About rules and rule sets

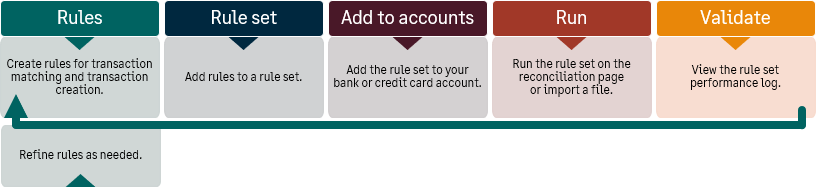

Use rules and rule sets to define how to match and create transactions in Sage Intacct for reconciliation based off bank data from an import file or bank feed. You cannot reconcile an account with an import or bank feed unless it has a rule set, so it's important to know how to set them up.

There are many different ways to use rules to account for real-life scenarios. For example, you can create a rule to ignore leading zeroes on transactions. Or, create a rule to match transactions within a range of posting dates.

View matching rule examples and creation rule examples.

To set up rules and rule sets, enable Cash Management permissions for Bank transactions rules and Bank transactions rule sets. You cannot see menu options for these items until you enable these permissions.

Use matching rules to match bank transactions to transactions in Intacct. For example, you might want to automatically match supplier payments and credits, payroll cheques and ACH, and charge payoff payments.

When you set up a matching rule, it's recommended to use filters. Grouping is optional. Defining a matching condition for amount is required. You can add other matching conditions as needed.

Rules are assigned to rule sets and rule sets are assigned to one or more bank or credit card accounts. You can save time by using the same rule in multiple rule sets or by assigning the same rule set to multiple accounts.

Create matching rules at the same level in which the bank account was created and the same level that you perform reconciliations. For example, if a bank account was created within an entity, create rules at the entity level.

How it works

Rules run in the following circumstances:

- When you access the account reconciliation page.

- When you import a bank file.

- When bank transactions arrive into Sage Intacct from a bank feed.

- Automatically every 4 hours.

A matching rule first applies any filters to reduce the number of unmatched transactions for more accurate matching. If you're not using any filters, the rule considers all transactions.

Next, transactions are grouped based on the selected options. For example, multiple Intacct transactions might be grouped together based on document number to match to one lump sum at the bank.

After grouping, the rule matches transactions using the defined matching conditions. Matching conditions consider the total value of the group when matching against a single transaction. For example, the total amount of a group of Intacct transactions needs to equal the total amount of a bank transaction to match if you are trying to match multiple transactions to one lump sum.

All conditions defined in the rule must be met for transactions to match. If a transaction doesn't match exactly to the defined criteria in the rule, the transaction will not automatically match for reconciliation.

Use creation rules to automatically create transactions in Intacct that automatically match to bank transactions. Currently, you can create credit card transactions and journal entries. Learn how to set up commonly used creation rules.

For multi-entity shared companies with multiple base currencies, create creation rules and transaction templates for credit card transactions at the entity level.

How it works

Creation rules require a filter for bank transactions posting dates. This prevents undesired transactions from being created before that date.

You can use other filters to target different transactions and use operators like "begins with" and "contains". For example, you might want to target bank transactions that have a description of "fee" or "deposit" and create a matching journal entry.

When creating credit card transactions, you can filter by transaction type to create either a bank debit or a bank credit, depending on your needs.

When you add a creation rule to a rule set, make sure that it is positioned last in the sequence.

This is so the rule set first filters and considers all available transactions to match. Then, it can create a new transaction to match any eligible, remaining bank transactions.

Rules run in the following circumstances:

- When you access the account reconciliation page.

- When you import a bank file.

- When bank transactions arrive into Sage Intacct from a bank feed.

- Automatically every 4 hours.

Transaction templates

Creation rules rely on transaction templates to define how to create transactions based on bank data. Currently, you can create transaction templates for journal entries and credit card transactions.

Journal entry transactions and allocations

Use allocations for greater flexibility when entering the single journal entry offset line item within the transaction template. If you use allocations, make sure that the template is set to post journal entries upon creation. Allocations do not work when creating draft journal entries.

Companies using journal entry approvals

If your company is set up to approve journal entries before they post, the creation rule creates a draft journal entry with a reconciliation state of Draft matched. After the draft transaction is approved, it posts to the General Ledger and matches to the bank transaction for reconciliation.

Include VAT or GST taxes

If your company is subscribed to the Taxes application, you can include VAT or GST on transactions created using creation rules. Use transaction templates to select an existing tax schedule to calculate and record tax implications on created transactions.

When you're ready, add a rule to a rule set. Rule sets can contain multiple rules.

Create rule sets at the same level in which the bank account was created and the same level that you perform reconciliations. For example, if a bank account was created within an entity, create rule sets at the entity level.

The most specific matching rule needs to run first to prevent unintended matches. Make sure that creation rules run last. The rule set first matches any existing Intacct transactions to bank transactions before it attempts to create any new transactions.

Within a rule set, group matching rules first, and group creation rules last.

Matching rules

| Order | Range | Using filters | Match on amount | Match on document number | Match on exact date | Match on date within |

|---|---|---|---|---|---|---|

|

1 |

Narrow |

Yes |

Required |

Yes |

Yes |

No |

|

2 |

Narrow |

Yes |

Required |

Yes |

Yes |

No |

|

3 |

Narrow |

Optional |

Required |

Yes |

No |

within 3 days |

|

4 |

Wide |

Optional |

Required |

No |

Yes |

no |

|

5 |

Wide |

Optional |

Required |

No |

No |

within 3 days |

Creation rules

| Order | Range | Filter on bank transactions | Filter on Intacct transactions | Using multiple filters |

|---|---|---|---|---|

|

6 |

Narrow |

Yes |

Yes |

Yes |

|

7 |

Narrow |

Yes |

Yes |

No |

|

8 |

Narrow |

Yes |

No |

Yes |

|

9 |

Wide |

Yes |

No |

No |

When you're ready, apply the rule set to an account. You can only assign one rule set to an account.

You can use the same rule set with multiple accounts of the same type. For example, you can use one rule set for multiple bank accounts. And, you can use one rule set for multiple credit card accounts.

Changes you make to a rule or rule set only affect future transactions. Transactions already matched or manually unmatched are not affected.

A rule or rule set is used to match transactions, you can't delete it. However, you can set it to Inactive.

You can view the applied rule set for an account from two locations:

-

On the account record.

Look for the Applied rule set field. With the appropriate permissions, you can add or edit a rule set from the account record.

-

At reconciliation time.

Look for the Applied rule set field on the Reconciliation pop-up window. This field appears after you select a file to import or if the account is connected to a bank feed.

You can view matched transactions in an open period (a period that you have not yet reconciled) from a few different access points. Depending on your assigned permissions and where you are in the reconciliation workflow, you can view matched transactions:

-

On the Bank transactions list.

Users with Cash Management permissions for Bank transactions can view all bank and credit card transactions for all accounts on the Bank transactions list. Make sure to adjust the permissions to this list so it's only available for the appropriate users.

- On the Banking cloud tab of the account record.

- On the account reconciliation page.

If you unmatch a transaction that has been matched by a rule, the rule will continue to match other transactions but will ignore the transaction you have unmatched. If another transaction exists that is a match, then when the rule set runs again, that transaction will match.