Report on a modified accrual basis

If your company records transactions on an accrual basis, but managers need a report using a modified accrual basis, you do not need to change your accounting method to create this report.

Instead, create journal entries each quarter to back out the relevant entries. You can then run reports showing your cash position without affecting your regular books.

This example shows you how to prepare journal entries to adjust for unpaid bills. You can then run reports that reflect expenses and cash from that viewpoint.

Create a user-defined book

Create a user-defined book for the journals that you'll use to back out the unpaid bills.

| Subscription |

General Ledger |

|---|---|

| Regional availability |

All regions |

| User type | Business user |

| Permissions |

User-defined books: List, View, Add |

| Prerequisites |

Administrator must enable user-defined books in General Ledger > Setup > Configuration. |

- Go to General Ledger > Setup > More and select Add (circle) next to User-defined books.

- Enter a Book ID that will be meaningful to you when creating a report.

The Book ID appears in the Other books list when you create financial reports or other General Ledger reports.

- Enter a Description.

- Optionally, select the Management reporting checkbox to allow this book to bypass closed periods.

You cannot change this setting after the book is created.

Management reporting books do not impact your actual books. Furthermore, you can only configure user-defined journals and the Software Digital Board Book to post to management reporting books. Subledgers, such as Accounts Payable, cannot post to management books. -

Select Save.

Create a user-defined journal

Create an Accounts Payable journal that you'll use to create the adjustment entries.

| Subscription |

General Ledger |

|---|---|

| Regional availability |

All regions |

| User type | Business user |

| Permissions |

User-defined journals: List, View, Add |

| Prerequisites |

Administrator must enable user-defined books in General Ledger > Setup > Configuration. |

- Go to General Ledger > Setup > User-defined.

-

To add a new journal, select Create.

- Enter the Symbol and Title for the journal.

- In most places, the symbol appears along with the title of the journal, as in READJ--Real Estate Adjustments.

- Make sure that the symbol and title clearly distinguish the purpose of the journal.

-

Choose the User-defined book that you created in the previous section.

- Select Save.

- Go to General Ledger > Setup > User-defined.

-

Select Add to add a new journal.

- Enter the Symbol and Title for the journal.

- In most places, the symbol appears along with the title of the journal, as in READJ--Real Estate Adjustments.

- Make sure that the symbol and title clearly distinguish the purpose of the journal.

-

Choose the User-defined book that you created in the previous section.

- Select Save.

Run the Bills analysis report

Run the Accounts Payable AP supplier invoices analysis report to get a list of unpaid bills by account, location, and department. This is the information that you'll use to create the journal entries.

-

Go to Reports > Reports center.

-

In the applications list, select Accounts Payable to filter the reports.

-

Select Bills analysis.

-

In the Start date field, enter the inception date for your company.

-

In the End date field, enter the current date.

-

In the Filters section, select the following options:

-

Include payment details

-

Show: Detail

-

Show documents: Not paid

To get the data for each Location and Department, you can select them now and run the report for each location and department combination. Or you can run the report for all of them and then filter the data in Excel. -

-

Group by the Account number.

-

Print the report or Export it to Excel to manipulate the data as needed.

-

Make note of your totals by department and location if applicable.

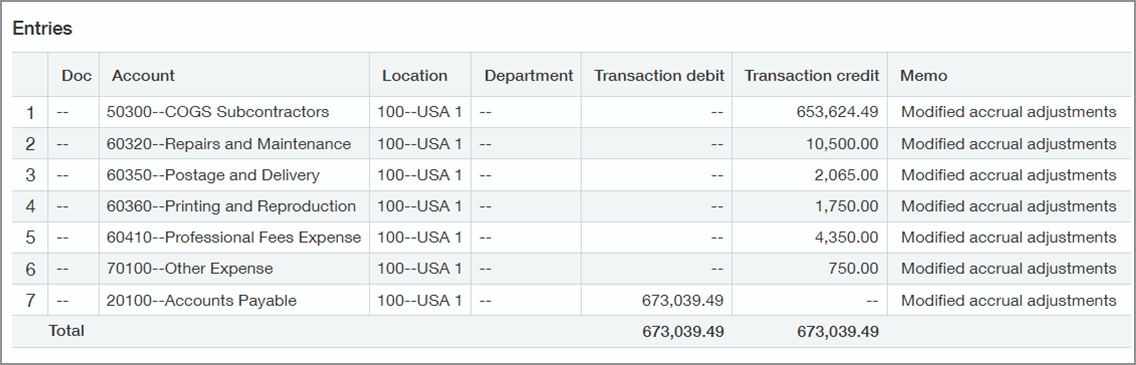

Create journal entries

Use the data from the report to create journal entries that reflect the unpaid bills.

-

Go to General Ledger > All > and select Add (circle) next to User-defined.

-

Select the user-defined Accounts Payable journal that you created in the earlier section.

-

Complete the remaining fields in the header section.

-

In the Entries section, select the Accounts Payable Account.

-

Select the Department and Location if applicable.

-

Enter a Debit for the total of the expenses for that department and location.

-

Select one of the expense accounts and enter a Credit for the applicable amount.

-

Continue crediting expense accounts as needed.

-

When you're finished entering information, select Submit.

For this example, we've debited the Accounts Payable account by a total of $673,039.49 and credited the Utilities expense account by the same amount.

Add the user-defined book to a column in a report

You can include the user-defined book in both standard reports, such as the General Ledger report, and in financial reports.

For this example, we'll add the user defined book to the balance sheet.

-

Go to Reports > All > Financial reports.

-

Use the filters to find the balance sheet.

-

Next to the name of the report, select Edit.

-

Select Duplicate and enter a report name.

The new report is added to the list.

-

Next to the new report, select Edit.

-

On the Columns tab, add a column to the report.

-

Add a Column title to indicate that this is the column with the modified accrual-based numbers.

-

In the new column, next to Other books, select Edit books.

-

Select the user-defined book that you created.

-

Make other changes as needed.

-

Select Save.

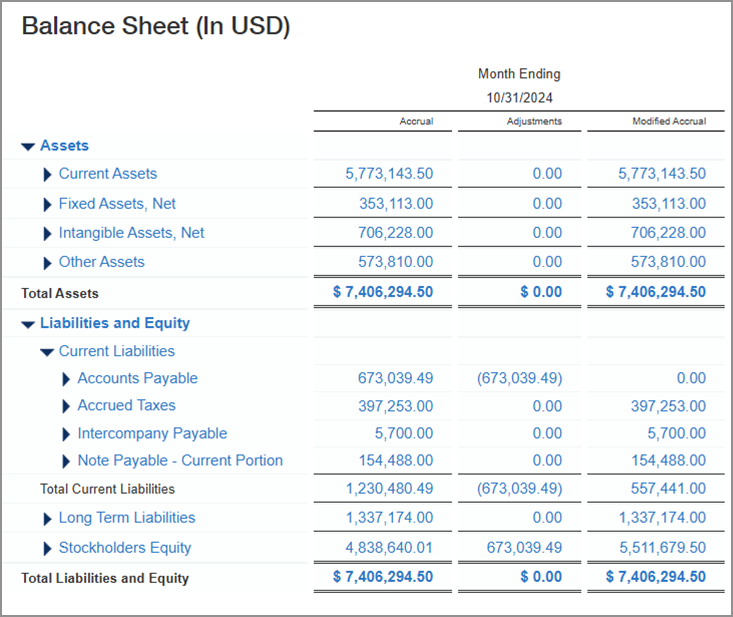

In the example balance sheet below, notice the following differences in the Modified Accrual column:

-

In the Liabilities section, the Accounts Payable total and the Total Current Liabilities are $673,039.49 lower.

-

The Stockholders Equity total is $673,039.49 higher.