Document sequences for auto-numbering IDs

This list supports the enhanced lists interface. Learn more about using enhanced lists.

You can use document sequencing to generate new IDs automatically for common transactions and records, such as new customers, suppliers, AR sales invoices, and more. For example, you can create a document sequence for AR sales invoices. This sequence automatically creates a new ID, such as "INV-0100" and increments the number each time a new AR sales invoice is entered.

You can save time by using document sequences. Instead of having users enter unique IDs for new customers, suppliers, and other records, you can have Intacct automatically generate the next sequence.

To view the Document sequence list, go to Company > Setup > Settings > Document sequence. From the Document sequence list, you can add a new sequence, or edit or view an existing sequence.

Where can I use numeric sequences?

You can create numeric sequences for many different types of records or transactions, such as for customers, suppliers, purchase requisitions, and adjustments.

Usually, you update the application configuration page or transaction definition to identify the specific sequence to use for a record or transaction. For example, if you create a sequence for AR sales invoices, update the Configure Accounts Receivable page to identify the document sequence. Administrators typically configure applications.

After you’ve configured your application, use caution when changing or deleting document sequences.

Best practice for numeric sequences

Intacct recommends against adding leading zeros as part of an ID sequence. IDs with leading zeros can cause errors when you import information into your company from Excel because Excel removes the leading zero. Use a character as a prefix to your ID; for example, C0001 for a customer ID.

Import Workaround: If you must use leading zeros in IDs, convert the column of ID numbers to text format in Excel before importing the file content. Excel will not remove the leading zeros when you save the file. Remember to convert the column of ID numbers to text format every time you use a template to import information that requires IDs.

For more information, see Name and ID creation—best practice.

Where can I use alpha sequences?

Alpha sequences are currently only available for use with Accounts Payable, Accounts Receivable, Cash Management, and French companies.

You can currently create alpha sequences for use with bank and credit card reconciliation matching in Cash Management, and for supplier and customer reconciliations in Accounts Payable, Accounts Receivable, and French companies.

To use alpha sequences, update the application configuration page or transaction definition to identify the alpha sequence to use for a record or transaction. For example, if you create a sequence for bank or credit card reconciliation, update Cash Management to use the alpha sequence. Administrators typically configure applications.

After you’ve configured your application, use caution when changing or deleting document sequences.

Add a document sequence

| Subscription |

Company |

|---|---|

| Regional availability |

All regions |

| User type |

Business |

| Permissions |

Document sequence: List, View, Add, Edit |

-

At the top level, go to Company > Setup > Settings and select Add (circle) next to Document sequences.

-

Enter the required fields, and any other information that you want to include in your sequence.

The required fields are:

-

Sequence ID

Cannot be changed after save.

-

Sequence name

-

Sequence status

-

Sequence type

Cannot be changed after save.

-

Primary sequence

Cannot be changed after save.

-

Next primary sequence

Automatically generated, but can be edited.

-

-

Select Save.

See the field descriptions for more information about what to enter in each field.

Fiscal year rollover

Fiscal year rollover for document sequences helps you manage your alpha and numeric sequences with easy year-end transitions, improved organization, and enhanced transaction matching.

Fiscal year rollover is only available for use with Contracts, Fixed Assets Management, and General Ledger at this time. Much like an alpha sequence, your Intacct application must be configured to use a fiscal year rollover document sequence.

To use fiscal year rollover:

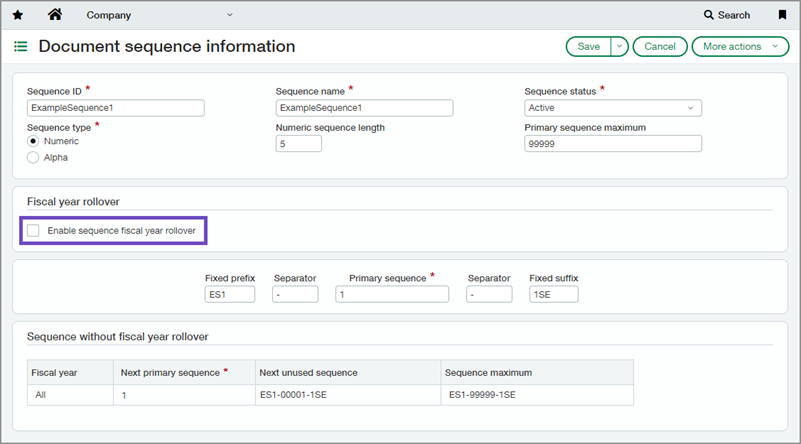

- Create a new document sequence.

- Enter information for the required fields.

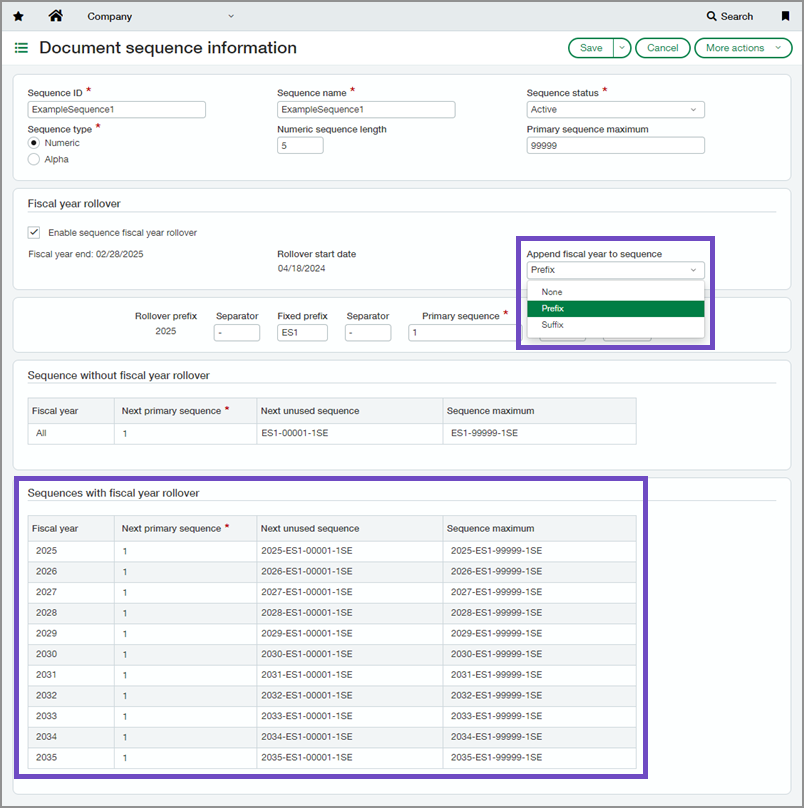

- Select the Enable sequence fiscal year rollover checkbox.

When selected, the fiscal year end for your company is displayed, and the day the rollover was enabled for this sequence. - Select how you want the fiscal year to be appended to your document sequence:

None: When selected, the fiscal year will not appear in your document sequence.

Prefix: When selected, the fiscal year is added as the Rollover prefix to your document sequence, followed by an editable Separator field.

Suffix: When selected, the fiscal year is added as the Rollover suffix to your document sequence, preceded by an editable Separator field.

- Save your changes.

When fiscal year rollover is enable, the next 10 years of document sequences with corresponding fiscal years are displayed. The year field is not editable.

Edit a document sequence

| Subscription |

Company |

|---|---|

| Regional availability |

All regions |

| User type |

Business |

| Permissions |

Document sequence: List, View, Add, Edit |

-

Go to Company > Setup > Settings > Document sequences.

-

Find the document sequence that you want to edit.

-

Select Edit at the end of the row.

-

Update the information that you want to include in your sequence.

The following fields cannot be edited:

Sequence ID

Sequence type

Primary sequence

-

Select Save.

-

Go to Company > Setup > Settings > Document sequences.

-

Select Edit next to the document sequence that you want to change.

-

Update the information that you want to include in your sequence.

The following fields cannot be edited:

Sequence ID

Sequence type

Primary sequence

-

Select Save.

See the field descriptions for more information about what to enter in each field.

Delete a document sequence

| Subscription |

Company |

|---|---|

| Regional availability |

All regions |

| User type |

Business |

| Permissions |

Document numbering: List, View, and Delete |

You delete a document sequence from the Document sequence list.

Use caution when deleting sequences. If you delete a sequence that's in use, users cannot create any documents using this sequence and they receive an error message.

Intacct recommends that you tightly control user permissions for this function using Company > Admin > Users > Subscriptions > Permissions.

-

Go to Company > Setup > Settings > Document sequences.

- Find the record that you want to remove.

-

Select More actions > Delete at the end of the row.

Depending on your user preferences, the system might prompt you to confirm the deletion.

-

Go to Company > Setup > Settings > Document sequences.

-

Find the record that you want to remove and select Delete.

Depending on your user preferences, the system might prompt you to confirm the deletion.

Turn off auto-sequencing

Auto-sequences for new IDs are assigned in the application configuration page for each Intacct application. Administrators can edit the sequences.

When you turn off auto-sequencing, existing IDs remain.

The following steps are an example of how to turn off document sequencing in Accounts Receivable. These steps can be used in other Intacct applications to turn off document sequences there as well.

| Subscription |

Administratio |

|---|---|

| Regional availability |

All regions |

| User type |

Business user with admin privileges |

| Permissions |

Application subscriptions: List, View, and Configure |

-

Go to Accounts Receivable > Setup > Configuration.

Some applications, such as Customization Services, Platform Services, and Web Services, do not have configuration options.

- Scroll down to Document sequencing.

- Delete the assigned document sequence under Invoices and leave the dropdown field empty to turn off auto-numbering.

- Save your changes.

Field descriptions

The following tables describe each field on the Document sequence list and the Document sequence information page:

Document sequence list fields

| Field | Description |

|---|---|

|

Sequence ID |

The name of the sequence. You specify this name in the corresponding field of the Document sequence information page. |

|

Sequence name |

The sequence name that prints on AR sales invoice PDFs. |

|

Next unused sequence |

Shows the next number available for use in a specific document sequence, which is useful for troubleshooting. For example, it might otherwise be time-consuming for the administrator to find the last AR sales invoice to check the number. You can reset this number on the Document sequence information page. |

|

Last updated |

This field shows the last time that a sequence was changed. It’s useful for troubleshooting. |

Document sequence information page

Sequence information

| Field | Description |

|---|---|

|

Sequence ID |

The name of the sequence. It’s important that you name the sequence using words that describe the documents for which you’ll use the sequence. If you use recurring AR sales invoices, you can set a different sequence ID from regular AR sales invoices. |

|

Sequence name |

The title that prints on PDFs of AR sales invoice-type documents in the Inventory Control (IC), Purchasing (PO), and Order Entry (OE) applications. The text you enter here is used as the title of the AR sales invoice-type documents. Printing a title on PDFs is useful in the IC/PO/OE applications. You might have several document templates that are of the AR sales invoice type, but are not invoiced (for example, adjustments). By using this sequence name, you can print a document with a different and more appropriate title. This field only affects the IC/PO/OE applications. |

|

Sequence status |

The default status is Active. If you do not want this sequence to appear on lists, but you do want to keep it for future use, choose Inactive. For example, say you create sequences that are relevant only to calendar quarters for expense reports such as EXPRPT-1847-2004Q1. You might want to make this sequence inactive at the beginning of Q2 when the sequence EXPRPT-1847-2001Q2 begins. You might still view inactive sequences by selecting the Include inactive checkbox in the Document sequence list. |

|

Sequence type |

The default setting is Numeric.

Alpha sequences are currently only available for use with Cash Management, or French companies. When you select Numeric, the numeric sequence length field is available for use, and all sequences are displayed in numbers. When you select Alpha, the numeric sequence length field is not available for use, and sequences are displayed in lower case letters. |

|

Numeric sequence length |

Only available when the Sequence type is Numeric. The total length of the primary numeric sequence that includes the leading zeroes. The maximum length allowed here is 16 characters. For example, if you enter 5 in this field, and set your Primary sequence to 123, the result is 00123 upon entering the first AR sales invoice. The length of the primary sequence is a total of 5 numbers, with two zeroes before the first instance of the primary sequence. The total length of the primary numeric sequence helps when sorting in lists. The number 00123 is displayed before 10123 in a list. If you do not specify the leading zeroes, 10123 is displayed before 123 in the list. This grouping makes lists appear as if they’re incorrectly ordered. |

|

Primary sequence maximum |

Displays the sequence maximum for your selected sequence. The default maximum for numeric and alpha sequences is 16 characters (numbers or letters). You can choose to make your sequence maximum fewer than 16 characters. When the end of the sequence is reached, you’ll receive an error message, and the document sequence administrator must start a new sequence. |

Fiscal year rollover

Fiscal year rollover is only available for use with Contracts and Fixed Assets Management at this time.

| Field | Description |

|---|---|

|

Enable sequence fiscal year rollover |

Checking this box lets you manage sequences that change at the start of each fiscal year. You can use it for both Numeric and Alpha sequences. When checked, these populated fields are displayed:

|

|

Append fiscal year to sequence |

Only available for use when you enable sequence fiscal year rollover. Use the dropdown to select where the fiscal year will be appended to the document sequence.

|

Document sequence fields

| Field | Description |

|---|---|

|

Rollover prefix |

When the fiscal year is added to the document sequence as a prefix, the year is automatically displayed here. This field is not editable and is based on the current fiscal year of you company. |

|

Fixed prefix, Separators, Fixed suffix |

Characters that appear before, in between, and after the primary sequence. The maximum length of the Fixed prefix and Fixed suffix fields is 30 characters. You can enter fewer characters than the maximum. The maximum length for the Separator fields is one (1) character. This applies to all Separator fields. For example, INV-E1-0000000012345678-2020Q3 could be a document ID that uses the maximum number of characters available.

When you enable sequence fiscal year rollover, the fiscal year can be added to your document sequence, with additional separator fields. For example, 2024-INVE1-0012345678-Q3 could be a document ID that uses a fiscal year as a suffix.

|

|

Primary sequence |

The start of this sequence. After you Save, you can no longer change this sequence. Intacct recommends against adding leading zeros as part of an ID sequence. IDs with leading zeros can cause errors when you import information into your company from Excel because Excel removes the leading zero. Use a character as a prefix to your ID; for example, C0001 for a customer ID. |

|

Rollover suffix |

When the fiscal year is added to the document sequence as a suffix, the year is automatically displayed here. This field is not editable and is based on the current fiscal year of you company. |

Sequences with or without fiscal year rollover

| Field | Description |

|---|---|

|

Fiscal year |

When fiscal year rollover is not enable, the sequences apply to all years. When fiscal year rollover is enable, the next 10 years of document sequences with corresponding fiscal years are displayed. This field is not editable. |

|

Next primary sequence |

When fiscal year rollover is not enabled, this field shows the next document's assigned sequence. When fiscal year rollover is enable, the next 10 years of the document's assigned sequences are displayed. The document sequence administrator can use the next unused value field for troubleshooting. For example, it might otherwise be time consuming for the administrator to find the last AR sales invoice to check the sequence. You can edit this sequence. However, be careful when editing this sequence after you have created documents that already use this sequence. Lowering the sequence below an existing sequence triggers an error if Warn is chosen for duplicate numbers in the AR or AP Configuration pages. To use this setting, go to Company > Admin > Subscriptions, then select Accounts Receivable or Accounts Payable, then select Configure. |

|

Next unused value |

This non-editable preview allows you to experiment with different settings for the prefix, suffix, and separators. Previewing the format of your sequence allows you to see how the final sequence appears when displayed on a document. |

|

Sequence maximum |

This non-editable preview allows you to experiment with different settings for the prefix, suffix, and separators. Previewing the format of the final value in a sequence allows you to adjust the sequence range as needed. |