Reallocate a revenue recognition schedule—AR or Order Entry

In some cases, you may need to change the way revenue is allocated across periods after the revenue recognition schedule has been created. For instance, events that occur after the transaction was created might cause a need to speed up or slow down revenue recognition.

Using the Revenue Reallocation window, you can reallocate revenue for any item where the schedule is either "Not Started" or "In progress."

You can only reallocate revenue recognition schedules that use the straight line recognition method.

| Subscription |

|

|---|---|

| Regional availability |

|

| User type | Business |

| Permissions |

General Ledger

|

| Configuration | Edit revenue schedules must be set to true in the Configure Revenue Management page. |

| Restrictions | The Recognition method on the revenue recognition template must be "Straight line". |

About reallocating "In progress" schedules

Once revenue has been posted at least once, a revenue recognition schedule is considered to be "in progress." Intacct reallocates unposted revenue as follows:

- Reallocation applies only to future periods: When you reallocate, you'll be asked to enter a new start date and new end date, which must be after the date that revenue was last posted.

- The amount to be reallocated is equal to the total unrecognized revenue: The remaining revenue will be allocated across all periods between the new start date and end date.

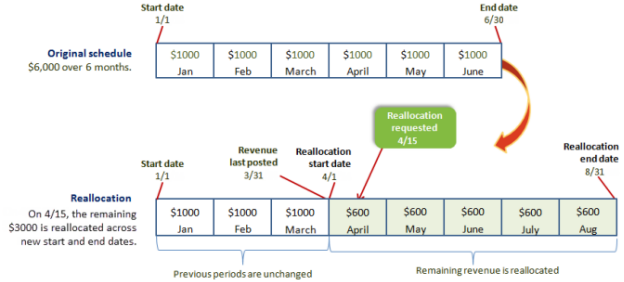

Say that your original revenue recognition schedule was set to allocate 6000.00 over 6 months, starting at the beginning of January. On April 15, you decide to reallocate the revenue to continue recognizing revenue until August 31.

In the example above, notice that the amount to be recognized (6,000.00) does not change. However, the allocation of the revenue changes so that:

- The amounts previously posted for January, February, and March remain unchanged, at 1,000.00 per period.

- The remaining 3,000.00 is reallocated across the new start and end dates. In this case, the start date is April 1, which is the first available date after the previous posting.

Reallocate revenue

You can reallocate any revenue that has not already been recognized.

To reallocate revenue:

- Open the desired revenue recognition schedule.

- In the Revenue Recognition Schedule window, select Edit.

- Select the Reallocate Revenue button.

The Revenue Reallocation dialog box appears.

- Enter the Start date and End date for the reallocation.

- If the schedule is "In progress," the Start date must be after the Revenue last posted on date.

- If the schedule is "Not Started," the Revenue last posted on field will be blank. In this scenario, you can enter any start and end date.

- Select Submit.

Intacct reallocates the total Open (unposted) revenue amount according to the associated recognition method and date range.

- Do one of the following:

- If you want to apply the reallocation, select Save. A Confirm change dialog box appears. Enter any text regarding the reallocation and select Save. If there are one or more Open periods with past Scheduled posting dates, a dialog box then appears asking you to indicate whether or not to post the entries for the prior periods. Select Yes to post them now or select No to just save the reallocated schedule without posting past periods.

- If you do not want to apply the reallocation, select Cancel.

Field descriptions

| Item | Description |

|---|---|

|

Template |

Name of the revenue recognition template that was assigned to this line item. |

|

Recognition method |

The allocation method that the assigned revenue recognition template uses to allocate revenue, such as "Straight line" or "Exact days per period." |

|

Schedule period |

The posting frequency (for example, monthly), as well as the status of the current schedule (such as "in progress"). |

|

Revenue last posted on |

Date that revenue was last posted for the schedule. Displays -- if the revenue schedule status is "Not started". |

|

Start date |

Dates on which you want to start and end the reallocation of revenue. When you select Submit, the remaining unrecognized revenue will be reallocated for any periods that fall between the new start and end dates.

|