About the Consolidation subscriptions

Sage Intacct offers the following consolidation options: Domestic, Global, and Advanced Ownership Consolidation. Each consolidation subscription enables you to consolidate books in a multi-entity shared company. You can select a relevant consolidation subscription based on your business needs.

For example:

- Wholly-owned single base currency: A multi-entity shared company with full ownership that operates in one base currency is a good candidate for Domestic Consolidation. Base currency is also known as the operating or reporting currency for an entity.

- Wholly-owned multi-base currency: A multi-entity shared company with full ownership that uses multiple base currencies is a good candidate for the Global Consolidation subscription.

- Tiered structure or partial ownership: A multi-entity shared company with a tiered structure of entities where one entity owns another, or includes partially owned entities is a good candidate for Advanced Ownership Consolidation.

About Domestic Consolidation

A Sage Intacct multi-entity shared company that is wholly owned where all entities use one base currency can benefit from using Domestic Consolidation for consolidated reporting.

Domestic Consolidation example

An example of a company that would benefit from Domestic Consolidation is one with business entities all located in the same region, such as a small local chain of inns located in Canada. Each inn is represented by its own entity and all the entities operate in the same base currency of the Canadian dollar.

Domestic Consolidation features

Domestic Consolidation includes the following features:

- Reporting periods with formalized, audit-ready elimination entries for local compliance with traceability standards.

- Inter-entity setup with accurate auto-elimination for inter-entity transactions.

- Accurate and transparent management and accounting standards compliance reporting, giving a big-picture view of your organization's consolidated financial health.

- Drill down into consolidation journals for audit traceability and reporting transparency to understand your consolidated numbers at-a-glance.

About Global Consolidation

Global Consolidation provides consolidated reporting for multi-entity companies with two or more base currencies used across entities. A company that would benefit from Global Consolidation is one with business entities located in different regions.

Global Consolidation example

An example of such a company is a global chain of retail stores with headquarters in the United Kingdom and business entities located in Bristol, London, Toronto, Los Angeles, and Sydney. Each business entity uses the local currency as its base currency. Each business entity is wholly owned by the company and the entity structure is flat, meaning there are no subsidiary or multi-level relationships among the entities.

Global Consolidation features

Global Consolidation provides all the features of Domestic Consolidation, plus:

- Automatically computed OANDA exchange rates eliminate the need for manual exchange rate management.

- Reports in the currency you want, whether it's for headquarters or a local business entity.

- Automated cumulative translation adjustments (CTAs) for compliance with accounting laws and accurate multi-currency consolidation accounting.

- Flexible addition and removal of entities to model organizational structure based on how you report results.

- Full control of auto-eliminations, currency translation rules, and dimensions to consolidate and create detailed reports.

About Advanced Ownership Consolidation

Advanced Ownership Consolidation uses ownership structures to enable multi-level consolidations and automated non-controlling interest entries in a multi-entity company.

Companies with any of the following structures would benefit from subscribing to Advanced Ownership Consolidation:

- Flat structures with 1 hierarchical level.

- Complex structures with multiple hierarchical levels

- Wholly owned entities and partially owned entities in the same structure

Advanced Ownership Consolidation uses ownership structures to:

- Enable multi-level consolidations through hierarchical relationships among parent and subsidiary entities.

- Consolidate partially owned entities.

- Correctly account for non-controlling interests outside the Intacct company.

- Maintain historical data by period, thereby enabling the accurate reflection of changes to entity hierarchies and ownership percentages over time.

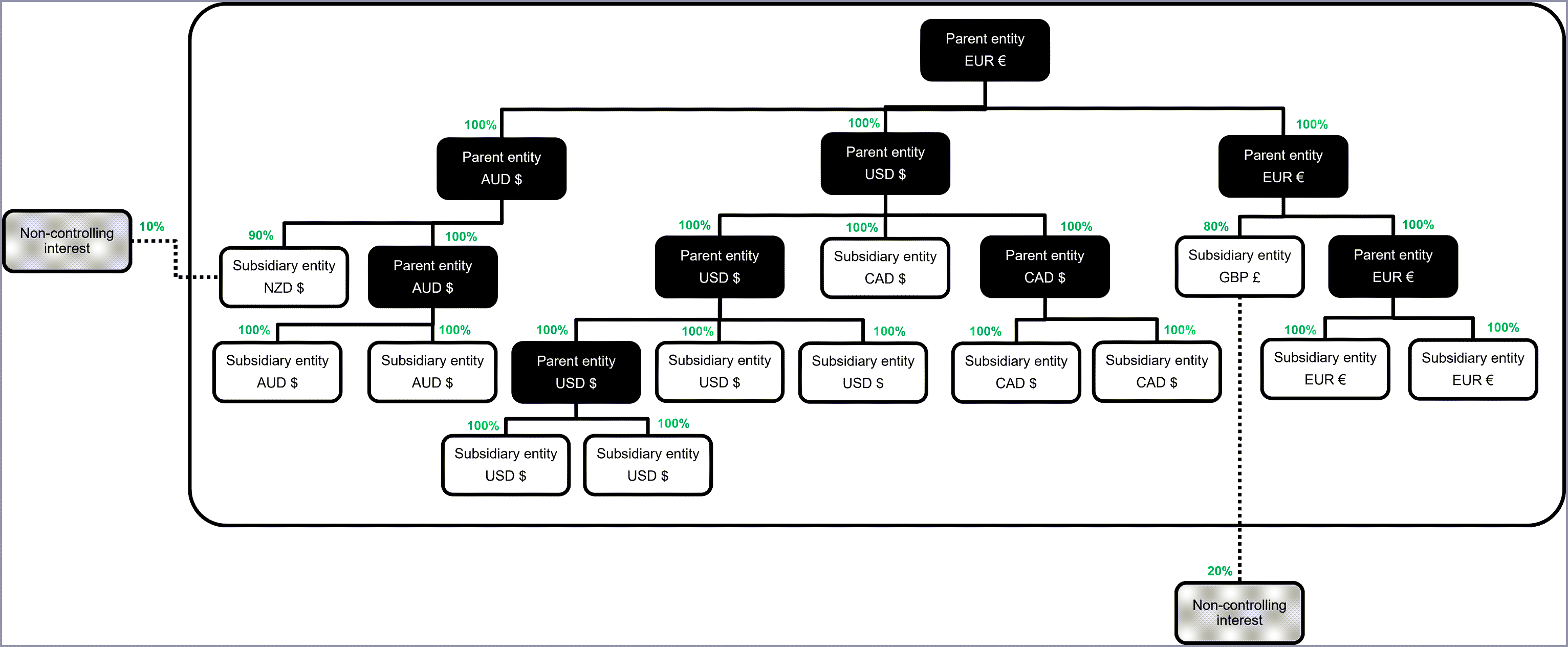

Advanced Ownership Consolidation example

An example is an event production company with headquarters in the UK, with regional offices in Australia, the US, and the UK:

- Each regional parent entity has a number of subsidiary entities in their region.

- Subsidiary entity relationships have differing hierarchical levels within each region.

- Non-controlling interests partially own 2 subsidiaries.

- 1 Australia subsidiary has a 10% non-controlling interest.

- 1 UK subsidiary has a 20% non-controlling interest.

Advanced Ownership Consolidation features

Advanced Ownership Consolidation provides all the features of Global Consolidation, plus:

- Consolidate on-demand with easy setup, as needed or when ownership structures change.

- Define multi-level ownership structures by period with dedicated reporting books generated for each reporting level and parent entity. Includes support for audit history by period.

- Auto-generate non-controlling interest, or minority interest, based on varying ownership percentages of at least 50% ownership. Support for both partial and full ownership.

- Use the Financial Report Writer to generate flexible management and accounting standards compliance reports based on consolidated data.

Consolidation feature comparison

Intacct Consolidation features per subscription can be summarized thus:

| Product | Multi-entity insights | Auditing | Currency translation | Multi-level consolidation | Partial ownership |

|---|---|---|---|---|---|

| Core Sage Intacct | Yes | Limited | No | No | No |

| Domestic Consolidation | Yes | Yes | No | No | No |

| Global Consolidation | Yes | Yes | Yes | No | No |

| Advanced Ownership Consolidation | Yes | Yes | Yes | Yes | Yes |

Multi-base currencies and multiple transaction currencies

When you enable multiple base currencies in your company, Intacct adds a fee for a Consolidation subscription that uses multiple base currencies. You can select either Global Consolidation or Advanced Ownership Consolidation as your Intacct Consolidation solution. Advanced Ownership Consolidation includes all the features of Global Consolidation, plus support for multi-level consolidations with partial ownership and non-controlling interest. Contact your account manager for more information.

Using multiple base currencies is predicated upon enabling multiple transaction currencies. The option of using multiple transaction currencies is separate from multiple base currencies. Learn more about enabling multiple transaction currencies in your Intacct company.