Field descriptions: Cancel Contract

Cancel Contract Line fields

| Field | Description |

|---|---|

| Cancellation date |

The effective date for the cancellation. Billing scheduled on or after the cancellation date will be terminated. For example, say you have an invoice scheduled for March 15. If you use March 15 as the cancellation date, the March 15 invoice will be terminated. If you use March 16 as the cancellation date, the March 15 invoice is left open. When the total revenue posted or scheduled to post prior to the cancellation date does not equal the total amount billed, Intacct will split the next scheduled period's revenue into two periods:

Example

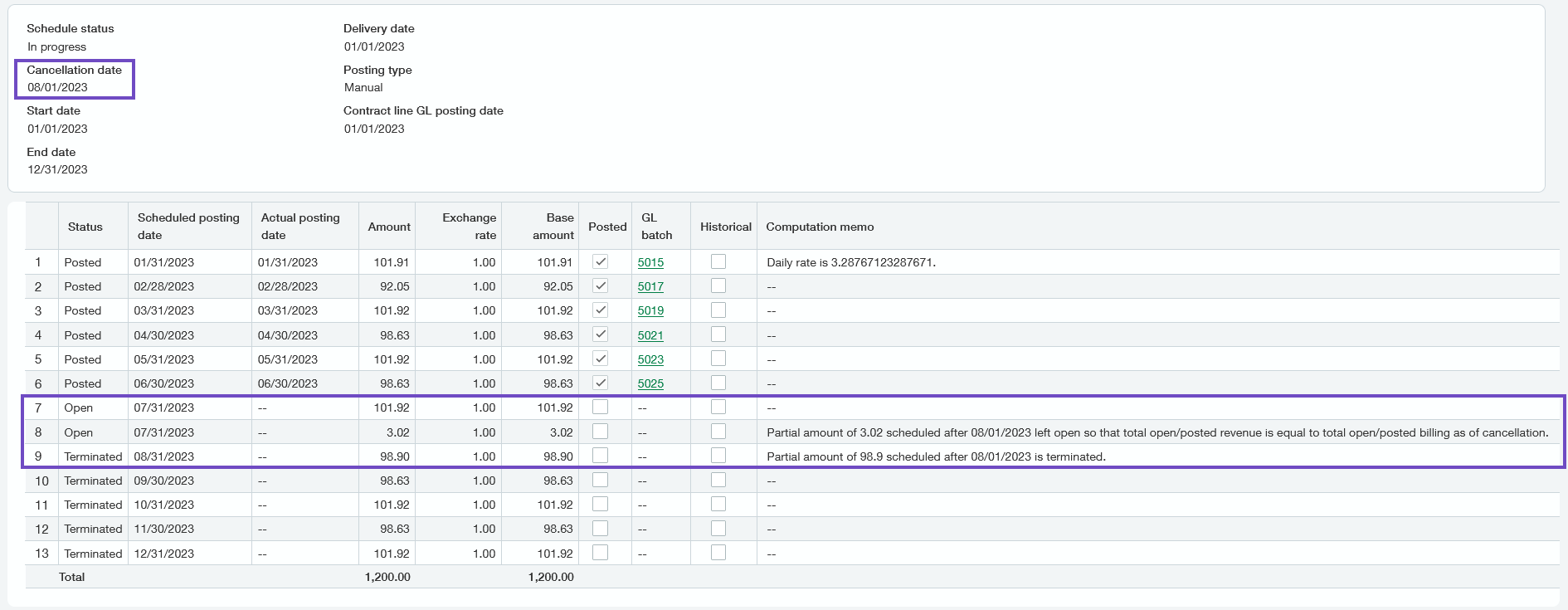

Say you have a contract line that starts 01/01/2023 and ends 12/31/2023 with a Flat/Fixed amount of 100.00 with a Billing frequency of Include with every invoice. The contract line uses the Daily rate recognition method for its revenue schedule. In July, the customer calls and wants to keep service through the end of July but then cancel the contract line going forward. As of 07/31/2023 (the cancellation date minus 1), the total billed amount is 700.00, but the total scheduled revenue amount is only 696.98, which includes an Open amount of 101.92 already scheduled to post on 07/31/2023. You cancel the contract line using 08/01/2023 as the cancellation date. On cancel, Intacct deletes the next period scheduled on 08/31/2023 for the amount of 101.92, splits it into two partial periods, schedules the difference needed to equal the billed amount on the cancellation date minus 1, and leaves the remaining terminated portion scheduled to post on 08/31/2023 as in the following example: |

| Apply to billing revenue schedules | Select this checkbox to cancel both billing and revenue schedules. Although billing and revenue schedules might not be concurrent, they are canceled together. |

| Apply to expense schedules | Select this checkbox to cancel all expense schedules associated with the contract line. |

| Create adjustments |

Adjustments for revenue and billing schedules:

Typically, you will only select Create adjustments if the billed amount prior to cancellation will never be paid. When you select this field, Sage Intacct creates an AR adjustment of type = Credit memo and automatically applies it to the correct contract invoice. The adjustment does the following:

Note the following expected behavior concerning the Create adjustments field:

Adjustments for expense schedules:

Sage Intacct automatically creates a reversal GL entry for any expense amounts that were posted after the cancellation date. For example, say you already posted an expense amount of 10.00 for February using a posting date of February 28. Later, you need to cancel the contract using a cancellation date of February 2. If you select to create an adjusting entry, Intacct will credit the Expense recognition account for 10.00 and debit the Expense accrual account for 10.00. If your company is subscribed to the Taxex application, do not select Create adjustments. Instead, use a debook contract line to reverse any outstanding invoices. |

| Include unbilled usage with invoice generation |

Select this checkbox if you want to invoice usage that has not yet been recorded or that you want to be available for invoicing after the cancellation date. |

| Generate any percent complete billing schedule entries | Select this checkbox to have Intacct automatically calculate unbilled percent complete billing as part of the cancellation process. It will schedule the amount to post on the cancellation date minus one and leave it open on the billing schedule. Learn more about percent complete billing. |

Cancel Contract fields

| Field | Description |

|---|---|

| Cancellation date |

The effective date for the cancellation. Billing scheduled on or after the cancellation date will be terminated. For example, say you have an invoice scheduled for March 15. If you use March 15 as the cancellation date, the March 15 invoice will be terminated. If you use March 16 as the cancellation date, the March 15 invoice is left open. When the total revenue posted or scheduled to post prior to the cancellation date does not equal the total amount billed, Intacct will split the next scheduled period's revenue into two periods:

Example

Say you have a contract line that starts 01/01/2023 and ends 12/31/2023 with a Flat/Fixed amount of 100.00 with a Billing frequency of Include with every invoice. The contract line uses the Daily rate recognition method for its revenue schedule. In July, the customer calls and wants to keep service through the end of July but then cancel the contract line going forward. As of 07/31/2023 (the cancellation date minus 1), the total billed amount is 700.00, but the total scheduled revenue amount is only 696.98, which includes an Open amount of 101.92 already scheduled to post on 07/31/2023. You cancel the contract line using 08/01/2023 as the cancellation date. On cancel, Intacct deletes the next period scheduled on 08/31/2023 for the amount of 101.92, splits it into two partial periods, schedules the difference needed to equal the billed amount on the cancellation date minus 1, and leaves the remaining terminated portion scheduled to post on 08/31/2023 as in the following example: Expense amounts scheduled on or after the cancellation date will be terminated. The cancellation credits any deferred expense balance and debits any expense accrual balance. |

| Cancel all contract schedules | Select this checkbox to cancel all contract lines and all expense lines in the contract. When you use this option, Intacct sets the contract State to Canceled. |

Cancel contract line revenue and billing

| Field | Description |

|---|---|

| Contract line no | The contract line number. |

|

Contract line item ID and Contract line item name |

The item ID and name associated with the contract line. |

| Create adjustments |

Typically, you will only select Create adjustments if the billed amount prior to cancellation will never be paid. When you select this field, Sage Intacct creates an AR adjustment of type = Credit memo and automatically applies it to the correct contract invoice. The adjustment does the following:

Note the following expected behavior concerning the Create adjustments field:

If there is any sales tax or other subtotals associated with the unpaid invoice, you still need to manually create a credit memo for the applicable amounts to receive against the invoice.

If your company is subscribed to the Taxex application, do not select Create adjustments. Instead, use a debook contract line to reverse any outstanding invoices. See Before canceling a contract schedule for more information. |

| Include unbilled usage in invoice generation |

Select this checkbox if you want to invoice usage that has not yet been recorded or that you want to be available for invoicing after the cancellation date. |

| Generate any percent complete billing schedule entries | Select this checkbox to have Intacct automatically calculate unbilled percent complete billing as part of the cancellation process. It will schedule the amount to post on the cancellation date minus one and leave it open on the billing schedule. Learn more about percent complete billing. |

Cancel contract line expense

| Field | Description |

|---|---|

| Expense cancellation date |

The effective date of the cancellation. Expense amounts scheduled on or after the cancellation date will be terminated. The cancellation credits any deferred expense balance and debits any expense accrual balance. |

| Contract line no | The contract line number associated with the expense |

|

Contract line item ID and Contract line item name |

The item ID and name associated with the contract line. |

|

Create adjusting journal entry |

If you select this checkbox, Sage Intacct automatically creates a reversal GL entry for any expense amounts that were posted after the cancellation date. For example, say you already posted an expense amount of 10.00 for February using a posting date of February 28. Later, you need to cancel the contract using a cancellation date of February 2. If you select to create an adjusting entry, Intacct will credit the Expense recognition account for 10.00 and debit the Expense accrual account for 10.00. |

Cancel contract expenses