Field descriptions: Contract line

| Subscription |

Contracts |

|---|---|

| Regional availability |

|

| User type |

Business Employee Project Manager Warehouse |

| Permissions |

Contract: List, View, Add, Edit, Delete, Post |

| Restrictions |

Only Business users can Add, Edit, Delete, or Post contracts. Employee, Project Manager, and Warehouse users can only List and View contracts. |

Contract line tab

| Field | Description |

|---|---|

|

Item |

Use the Item selection list to select the desired line item. You cannot change the Item after you save the contract line. If the item has contract defaults set, one or more of the revenue templates and/or billing template fields will display the default value associated with the item. Learn more about setting Contracts defaults on items. If the item has an entry in the selected billing price list, Intacct will populate the Flat/fixed amount field with a suggested price. Items must have Item type = "Non-Inventory" or "Non-Inventory (sales only)". |

|

For termed contracts:

For evergreen contracts:

Learn more about recurring billing periods. |

|

|

Item description |

Defaults to the Extended description defined on the Item Information page for the item. You can enter any desired text in this field up to 400 characters. This field displays up to 50 characters. |

|

State |

Displays one of the following:

There's an additional state of Renewal forecast that's only applicable to report data and never displays in the user interface. |

|

Change type |

This field is only applicable to termed contracts. The Change type field is only applicable if the following conditions are true:

For quantity-based billing items, the MRR is only applicable to the Flat amount. Selectable options are:

The Change type field displays the following values when certain events occur:

You cannot edit the Change type field for a renewed contract line in a renewal child contract of a parent contract. |

|

Renew |

This field is only applicable to termed contracts. Select this checkbox to indicate that the line should be included when the contract is renewed. Leave this checkbox blank if the line item shouldn’t be included in renewals. Project time contract lines are not renewable. Learn more about renewing a contract. |

|

Recurring |

This field is only applicable to evergreen contracts. When this field is true, the contract line will automatically renew after each recurring billing period ends or when indicated by the evergreen template. If the contract line start date is in the current recurring billing period, clearing this field will end the contract line as of the contract line end date. Intacct will close the contract line when indicated by the evergreen template. If the contract line start date is in a past recurring period, clearing this field will end the contract line immediately. In this scenario, Intacct immediately sets the contract line's state to "Closed" and removes it from the Contract lines grid. Use the contract's Evergreen history tab to view the contract line details. |

|

Cancel date |

This field only displays if the contract line was canceled. Displays the cancellation date. |

|

Bill-to source |

This field only displays if Enable bill-to contact at the line level (Contracts only) is set to true in the Configure Order Entry page. Specify where the bill-to contact information should come from when you create or edit a contract line. Options are:

You can change the Bill-to source option as needed over the life of the contract line. |

|

This field only displays if Enable bill-to contact at the line level (Contracts only) is set to true in the Configure Order Entry page. The bill-to contact associated with the contract line. Defaults to the bill-to contact entered on the contract header. To change this contact:

Setting different bill-to contacts for different contract lines is useful if you want to consolidate invoices by bill-to contacts. |

|

|

Ship-to source |

This field only displays if Enable ship-to contact at the line level is set to true in the Configure Order Entry page. Specify where the ship-to contact information should come from when you create or edit a contract line. Options are:

You can change the Ship-to source option as needed over the life of the contract line. |

|

Ship to |

This field only displays if Enable ship-to contact at the line level is set to true in the Configure Order Entry page. The ship-to contact associated with the contract line. Defaults to the ship-to contact entered on the contract header. This contact may be used by Avalara or Advanced Tax to calculate taxes for the contract line when it is invoiced. To change this contact:

|

|

For termed contracts:

For evergreen contracts:

|

|

|

Exchange rate type, Exchange rate date, and Exchange rate |

These fields are only applicable to multi-currency companies. Intacct uses this exchange rate when posting to Unbilled accounts. It also uses this exchange rate for revenue recognition associated with this line that's posted before the invoice associated with the revenue recognition is posted. The exchange rate is associated with the exchange rate type selected on the contract. The Exchange rate date field defaults as follows when the contract uses a currency other than the base currency:

Learn more about contract exchange rate dates. |

|

Delivery status |

This field is only applicable to termed contracts. Defaults from the selected item. Options are:

You can change the Delivery status when you add a contract line. After the contract line is saved, the delivery-related fields are not editable. You can change a contract line's Delivery status by executing the Deliver contract line function. Event-driven recognition is currently limited to revenue templates where the Recognition method = "Straight line" or "Daily rate". If you select a revenue template with a different Recognition method, Intacct will automatically set the Delivery status to "Delivered" when you save the contract line. |

|

Delivery date |

This field is only applicable to termed contracts. The Effective date selected when the contract line's Delivery status was set to "Delivered". If the item's default status = "Delivered", this date is equal to the contract line start date. |

|

This field is only applicable to termed contracts. Defaults from the selected item. Options are:

You can change the Revenue recognition deferral status when you add a contract line. After the contract line is saved, you cannot change this field. See Troubleshoot Deliver contract lines for possible solutions. |

| Field | Description |

|---|---|

|

Billing method |

Determines how the contract line will be billed. Options are:

All billing methods are applicable to termed contracts except for kit item contract lines. The only billing method applicable to kit item contract lines is "Fixed price". The only billing methods applicable to evergreen contract lines are "Fixed price" and "Quantity based" with Quantity type = "Variable". When you select a billing method, Intacct only displays fields in the Billing section that are applicable to that billing method. Learn how to add contract lines for each billing method. |

|

Determines how often the flat or fixed amount will be billed. Options are:

All options are applicable to termed contracts. The only option applicable to evergreen contract lines and kit item contract lines is "Include with every invoice". The "Include with every invoice" Flat/fixed amount frequency option on the contract line is not supported when the bill-in-advance period = "Days". To bill more than once during the contract term, set the contract line's Flat/Fixed amount frequency to "Use billing template". |

|

|

Prorate partial periods |

This field is only applicable when Flat/fixed amount frequency = Include with every invoice. Select this option to have Intacct automatically calculate prorated prices when a contract line's start and/or end date results in one or more partial periods. Learn more about prorating partial periods for recurring billing. |

|

Billing frequency |

This field is only applicable when Flat/fixed amount frequency = Include with every invoice. Indicates the interval for recurring billing. Options are:

Any default value is populated from the Billing frequency on the contract record. You cannot change the contract line's billing frequency after you create an invoice, recognize revenue, or include the contract line in an MEA. This field is required when Billing frequency is not defined on the contract header. |

|

Quantity type |

This field is only applicable if Billing method = "Quantity-based". Options are:

For evergreen contracts: This field defaults to "Variable" and cannot be edited. |

|

Reset usage quantity |

This field is only applicable if Billing method = "Quantity-based" and Quantity type = "Variable". Determines when the included units are counted and/or determines when the system billing counter resets. Options are:

The setting for this field may default from the Billing price list selected on the contract. Changing this field will affect how the system calculates usage billing. For evergreen contracts: This field defaults to "After each invoice" and cannot be edited. Learn more about how Intacct determines billing quantities. |

|

Usage quantity recurs |

This field is only applicable if Billing method = "Quantity-based" and Quantity type = "Variable". This field is not applicable to evergreen contract lines. When you select this field, the system considers every usage record you enter for a line item as a recurring usage record. Each period, it creates new usage records in order to re-invoice the quantities (for example, user licenses). The setting for this field may default from the Billing price list selected on the contract. Changing this field will affect how the system calculates usage billing. The Billing frequency on the contract record determines how often quantity recurs for contract lines where the Flat/fixed amount frequency is One-time or Use billing template. In this scenario, Billing frequency on the contract record is required for contract lines with recurring usage. Learn more about recurring usage. Learn more about how Intacct determines billing quantities. |

| On contract line end date |

This field is only applicable if Billing method = "Quantity based" and Quantity type = "Committed". If there are remaining unused quantities as of the contract line end date, the options for how to account for the remaining quantities are as follows:

On the contract line end date plus 1 (plus any offset value), the Intacct scheduler initiates the applicable end date action for the contract line. The scheduler only executes the end date action one time. If you subsequently delete the system-created unused quantity usage record or uncancel the contract line, you need to manually account for any unused quantity as applicable. |

|

This field is only applicable if Billing method = "Quantity-based" and Quantity type = "Committed". If the customer has completely consumed the committed quantity but continues to consume additional quantities, the options for overage are as follows:

See the contract line's Audit Trail for details after the end date action executes. |

|

|

Billing template, Start date, and End date |

This field is only applicable if Flat/fixed amount frequency = "Use billing template". A billing template defines the schedule to invoice the flat/fixed amount for a contract line over the contract line term. The billing template start and end dates are only applicable to Predefined percentages billing templates. They default to the contract line start and end dates minus any bill-in-advance period. The billing template start date must be on or after the contract line start date minus any bill-in-advance period. You can extend the billing template end date beyond the contract line end date. If you want to schedule billing for a particular day of the month, set the billing template start date to the applicable date. For example, if the contract start date is September 1st, but you want to bill on the 15th of each month, you could set the billing template start date to September 15. The billing schedule generated from the template will schedule the invoices on the 15th of each applicable month. This method works for days numbered 1 - 28. To schedule billing dates at the end of the month, edit the billing schedule manually. If the GL posting date is different from the billing template start date, the billing schedule might be affected. See how the contract line GL posting date affects billing schedules for more information. Learn more about billing templates. |

|

Bill in advance: number of days or months before contract start date |

This field is only applicable to termed contracts. The bill-in-advance settings instruct Intacct to automatically create billing schedules that start before a contract line starts. These fields only display if the Bill in advance fields are populated on the contract. The bill-in-advance start date cannot occur in a closed period. For example, today is February 9, and you've just closed January's books. You want to add a new contract line that starts March 9. The contract's bill-in-advance period is two months, which would put the first invoice in a closed period. In this scenario, set the GL posting date to February 9 and Intacct will adjust the billing schedule, which you can then edit as applicable. See GL posting date. |

Calculate

| Field | Description |

|---|---|

|

Use the optional Quantity and Rate fields somewhat differently based on the billing method. When Billing method = "Fixed price":

When Billing method = "Quantity based" and Quantity type = "Variable":

The Rate field will accept a maximum of eight decimal places. Intacct assumes 1 if you do not wish to use the Quantity or Rate fields. |

|

|

Committed qty and Rate |

When Billing method = "Quantity based" and Quantity type = "Committed"

For example, say that you provide SMS messaging services and that you charge 0.10 per message for customers who commit to a volume of 5,000 messages in a given year. In this example, the Committed qty = 5,000. The Rate = 0.10. The committed rate can default from a billing price list. If you want to bill for overage, the contract must have a billing price list specified that has a valid price list entry for the selected item. Included units must be 0.00 in the billing price list entry. |

|

Hours and Blended rate |

When Billing method = "Project time":

Learn more about estimated time-based recognition. |

|

Multiplier |

Use this optional field to multiply the Flat/fixed amount by a value. It does not matter whether or not the item has a price list entry. For example, say you’re selling 10 user licenses at 100/month and the Flat/fixed amount = 1000. Say you’re contracting for 6 months. Enter 6 in the Multiplier field. The Flat/fixed amount is now 6000. The Multiplier field will accept a maximum of ten decimal places. Intacct assumes 1 if you do not wish to use the Multiplier field. For MEAs, any value in the Multiplier field will be used to calculate the extended fair value of the contract line. |

|

Discount |

Use this optional field to apply a discount percentage to the Flat/fixed amount. In order to use this field, the Quantity and Rate fields must be populated with values. For example, say that the Flat/fixed amount is 1,000. Type 1 in the Quantity field and press Tab. Intacct populates 1000 in the Rate field. Enter 5 in the Discount field. The Flat/fixed amount is now 950 after a 5% discount. You can enter up to 8 decimal places. For example, 10.33333333 would be a discount of 10 and 1/3 percent. For MEAs, any value in the Discount field will be used to calculate the extended fair value of the contract line. |

If there is an entry for the item in the billing price list selected on the contract, Intacct populates this field with a suggested amount. You can change the suggested amount using the Calculator fields or by simply typing a desired amount directly in this field. The Flat/fixed amount for imported contract lines does not default from the associated contract's billing price list. The Flat/fixed amount will be the value entered for the contract line in the contract line import template. Where do I enter sales tax associated with billing amounts?

The Order Entry transaction definition that you use when you generate a contract invoice contains the tax calculation logic. If logic exists, the sales tax is automatically calculated and included in the contract invoice. As with Order Entry transactions, tax related to kits is calculated on the kit item and not on the kit components. If it is your business process to do so, you can edit the contract invoice in Order Entry to manually enter or update sales tax amounts. You do not enter any sales tax information in Contracts. |

|

|

Base flat/fixed amount |

The Flat/fixed amount expressed in the base currency of the location/entity selected on the contract. This field is only applicable to multi-currency companies. |

|

Estimated txn amount |

This field is read-only. This field is only applicable when Billing method = "Project time". The product of the Hours and Blended rate. This is the expected value of timesheet billing for the time and materials project. Learn more about estimated time-based recognition. |

|

Estimated base amount |

This field is read-only. This field is only applicable when Billing method = "Project time". This field is only applicable to multi-currency companies. The Estimated txn amount expressed in the base currency of the location/entity selected on the contract. |

|

Flat/fixed amount per invoice |

This field is only applicable when Flat/fixed amount frequency = "Include with every invoice". The amount to bill for each invoice. |

|

Base/flat/fixed amount per invoice |

This field is only applicable when Flat/fixed amount frequency = "Include with every invoice". The flat/fixed amount per invoice expressed in the base currency. |

|

Duration (in periods) |

This field is only applicable when Flat/fixed amount frequency = "Include with every invoice". When Prorate partial periods = false, this field equals the number of billing periods for the contract line. When Prorate partial periods = true, the calculation is as follows:

If there are 2 partial periods, then the second partial period is also calculated and added to the duration. This value is calculated with a precision of 10 and rounded to 2 decimal places in the display. |

|

Total flat/fixed amount |

This field is only applicable when Flat/fixed amount frequency = "Include with every invoice".

|

|

Total base flat/fixed amount |

This field is only applicable when Flat/fixed amount frequency = "Include with every invoice". The Total flat/fixed amount expressed in the base currency. |

|

The Line type differentiates negative and positive value contract lines. Lines types are as follows:

Both Debook and Discount/Credit contract lines will appear with negative amounts on invoices and the amounts will appear in the Available credits link on the Receive payments page in Accounts Receivable. The only difference between the two negative line types is how they are treated in an MEA. See examples of Debook and Discount/Credit contract lines. Use the read-only Line type field to distinguish contract lines in your custom reports. |

|

|

Price list details |

If Intacct found an entry for the selected item in the billing price list, Intacct displays information about how it determined the suggested price. For example: |

|

View schedule |

Select this link to display the saved billing schedule or the preview billing schedule. |

Revenue

| Field | Description |

|---|---|

|

Component allocation |

Only applicable for kit component contract lines. Displays the revenue allocation calculation for the kit component contract line. For example, Total flat amount(12,000.00) * Revenue percent(10.00) = 1,200.00 This indicates the total flat/fixed amount for the parent kit item contract line is 12,000. The kit component contract line was assigned an allocation percent of 10. The total revenue allocated to the kit component contract line is 1,200.00. |

|

Recognize revenue on invoice |

Only applicable if Enable revenue recognition on invoice is set to true on the Configure Revenue Management page. Select Recognize revenue on invoice if you do not want to defer revenue for the contract line. When you select this field, Intacct automatically selects the "Recognize on invoice" revenue template for each revenue journal. As revenue is not being deferred, no revenue schedule will be visible on the contract line. When you generate an invoice for this contract line, Intacct automatically records the revenue to Billed Sales revenue. You can select this field on contract lines where the Billing method is either "Fixed price" or "Quantity based" with "Variable" Quantity type. This field is not editable on contract lines where the Billing method is "Project time", "Project materials", "Project time and materials", or "Quantity based" with "Committed" Quantity type. This field is not supported for items with Item type = "Kit". |

|

Revenue template 1 Start date End date Revenue template 2 Start date End date |

For termed contracts:

Use the Revenue template selection list to select the revenue template that will define the revenue schedule associated with revenue posting to the applicable journal. Your Contracts configuration may use one or two sets of revenue journals. The field labels for Revenue template 1 and Revenue template 2 will display the journal symbols selected in the Configure Contracts page for Revenue journal 1 and Revenue journal 2. The revenue template start date must be on or after the contract line start date. You can extend the revenue template end date beyond the contract line end date. If you want to schedule the entire Flat/fixed amount to post on one date, specify the same date as the start and end date. The revenue schedule might be affected if the GL posting date is after the revenue template start date. See GL posting date. If the default Delivery status for the contract line = "Undelivered", the revenue schedule cannot begin before the Delivery date regardless of the revenue template start date and might not begin until the Revenue recognition deferral status is met. If you edit the revenue schedule and change the scheduled posting date for the last period, Intacct will update the revenue template end date to that date. Note the following expected behavior regarding how templates with different recognition methods affect template dates:

Revenue templates are not required when the Billing method = Quantity-based, the Quantity type = Variable, and the Flat amount is 0.00. However, if you want to track Billed and Paid usage amounts in the contracts subledger (Journal balances tab), you must specify a revenue template before generating any invoices for the contract line. If you select Recognize revenue on invoice, the Revenue template 1 and Revenue template 2 fields always default to the system-generated revenue template named "Recognize on invoice". For evergreen contracts:

The Revenue template 1 and Revenue template 2 fields default to the system-generated revenue template named "Evergreen Revenue". However, if you selected Recognize revenue on invoice, the Revenue template 1 and Revenue template 2 fields default to the system-generated revenue template named "Recognize on invoice". The revenue start and end dates default to the contract line recurring billing period start and end dates. You cannot change the revenue template assignment or the revenue start and end dates. Evergreen revenue is recognized as follows:

Learn more about revenue templates. |

|

Revenue schedule 1 status and Revenue schedule 2 status |

Displays one of the following:

There is additional status of Renewal forecast that is only applicable to report data and never displays in the user interface. About revenue template fields

Your Contracts configuration may use one or two sets of revenue journals. The field labels for Revenue template 1 and Revenue template 2 will display the journal symbols selected in the Configure Contracts page for Revenue journal 1 and Revenue journal 2. |

|

Total revenue quantity |

The calculation for quantity-based revenue recognition is as follows:

Learn more about usage and quantity-based revenue recognition. This field is editable or read-only based on the following conditions: If Recognition method = "Quantity based" and Billing method = "Fixed price": This field is editable. Enter the total revenue quantity in this field. If Recognition method = "Quantity based" and Billing method = "Quantity based": This field is read-only. Intacct defaults the Total revenue quantity as follows:

If Recognition method = "Project time": This field is read-only. This field displays the Estimated txn amount, which is the expected value being deferred for the time and materials project. |

Dimensions

The dimension values here default from the values selected on the contract. Use the dropdown list beside the dimension to select different values as applicable.

| Field | Description |

|---|---|

|

Location Department Class Item Customer Supplier Project Task Employee Warehouse User-defined dimensions |

The Location selection list only displays the Location or Entity selected in the contract or children of that Location/Entity. Department and Location are always displayed. Other dimensions appear according to your GL configuration. If you selected at least one revenue template that's project-based, you must select the applicable Project in order to save the contract line. Learn more about linking projects with contracts. If you selected at least one revenue template that's task-based or if you’re deferring Project time revenue by Project and Task, you must select the applicable Project and Task in order to save the contract line. If the Billing method = Project materials or Project time and materials, the contract invoice will display dimension values and custom field values (as applicable) from the time and materials source transactions. For example, the dimensions selected on a timesheet will display on the contract invoice for the line item associated with the timesheet. If the contract line has been invoiced, has revenue posted, or participates in an MEA allocation, you cannot edit the dimensions. For items with Item type = Kit, the kit component contract lines inherit the dimension values selected on the kit item contract line. |

Historical details

After a non-historical schedule entry is posted, these historical fields cannot be edited.

If a contract line is not historical, this section is collapsed by default.

Learn about historical contract lines.

| Field | Description |

|---|---|

|

Historical |

Indicates whether a contract line is historical. |

| Historical billed | The total amount billed on or before the historical as of date. It cannot exceed the flat fixed amount. |

| Historical recognized | The total amount recognized on or before the historical as of date. It cannot exceed the flat fixed amount. |

| Historical as of date | The historical as of date is the day before your go-live date. It separates the historical data from the non-historical data. It must be after the GL posting date and cannot be more than 6 months in the future. The historical amounts on or before this date will be posted and summarized into a single entry. As a best practice, select the same date for all contract lines in a contract. |

| Historical offset GL account | A GL account dedicated for posting historical contract balances. |

Kit components tab

This tab is only applicable if the selected item's Item type = Kit.

This tab displays all kit component contract lines associated with the kit item contract line. Kit component contract lines display on the kit item contract line or in the Contract lines list. They do not appear as rows in the Contract lines grid on the contract.

You can select the kit item contract line in the Contract lines grid on the contract and then select Show details. The kit component contract lines display.

| Field | Description |

|---|---|

|

Line no. |

The kit component contract line number. Select the link in this column to open the kit component contract line. Intacct automatically creates kit component item contract lines when you add a kit item contract line. The kit component contract lines are numbered consecutively after the kit item contract line. For example, if there are 3 kit component items and the kit item contract line is line number 4, the kit component contract line numbers will be 5, 6, and 7. |

|

Item |

The kit component item ID. |

|

Item name |

The kit component item description. |

|

Allocation percent |

The percentage of revenue to recognize for each kit component item. The following is the expected behavior for the Allocation percent value:

|

|

Number of units |

The quantity of the kit component item to include in the kit item. This value cannot be updated on the contract line. This value is not common in kit items for contracts. This value has no impact on the price calculation for the kit item on a contract line. |

|

Delivery status |

Options are:

You can change this value for a kit component contract line when you add the kit item contract line. After you save the kit item contract line, use the Deliver contract or Deliver contract line function on the kit component contract line to set the Delivery status to Delivered. Only applicable if your company is using event-based recognition. |

|

Journal 1 status and Journal 2 status |

Displays one of the following:

|

|

Journal 1 revenue template and Journal 2 revenue template |

Select the revenue templates that will define the revenue schedule associated with revenue posting to the applicable journal. Your Contracts configuration may use one or two sets of revenue journals. The field labels for Revenue template 1 and Revenue template 2 will display the journal symbols selected in the Configure Contracts page for Revenue journal 1 and Revenue journal 2. By default, the revenue schedule defaults to start on the kit item contract line start date. To change the revenue schedule start date for a kit component contract line:

|

Renewal tab

This tab is only applicable to termed contracts.

Use the following fields on the Renewal tab to specify renewal settings for a contract line. The contract and the contract line must both have Renew selected in order for you to set up contract line renewal information.

| Field | Description |

|---|---|

|

Renewal term |

Displays the renewal length/period for the contract if Renew is selected on the contract. Displays "This contract hasn’t been set up for renewal" if the Renew checkbox is not selected on the contract. Learn how to set up a contract for renewal. |

|

Renewal billing template |

Specify a billing template for the contract line to use when it renews. The Renewal billing template field is only editable when Renew is selected on the contract line and the Flat-Fixed amount frequency = "Use billing template". The renewal billing template term must be less than or equal to the contract renewal term. If this field is left blank, on renewal the system will default the child contract line's billing template either to the default billing template selected on the item or the billing template selected on the source contract line. The billing template selected on the contract line takes precedence. |

|

Custom renewal amounts |

Intacct will automatically populate the Flat/fixed amount for a contract line in the renewed contract based on the Pricing option selected in the renewal template. However, you have the option to manually set a specific price for the contract line for one or more renewals. The custom renewal amount overrides the renewal template pricing option. For example, say you have a service item that renews annually, and the current contract line price is 1,000.00 per year. You contracted with the customer that the first two years of service will be set at 1,000.00, then two additional years at 1,050.00. In this example, you could set the Custom renewal amounts table on the contract line in the source contract as follows: In this example, the first row shows the first renewal will be 1,000.00. The second and third renewals will be 1,050.00. When the contract is renewed, Intacct removes the first row from the table, and the second row becomes the first row, the third row becomes the second row, and so on. In this example, the child contract will show the first renewal as 1,050.00 and the second renewal as 1,050.00. When the contract is renewed, you can change the renewal amounts for the contract line in the child contract as applicable. Users with the appropriate permissions can import custom renewal amounts for multiple contracts using CSV files. Learn more about custom renewal amounts. |

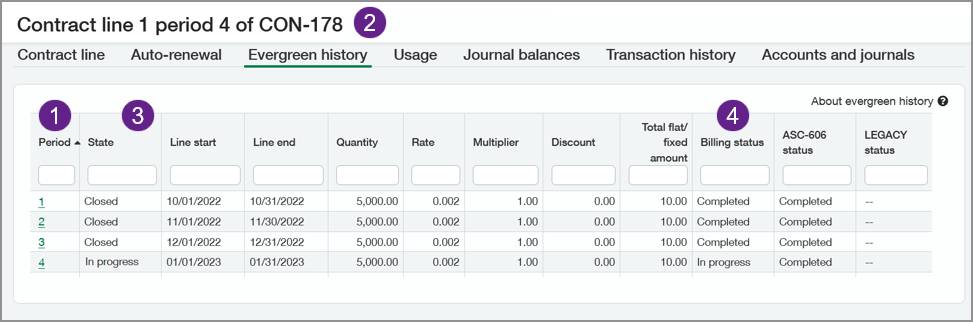

Evergreen history tab

This tab is only applicable to evergreen contracts.

When accessed from the contract, the Evergreen history tab displays all recurring billing periods for each contract line in the contract.

When accessed from the contract line, this tab displays the evergreen history for just the selected contract line.

You can see price changes over the life of a contract line on this tab. You can also delete an "In progress" contract line or an ended contract line in order to make changes to a past recurring period when you access this tab from the contract.

The following is an example of the Evergreen history tab on a contract line:

- The Period column displays the recurring billing period number associated with each contract line. You can select the period number to open the contract line for that recurring billing period.

- The contract line popup window displays the contract line number and the selected recurring billing period number.

- The State is the contract line State as it relates to the corresponding recurring billing period.

- The Billing status is the billing schedule status. If there's a Flat/fixed amount on the contract line, each recurring billing period for the contract line has its own billing schedule. A "Closed" contract line for a recurring billing period can have an "In progress" billing schedule if an invoice for that recurring billing period has not been generated.

| Field | Description |

|---|---|

|

Line no |

The contract line number associated with the corresponding recurring period. This field only displays when viewing evergreen history from the contract. |

|

Period |

The recurring billing period number. When a recurring billing period ends, Intacct creates a new contract line with the same contract line number for the next recurring billing period and assigns it a period order value. The first recurring billing period is 1, the second is 2, and so on. Learn more about recurring billing periods. |

|

State Line start Line end Quantity Rate Multiplier Discount Total flat/fixed amount Billing status Revenue 1 status Revenue 2 status |

See the Contract line field descriptions for information on these fields. |

Auto-renewal tab

This tab is only applicable to evergreen contracts.

| Field | Description |

|---|---|

|

Billing frequency |

The contract line's billing frequency (Monthly, Quarterly, or Annually). |

|

Trigger date |

The date Intacct creates the next recurring billing period. This is the "In progress" contract line end date plus or minus the number of days specified in the selected evergreen template. Only displays a value if Recurring = true. |

|

Renewal date |

The "In progress" recurring billing period end date + 1 day. This will be the start date for the contract line for the next recurring billing period. Only displays a value if Recurring = true. |

|

Override evergreen amounts table |

Intacct will automatically populate the Flat/fixed amount for a contract line in the applicable future recurring billing periods based on the Pricing option selected in the evergreen template. However, you have the option to manually set a specific price for the contract line for one or more future recurring billing periods. In this scenario, Intacct uses the override amount instead of the evergreen template pricing option. Users with the appropriate permissions can import override amounts for multiple contracts using CSV files. Learn how to override evergreen billing amounts. |

Expenses tab

The Expenses tab at the contract line level is only applicable to termed contracts. Expenses for evergreen contracts can be entered at the contract level.

See Expense line fields for field details.

Usage tab

The Usage tab appears:

- When Billing method = "Quantity based".

- When Billing method = "Fixed price" AND one of the revenue templates selected has Recognition method = "Quantity based".

You can add a usage record to "In progress" contract lines using the Usage tab. If the contract line state is "Canceled", add a usage record using the Usage Data page.

Use the Refresh button to update the quantity totals after you add or edit a usage record.

For evergreen contract lines, see How does usage work with recurring billing periods?

| Field | Description |

|---|---|

|

Committed quantity |

Displays the given allotment of your product or services that the customer is expected to consume over the course of the contract line. This field is only applicable to committed quantity billing. |

|

Total unused quantity |

Displays the Committed quantity minus the Total used quantity for the contract line. This field is only applicable to committed quantity billing. |

|

Total used quantity |

Displays the total quantity for all usage records for the contract line. This field is only applicable to committed quantity billing or quantity-based revenue recognition. |

|

Total billed quantity |

Displays the total quantity invoiced for all usage records for the contract line. Usage records that were invoiced will display a link to the associated invoice in the Document ID field. |

|

On contract line end date |

Displays the end date workflow action for the committed quantity billing contract line. |

|

If usage exceeds the committed quantity |

Displays the overage policy for the committed quantity billing contract line. |

Entries

| Field | Description |

|---|---|

|

Usage date |

The date associated with the item usage. Can be the date the usage was added to Intacct, the date the actual usage occurred, and so on. |

|

Quantity |

The quantity of the item that was used or otherwise consumed. |

|

Usage type |

Will display one of the following options:

|

|

Billed date |

The date the corresponding usage quantity was invoiced. |

|

Recur usage date |

If the usage quantity is recurring, this column displays the date the corresponding usage was counted. Intacct automatically creates a new usage record for cumulative quantities in order to be able to re-invoice the amounts. For example, say you enter a usage record with Usage date = 1/31 and usage Quantity = 100. When you generate invoices in January, the Recur usage date for this record is 1/31, which is the same as the Usage date because this is the first time it’s counted. When you generate invoices on February 28, Intacct automatically creates another usage record with a Usage date = 1/31, usage Quantity of 100, and Recur usage date of 2/28. In February's invoice, the usage quantity would be 200 (100 in January + 100 in February). In March, there would be three records for 100, and so on. Usage dates must be within the contract line start and end date range. This field is not applicable to evergreen contract lines. |

|

Document ID |

Displays the invoice transaction ID if the usage was invoiced. Select the link in this field to open the invoice in a separate browser window. |

|

Service period start date |

Indicates the beginning of the time frame during which your business’s services are provided or consumed for this usage entry. Learn more about service periods. |

|

Service period end date |

Indicates the end of the time frame during which your business’s services are provided or consumed for this usage entry. Learn more about service periods. |

Journal balances tab

The Journal balances tab shows the current balances for Deferred revenue, Sales revenue, Accounts Receivable, and Expense GL entries associated with the contract or contract line for the applicable set of journals. Intacct generates these totals as of the moment you opened the In progress contract. For the contract, amounts are shown in the transaction currency. For contract lines, amounts are shown in both the transaction currency and base currency.

You can do the following on this tab:

- To view journal balances as of a certain date, enter a date in the As of date field and select Refresh. The contract must be in Edit mode in order for you to enter a date in the As of date field.

- To view journal balances in the base currency for a specific contract line, select Show details for that row.

-

To customize which fields appear in the contract line tables, go to More actions > Edit Contract line journal 1 balances layout or Edit Contract line journal 2 balances layout.

- To see Billed and Paid amounts for a variable quantity usage contract line with a 0.00 flat or fixed amount, associate a revenue template with the contract line before generating any invoices for it.

- To view a GL report that shows a breakdown of an amount by each account, select the link in a desired column. From the report, you can drill-down to a specific journal entry. For evergreen contracts only from the Journal balances tab on the contract: The links to the GL report are not active for the In progress period summary of all contract lines as the contract lines can have different date ranges. The links are active for the All periods summary

- For evergreen contracts only: You have the option to see the unbilled, billed, and paid balances for the in progress recurring billing period or for the entire evergreen history. To change the display, select the applicable Show balances for option and select Refresh.

Note the following expected behavior:

- For kit contract lines: All balances will be 0.00 for the kit item contract line. The applicable values will display for the kit component contract lines.

- For contract lines where Recognize revenue on invoice = true: As no revenue is being deferred, only journal balances for Sales revenue and Accounts Receivable will be displayed.

Learn how to reconcile a contract to the General Ledger.

| Column | Description |

|---|---|

|

Unbilled |

The Deferred Revenue, Sales Revenue or Accounts Receivable amount that has not been invoiced. |

|

Billed |

The Deferred Revenue, Sales Revenue or Accounts Receivable amount that has been invoiced. |

|

Paid |

The Deferred Revenue, Sales Revenue or Accounts Receivable amount that has been paid. |

|

Deferred |

The amount of the expense that has not been recognized. |

|

Recognized |

The amount of the expense that has been recognized. |

Transaction history tab

When accessed from the contract, the Transaction history tab displays the entire debit/credit history for the contract. When accessed from the contract line, this tab displays the debit/credit history for just the selected contract line.

For evergreen contract lines: this tab shows the debit/credit history for the selected recurring billing period.

Auditors can use this information to verify the reclassification of Deferred Revenue, Sales Revenue, Accounts Receivable, and Expense GL entries. There are two journal entries associated with each line/event combination.

You can do the following on this tab:

- To view transaction history as of a certain date, enter a date in the As of date field and select Refresh. The contract must be in Edit mode in order for you to enter a date in the As of date field.

- To locate all activity related to a certain posting type, classification, and more, use the column filters . For example, to find all activity related to Deferred revenue, type "deferred" in the Posting type column filter.

Use the % wildcard character to further narrow the results in text fields. For example, if you just type "billed" in the Classification column, you'll see both Billed and Unbilled activity. If you type "billed%", you'll just see activity related to Billed amounts.

| Column | Description |

|---|---|

|

Historical |

Indicates whether the corresponding entry was created as a result of contract schedules processing that occurred as part of your Contracts implementation. If this box is checked, the corresponding entry was made in the Contracts subledger and not in the GL. |

|

Transaction date |

The posting date of the corresponding event. On payment events use the AR Receipt date as the Transaction date. |

|

Detail line |

The contract line associated with the corresponding event. This column only displays when you access the Transaction history tab from the contract. |

|

Expense line |

The expense line associated with the corresponding event. |

|

Type |

The type of amount associated with the corresponding event. Displays one of the following:

|

| Event |

The action on which the GL entry was made. Displays one of the following:

|

|

Balance type |

The type of balance affected by the event. Displays one of the following:

|

|

Posting type and Classification |

The posting type/classification combinations are as follows:

To view the GL accounts associated with these combinations, see the Posting configuration tab in the Configure Contracts page or the Accounts and journals tab on the contract line. |

|

Amount |

|

|

Base amount |

|

|

Exchange rate |

|

|

GL batch |

Select the link in this column to view the journal entry created by the system for the corresponding event. Note that Accounts Receivable, Deferred Revenue, and Sales Revenue posting to the Billed classification occurs on the Accounts Receivable invoice, so there is no GL batch link displayed. To see these journal entries, select the contract invoice Transaction link and then select the Posting details tab in the contract invoice. |

|

Transaction |

When Event = "On invoice" or "On payment", this column displays the invoice transaction identifier. Select the link in this column to open the invoice in a separate browser window. |

Accounts and journals tab

The Accounts and journals tab appears after a new contract line is first saved. The revenue and expense journals, billing and revenue accounts, and expense accounts are defined in the Configure Contracts page. The MRR and Customer count journals and Software Digital Board Book accounts are defined in the Configure Digital Board Book page.

Journals

| Field | Description |

|---|---|

|

Revenue Journal 1 and Revenue journal 2 |

Depending on whether your Contracts configuration uses one set of journals or two, you might see Revenue Journal 1 and/or Revenue Journal 2. These are the journals to which revenue is posted. The journals displayed here are defined in the Configure Contracts page. |

| Monthly recurring revenue (MRR | Only applicable if your company is also subscribed to the Software Digital Board Book. Refers to the journal to which MRR events are posted. |

| Customer Count | Only applicable if your company is also subscribed to the Software Digital Board Book. Refers to the statistical journal to which customer changes relating to MRR are posted. |

Billing and revenue accounts

| Field | Description |

|---|---|

| AR unbilled |

The account to which to post the contract line amount that has not yet been invoiced. |

| AR billed | The account to which to post an Accounts Receivable amount that has been invoiced. |

| DR unbilled |

The account to which to post the total value of the contract that has not yet been recognized or invoiced. |

| DR billed | The account to which to post a Deferred Revenue amount for which you’ve sent an invoice but the customer has not yet paid. |

| DR paid | The account to which to post a Deferred Revenue amount for which you have sent and invoice and the invoice has a payment applied to it. |

| Sales unbilled | The account to which to post a Sales Revenue amount that has not been invoiced. |

| Sales billed | The account to which to post a Sales Revenue amount that has been invoiced but the customer has not yet paid. |

| Sales paid | The account to which to post a Sales Revenue amount that has been invoiced and has a payment applied to it. |

Expense accounts

| Field | Description |

|---|---|

| Deferred expense |

The account to which to post an expense amount that has been incurred but not yet consumed. |

| Recognized expense |

The account to which to post an expense amount when recognizing the deferred expense. |

| Expense accrual |

The account to which the liability accrual is posted. |

Software Digital Board Book accounts

| Field | Description |

|---|---|

| New MRR | Account used to track the MRR from new MRR accounts. When a new MRR account is created, the customer is added to the account you create for customers. |

| Add-on MRR | Account to track the amount of increased monthly recurring revenue per customer. |

| Renewal upgrade | Account to track the amount of monthly recurring revenue due to customers upgrading their subscription. |

| Renewal downgrade | Account to track the amount of reduced MRR due to customers downgrading their subscription on renewal. |

| Downgrade | Account to track the amount of reduced MRR due to customer reducing subscription MRR. |

| Churn MRR | Account to track complete loss of MRR from a customer. |

| MRR offset | The account to offset debits from MRR accounts. |

| Customer | This statistical account is used to track the cumulative balance of customers. The first time you get an order from a customer, the customer count in the journal you created for customer count increases here. As customers leave, the customer count decreases. |

MRR history tab

This tab is only applicable to termed contracts.

The MRR history tab is only applicable if your company is subscribed to the Software Digital Board Book. Learn more about how MRR is tracked.

| Field | Description |

|---|---|

|

Transaction date |

The date the journal entry posted. |

|

Detail line |

The contract line number associated with the MRR. |

|

Change type |

Displays one of the following options:

|

|

Amount |

The amount associated with the MRR expressed in the transaction currency. |

|

Base amount |

The amount associated with the MRR expressed in the base currency. |

|

Stat/GL Batch |

Select the link in this column to view the journal entry created by the system for the corresponding event. |

Project time history tab

This tab only appears for contract lines where Billing method = "Project time". See Estimated time-based recognition for more information on Project time contract lines.

| Field | Description |

|---|---|

| Transaction date | The posting date of the corresponding transaction. |

| Type |

The type of amount associated with the corresponding transaction. Displays one of the following:

|

| Amount | The total amount billed for the associated aggregated hours expressed in the transaction currency. Select the link in this column to open the Aggregated Timesheet Entries page in a separate window to see the timesheet entries associated with the contract invoice. |

| Base amount | The total amount billed for the associated aggregated hours expressed in the base currency. |

| Transaction | The contract invoice transaction identifier. Select the link in this column to open the invoice in a separate browser window. |