000 depreciation rate × (12 − 3 + 1) ÷ 12 ÷ 10 months |

| 11 | 01/31/2025 | 3,750.00 | (200,000.00 depreciable cost − 50,000.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| ... | ... | ... | ... |

| 22 | 12/31/2025 | 3,750.00 | (200,000.00 depreciable cost − 50,000.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| 23 | 01/31/2026 | 2,625.00 | (200,000.00 depreciable cost − 95,000.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| ... | ... | ... | ... |

| 34 | 12/31/2026 | 2,625.00 | (200,000.00 depreciable cost − 95,000.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| 35 | 01/31/2027 | 1,837.50 | (200,000.00 depreciable cost − 126,500.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| ... | ... | ... | ... |

| 46 | 12/31/2027 | 1,837.50 | (200,000.00 depreciable cost − 126,500.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| 47 | 01/31/2028 | 1,286.25 | (200,000.00 depreciable cost − 148,550.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| ... | ... | ... | ... |

| 58 | 12/31/2028 | 1,286.25 | (200,000.00 depreciable cost − 148,550.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| 59 | 01/31/2029 | 900.38 | (200,000.00 depreciable cost − 163,985.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

| 60 | 02/28/2029 | 900.38 | (200,000.00 depreciable cost − 163,985.00 accumulated depreciation) × .3000 depreciation rate ÷ 12 months |

At the end of the schedule, R34,214.25 of depreciation remains, which will be recorded as a loss upon disposal.

Scenario:

-

Depreciation rate: 30.00%

-

Useful life: 5 years

-

Convention: Half year

-

Asset cost: R210,000.00

-

Salvage value: R10,000.00

-

Depreciable cost: R200,000.00

-

In-service date: 01/01/2024

-

First tax month: January

-

Use salvage value = True

Schedule:

| Period | Scheduled posting date | Depreciation amount (R) | Calculation |

|---|---|---|---|

| 1 | 12/31/2024 | 30,000.00 |

(200,000.00 depreciable cost − 0.00 accumulated depreciation) × .3000 depreciation rate ÷ 2 The first period is divided by 2 because of the half year convention. |

| 2 | 12/31/2025 | 51,000.00 | (200,000.00 depreciable cost − 30,000.00 accumulated depreciation) × .3000 depreciation rate |

| 3 | 12/31/2026 | 35,700.00 | (200,000.00 depreciable cost − 81,000.00 accumulated depreciation) × .3000 depreciation rate |

| 4 | 12/31/2027 | 24,990.00 | (200,000.00 depreciable cost − 116,700.00 accumulated depreciation) × .3000 depreciation rate |

| 5 | 12/31/2028 | 17,493.00 | (200,000.00 depreciable cost − 141,690.00 accumulated depreciation) × .3000 depreciation rate |

At the end of the schedule, R40,817.00 of depreciation remains, which will be recorded as a loss upon disposal.

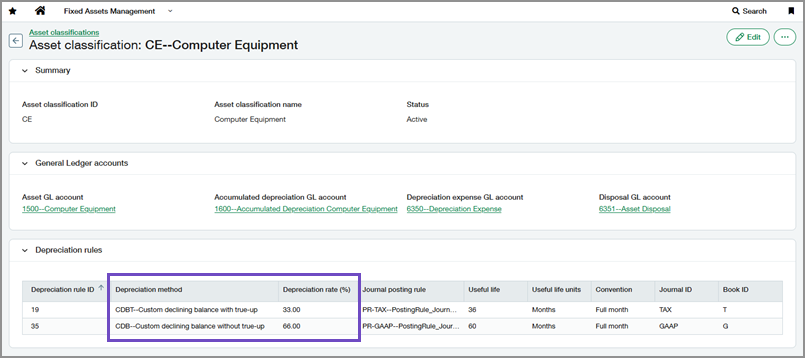

How it works

You can select the new depreciation methods when creating or editing depreciation rules for an asset or asset classification. Then, you can choose a depreciation rate. Depreciation schedules are generated when the assets are placed in service.

-

Go to Fixed Assets Management > All > Asset classifications.

-

Find the classification to which you want to add a depreciation rule.

-

Select More actions > Edit at the end of the row.

-

In the Depreciation rules section, select Add row or Add (circle).

-

For Depreciation method, select Custom declining balance with true-up or Custom declining balance without true-up.

-

Enter a Depreciation rate (%) from 1.00 to 100.00.

-

Select a Journal posting rule ID.

-

Enter a Useful life.

-

Select Save.

Your changes do not affect assets that already use this classification. All future classification assignments will use the new information.

-

Go to Fixed Assets Management > All > Assets.

-

Find the asset to which you want to add a depreciation rule.

The asset must be in the Ready for review state.

-

In the Depreciation rules section, select Add row or Add (circle).

-

For Depreciation method, select Custom declining balance with true-up or Custom declining balance without true-up.

-

Enter a Depreciation rate (%) from 1.00 to 100.00.

-

Select a Journal posting rule ID.

-

Enter a Useful life.

-

Select Save.

Permissions and other requirements

| Subscription |

Fixed Assets Management |

|---|---|

| Regional availability |

All regions |

| User type |

Business |

| Permissions |

Fixed Assets Management

|