CSV import: AP supplier invoices

You can import large batches of AP supplier invoices into Intacct, which is easier than inputting them manually. You can import Accounts Payable AP supplier invoices by uploading a CSV file.

When uploading AP supplier invoices, you select whether the AP supplier invoices represent live or historical transactions. Historical transactions are typically used to capture AP supplier invoice detail from a previous system that you already accounted for in your opening balances.

The enhanced list for this area of Intacct supports CSV and Import service imports. Open the Import dropdown to choose the option that best fits your needs.

Learn more about importing AP supplier invoices with the import service.

You must have the following to import AP supplier invoice information.

| Subscription | Accounts Payable |

|---|---|

| User type | Business |

| Permissions |

AP supplier invoices: List, View, Edit, Add, Post If you do not have Post permissions, you can import the transactions as drafts. |

Download a template

Download a new blank template from the Import pop-up window whenever you import AP supplier invoices information into Sage Intacct. This is important because:

- Templates are automatically customized based on your company configuration, including dimensions and custom fields you created.

- Templates can be updated by Intacct at any time, especially when a new version of Intacct is released. This means that an older template might not work.

- Go to Accounts Payable > All > AP supplier invoices and select Import.

- Select the Download template link.

Prepare a CSV file for import

When you download a template from the Import pop-up window or an object list page, the correct headers are in the template already. All you have to do is fill in the columns with your data, save it as a CSV file, and upload the file.

The header titles in the template you download correlate to fields in Intacct. Incorrect header titles will cause an upload error.

For more information about the CSV upload process, including best practices, common errors, and how to upload your CSV file, see Prepare your file for CSV import.

About importing AP supplier invoices

There are several things to consider when you import AP supplier invoices into Intacct.

AP supplier invoices must be positive

When importing AP supplier invoices, make sure that the number you import is positive. Negative numbers can cause problems both in the AP and AR subledgers, as well as in the GL.

Live vs. historical transactions

When you import AP supplier invoices, AR sales invoices, or adjustments, you choose the type of transaction they will be imported as: live or historical transactions

- Live transactions are imported and posted to the GL.

OR

- Historical transactions are imported and are not posted to GL. Instead, they are posted to either the AP or AR subledgers.

If you apply a payment to a historical transaction (AP supplier invoice or AR sales invoice), Intacct updates the subledger and the GL. This reduces your AP and AR, and affects cash.

If you do choose to import a paid or partially paid AP supplier invoice, note that Intacct automatically creates a historical debit memo adjustment for the paid portion of the imported AP supplier invoice. A 0 value entry that corresponds to the debit memo appears in Posted payments, and is set to your default payment method.

If you must delete an AP supplier invoice or AR sales invoice that has already been imported, ask your designated support to contact Sage Intacct Support. For more information about contacting support, see The Sage Intacct Community.

Journals must be established

Before you upload any transactions, you must establish journals for the transactions. Do this through Company > Admin > Subscriptions, and then configuring journals for both AP and AR applications before you import open AP supplier invoices, AR sales invoices, and adjustments.

Use row numbers

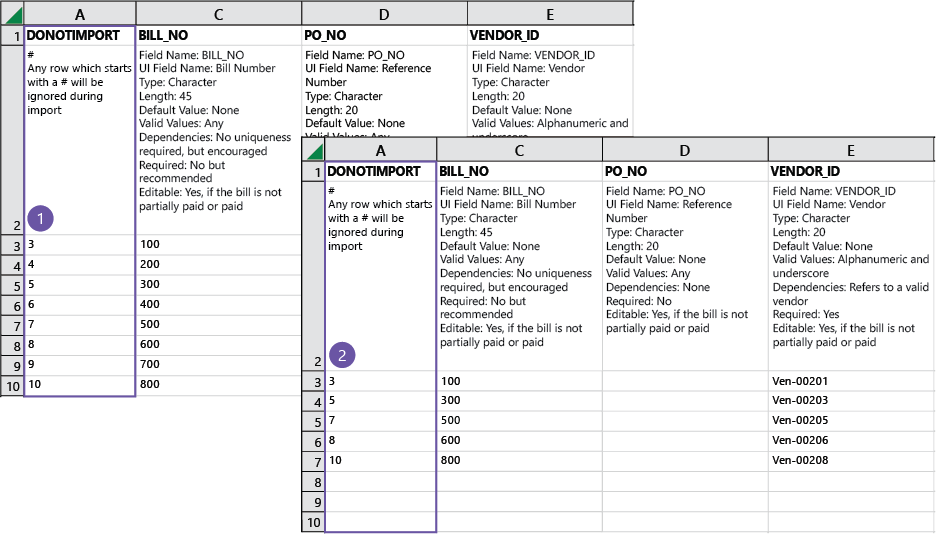

When importing AP supplier invoices or AR sales invoices, if errors are found during upload, the entire CSV file is rejected. You can more easily find the errors in the file if you use row numbers in the Do Not Import column (1). If your CSV file is rejected because errors are found, the error file contains the original row number, allowing you to quickly pinpoint where to make changes (2).

How to import AP supplier invoices

- Go to Accounts Payable > All > AP supplier invoices and select Import.

- Select Choose File and locate the CSV file you want to import.

- If your CSV file contains dates, you can set the date format to match the format in the CSV file.

- You can allow the system to auto-detect the type of CSV file that you are uploading, or you can select a specific CSV file format, such as Mac OSx, Windows-1252, and more.

- Select how you want the file to post after importing:

- General ledger: imported transactions are posted live to the general ledger.

When selected, rules are listed on the import dialogue about how the transactions post to the General Ledger. - Historical: transactions have no effect on the general ledger.

When selected, you can choose to process the import offline. This is useful if your import file is large. When the import is finished, you receive an email to the address you specify.

Transactions and other records that are processed offline show a source of System in the audit trail, instead of CSV import. - General ledger: imported transactions are posted live to the general ledger.

- If you want to be notified by email when an offline import is finished or if errors occur in the import process, enter your email address.

- Select Import.

Field descriptions

The field definitions in your template explain what type of information is required for each field, and how to enter valid information. It's always a good idea to read the field definitions before making entries.

If you downloaded a template from the Import pop-up window or an object list page, your template contains the headers and dimensions that are specific to your company. The following headers are for a standard template and may not contain some field definitions specific to your company.

To import dimension values, enter information in the appropriate dimension column of the import spreadsheet. Otherwise, no information appears for that dimension.

If you relabeled any dimensions (see Terminology for more information), your dimension name doesn’t appear in the CSV template, but the original Intacct dimension name does.

Some fields on the AP supplier invoice Information page, such as Recommended payment date, Payment priority, and Supporting document ID, are not implemented for import, so do not make entries for these fields. Any information entered for these fields is not uploaded.

When importing data, names in the FIELD column may differ from terminology used in your location. For information on terms that may differ in your location, see Terminology across locales.

Required fields when importing AP supplier invoices

| Field Name: | DONOTIMPORT |

|---|---|

|

# |

Any row that starts with # is ignored during import. |

| Field Name: | BATCH_TITLE |

|

UI Field Name: |

Batch |

|

Type: |

Character |

|

Length: |

70 (Not including prepended value: see Dependencies) |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

Batch will be prepended with "HISTORY—" |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

All transactions imported with the same batch title are uploaded with the same GL posting date defined on the first transaction line.

AP supplier invoices imported into an existing batch receive the same GL posting date defined for that batch. Depending on whether you include a BATCH_TITLE, manual or automatic summaries are created.

BATCH_TITLE is prepended with ""HISTORY". |

| Field Name: | BILL_NO |

|

UI Field Name: |

AP supplier invoice number |

|

Type: |

Character |

|

Length: |

45 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

No uniqueness required, but encouraged |

|

Required: |

Not required, but recommended. |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | PO_NO |

|

UI Field Name: |

Reference number Other names for Reference Numbers

When entering information about AP supplier invoices, you might see several different terms used to mean the same thing. Reference number, PO Number, and DOC number all refer to the number assigned to your AP supplier invoice, but are used in different places in Intacct.

|

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | VENDOR_ID |

|

UI Field Name: |

Supplier |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

Refers to a valid supplier. |

|

Required: |

Yes |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | PAYTO |

|

UI Field Name: |

Pay to |

|

Type: |

Character |

|

Length: |

40 |

|

Default Value: |

Pay to assigned supplier |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

A valid Contact |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | RETURNTO |

|

UI Field Name: |

Return to |

|

Type: |

Character |

|

Length: |

40 |

|

Default Value: |

Return to assigned supplier |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

A valid Contact |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | POSTING_DATE |

|

UI Field Name: |

GL posting date |

|

Type: |

Date |

|

Length: |

10 |

|

Default Value: |

Based on transaction summary settings |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

If the summary frequency is Daily, the posting date for each AP supplier invoice will be the CREATED_DATE. If the summary frequency is Monthly, the posting date for each bill will be the month end date. |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid. |

| Field Name: | CREATED_DATE |

|

UI Field Name: |

Date |

|

Type: |

Date |

|

Length: |

10 |

|

Default Value: |

Today's date |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | DUE_DATE |

|

UI Field Name: |

Due date |

|

Type: |

Date |

|

Length: |

10 |

|

Default Value: |

None |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

Cannot be before the CREATED_DATE |

|

Required: |

Yes, if you have not created a default term for the supplier. If you have already set the default term for the supplier, the field is not required and the due date is calculated based on the supplier terms. |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | TOTAL_DUE |

|

UI Field Name: |

Amount |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Should non-zero with negatives designated by a leading dash |

|

Dependencies: |

None |

|

Required: |

No Are you importing transactions with multiple line amounts? If so, leave TOTAL_DUE empty. Sage Intacct will calculate the transaction total for you, based on the line item amounts.

|

|

Editable: |

No |

| Field Name: | TOTAL_PAID |

|

UI Field Name: |

No corresponding field in the Create AP supplier invoice page. This is the amount of a prior partially paid AP supplier invoice. |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Should be non-zero with negatives designated by a leading dash |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

No |

|

Note: |

This field does not allow you to apply a payment to an AP supplier invoice. |

| Field Name: | PAID_DATE |

|

UI Field Name: |

No corresponding field in the Create AP supplier invoice page. This would be the date of a prior partially paid AP supplier invoice. |

|

Type: |

Date |

|

Length: |

10 |

|

Default Value: |

None |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

Cannot be before the CREATED_DATE |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | TERM_NAME |

|

UI Field Name: |

Terms |

|

Type: |

Character |

|

Length: |

40 |

|

Default Value: |

Defaults to term assigned to vendor, if any |

|

Valid Values: |

Any |

|

Dependencies: |

Must be a valid Accounts Payable term name |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | DESCRIPTION |

|

UI Field Name: |

Description |

|

Type: |

Character |

|

Length: |

80 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | BASECURR |

|

UI Field Name: |

Base currency |

|

Type: |

Character |

|

Length: |

3 |

|

Default Value: |

None |

|

Valid Values: |

Any defined ISO three-letter ISO-4127 currency code such as USD or EUR |

|

Dependencies: |

Must reference a previously defined currency; locations in line items must use the same base currency. |

|

Required: |

No, except for shared multi-entity companies with multiple base currencies. |

|

Editable: |

No |

|

Notes: |

Applies only to shared multi-entity companies that use multiple base currencies. In this case, LOCATION_ID must also be in an entity that uses the same base currency as BASECURR. Also, this field defines the transaction base currency. Verify that locations in line items use the same base currency. |

| Field Name: | CURRENCY |

|

UI Field Name: |

Currency |

|

Type: |

Character |

|

Length: |

3 |

|

Default Value: |

Base Currency |

|

Valid Values: |

Any defined currency, such as USD or EUR; blank denotes base currency. |

|

Dependencies: |

Must reference a previously-defined currency. |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Use only for multi-currency companies. This field defines the transaction currency. If no entry is defined here, the base currency is used. Applies only if your company uses foreign currency transactions, and the transaction is in a foreign currency. Otherwise, this field is optional, and the system uses the base currency. |

| Field Name: | EXCH_RATE_DATE |

|

UI Field Name: |

Exchange rate date |

|

Type: |

Date |

|

Length: |

10 |

|

Default Value: |

Today |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

None |

|

Required: |

Yes, unless you provide the EXCHANGE_RATE |

|

Editable: |

Yes |

|

Notes: |

Use only for multi-currency companies. This field determines the exchange rate as of this date. Applies only if your company uses foreign currency transactions, and the transaction is in a foreign currency. Otherwise, this field is optional, and the system uses the base currency. |

| Field Name: | EXCH_RATE_TYPE_ID |

|

UI Field Name: |

Exchange rate type |

|

Type: |

Character |

|

Length: |

40 |

|

Default Value: |

Intacct Daily Rate, unless a custom exchange rate is defined as the default |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

Must reference a previously defined exchange rate type |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Use only for multi-currency companies. Defines an optional custom exchange rate type. The Intacct Daily Rate is used if no optional one is defined here. Applies only if your company uses foreign currency transactions, and the transaction is in a foreign currency. Otherwise, this field is optional, and the system uses the base currency. |

| Field Name: | EXCHANGE_RATE |

|

UI Field Name: |

Exchange rate |

|

Type: |

Number |

|

Length: |

17, not including decimal point |

|

Default Value: |

Defaults to the exchange rate of the CURRENCY on the EXCH_RATE_DATE for the EXCH_RATE_TYPE |

|

Valid Values: |

Positive integers |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Use only for multi-currency companies. Overrides the default exchange rate, which is the product of the CURRENCY, EXCH_RATE_DATE and EXCH_RATE_TYPE. Applies only if your company uses foreign currency transactions, and the transaction is in a foreign currency. Otherwise, this field is optional, and the system uses the base currency. |

| Field Name: | TAXSOLUTIONID - This field only applies to companies subscribed to the Taxes application. |

| UI Field Name: | Tax solution |

| Type: | Character |

| Length: | 100 |

| Default Value: | None |

| Valid Values: | Alphanumeric and underscore |

| Dependencies: | Must refer to a valid VAT or GST tax solution |

| Required: | Yes, if your organization is configured for multiple tax jurisdictions and you are importing at the top level |

| Editable: | No |

| Field Name: | INCLUSIVETAX - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Inclusive taxes |

|

Type: |

Character |

|

Length: |

1 |

|

Default Value: |

F |

|

Valid Values: |

T (True), F (False) |

|

Dependencies: |

The Taxes application is enabled for a VAT or GST tax solution. |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

This field is only applicable for VAT or GST tax solutions. If you set this field to T, enter a value in TOTALTRXAMOUNT and leave AMOUNT blank. |

| Field Name: | ISPARTIALEXEMPT - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Partly exempt |

|

Type: |

Character |

|

Length: |

1 |

|

Default Value: |

F |

|

Valid Values: |

T (True), F (False) |

|

Dependencies: |

The Taxes application is enabled, the tax solution is United Kingdom: VAT, and partial exemption is enabled. |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | LINE_NO |

|

UI Field Name: |

No field name as such. These are the incrementing numbers on the left side of the transaction area in the AP supplier invoices page. |

|

Type: |

Number |

|

Length: |

4 |

|

Default Value: |

None |

|

Valid Values: |

Positive integer |

|

Dependencies: |

Start with 1 for the first line of a transaction, and increment by one for each subsequent line. |

|

Required: |

Yes |

|

Editable: |

No |

| Field Name: | MEMO |

|

UI Field Name: |

Memo |

|

Type: |

Character |

|

Length: |

1000 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | ACCT_NO |

|

UI Field Name: |

Account |

|

Type: |

Character |

|

Length: |

24 |

|

Default Value: |

None |

|

Valid Values: |

Must conform to primary/sub account specifications. |

|

Dependencies: |

Refers to a valid account number |

|

Required: |

Yes. See note for more information. |

|

Editable: |

No |

|

Note: |

If your company is Accrual only, the contents of this field are ignored at import. If your company is Accrual and Cash, this field is used to book the expense account in the cash books, therefor it is important the correct GL expense account is entered here for the cash book to post correctly at the time of payment. |

| Field Name: | ACCT_LABEL |

|

UI Field Name: |

Account label |

|

Type: |

Character |

|

Length: |

80 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | LOCATION_ID |

|

UI Field Name: |

Location |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

An existing valid location |

|

Dependencies: |

None, except in shared multi-entity companies with multiple base currencies, the LOCATION_ID must use the same currency as the BASECURR field. |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

|

Notes: |

In shared multi-entity companies with multiple base currencies, LOCATION_ID must be in an entity that uses the same base currency as BASECURR. |

| Field Name: | DEPT_ID |

|

UI Field Name: |

Department |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Should be a valid department |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Field Name: | AMOUNT |

|

UI Field Name: |

Amount |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Should be non-zero with negatives designated by a leading dash |

|

Dependencies: |

None |

|

Required: |

Yes Not required for if your company is subscribed to the Taxes application and INCLUSIVE is set to T. |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

|

Note: |

Amount refers to line items that make up a total AP supplier invoice. For example, if an AP supplier invoice totals R1000, and each line item in the AP supplier invoice is R200, you would enter R1000 in the Total Due column, and then five separate lines with R200 in the Amount column. The total of the Amount column must match the total for the Total Due column if they are identified for the same AP supplier invoice. We recommend that you leave Total due empty and let Sage Intacct calculate it based on the Amount, to avoid errors that prevent import. If your company is subscribed to the Taxes application, and if INCLUSIVE is set to T, enter a value for TOTALTRXAMOUNT and leave this field and TAX_AMOUNT blank. |

| Field Name: | ALLOCATION_ID |

|

UI Field Name: |

Allocation |

|

Type: |

Character |

|

Length: |

50 |

|

Default Value: |

None |

|

Valid Values: |

An existing valid transaction allocation |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | APBILLITEM_APACCOUNT |

|

UI Field Name: |

AP account |

|

Type: |

Character |

|

Length: |

24 |

|

Default Value: |

None |

|

Valid Values: |

Must conform to primary/sub accounts. |

|

Dependencies: |

Refers to a valid account number and balancing account as payable account. |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | ACTION |

|

UI Field Name: |

Transaction status |

|

Type: |

Character |

|

Length: |

None |

|

Default Value: |

Draft |

|

Valid Values: |

Draft, Submit |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

No |

|

Note: |

For AP supplier invoices with an action of Draft, required field validation is relaxed. Only AMOUNT and LOCATION_ID are required for draft AP supplier invoices. |

| Field Name: | SUPDOCID |

|

UI Field Name: |

Attachment |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

None |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | BILLABLE |

|

UI Field Name: |

Billable |

|

Type: |

Character |

|

Length: |

Any |

|

Default Value: |

F |

|

Valid Values: |

T (True), F (False) |

|

Dependencies: |

No |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | BILLED |

|

UI Field Name: |

Billed |

|

Type: |

Character |

|

Length: |

Any |

|

Default Value: |

F |

|

Valid Values: |

T (True), F (False) |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | BILLED |

|

UI Field Name: |

Billed |

|

Type: |

Character |

|

Length: |

Any |

|

Default Value: |

F |

|

Valid Values: |

T (True), F (False) |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | NAMEOFACQUIREDASSET |

|

UI Field Name: |

Name of acquired asset |

|

Type: |

Character |

|

Length: |

100 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | SELECTEDASSETMODE |

|

UI Field Name: |

Asset creation |

|

Type: |

Character |

|

Length: |

1 |

|

Default Value: |

S |

|

Valid Values: |

S, M, N (S = Create fixed asset, M = Create multiple fixed assets, N = Do not create asset) |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | ASSETQUANTITY |

|

UI Field Name: |

Number of assets |

|

Type: |

Number |

|

Length: |

10 |

|

Default Value: |

None |

|

Valid Values: |

Digits 0-9 |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | INCLUDETAXINASSETCOST |

|

UI Field Name: |

Include tax in asset cost |

|

Type: |

Character |

|

Length: |

5 |

|

Default Value: |

F |

|

Valid Values: |

T (True), F (False) |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | ClassificationID |

|

UI Field Name: |

Asset classification |

|

Type: |

Character |

|

Max length: |

24 |

|

Default Value: |

None |

|

Dependencies: |

A valid asset classification. |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | ASSETID |

|

UI Field Name: |

Asset |

|

Type: |

Character |

|

Length: |

50 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

A valid asset |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | TAX_LINE_NO - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

No field name as such. These are the incrementing numbers for the tax lines specific to line items. |

|

Type: |

Number |

|

Length: |

4 |

|

Default Value: |

None |

|

Valid Values: |

Positive integer |

|

Dependencies: |

Start with 1 for the first tax line of a line item, and increment by one for each subsequent line. |

|

Required: |

Yes, for VAT or GST tax solutions |

|

Editable: |

Yes |

|

Notes: |

This field is only applicable for VAT or GST tax solutions. |

| Field Name: | TAX_AMOUNT - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Transaction tax |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Any, with negatives values designated by a leading dash |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Notes: | This field is only applicable for VAT or GST tax solutions. The amount entered will override the tax calculated by the tax detail. |

| Field Name: | TAX_DETAILID - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Tax detail |

|

Type: |

Character |

|

Length: |

30 |

|

Default Value: |

None |

|

Valid Values: |

Refers to a valid tax detail ID |

|

Dependencies: |

None |

|

Required: |

Yes, for VAT or GST tax solutions |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid |

| Notes: | This field is only applicable for VAT or GST tax solutions. |

| Field Name: | TOTALTRXAMOUNT - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Transaction total |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Any, with negative values designated by a leading dash |

|

Dependencies: |

None |

|

Required: |

Yes, only if INCLUSIVETAX is set to T |

|

Editable: |

Yes, if the AP supplier invoice is not partially paid or paid and INCLUSIVETAX is enabled |

| Notes: | This field is only applicable for VAT or GST tax solutions. |

| Field Name: | APBILLITEM_PROJECTID |

|

UI Field Name: |

Project |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

A valid Project |

|

Dependencies: |

A valid Project |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | APBILLITEM_CUSTOMERID |

|

UI Field Name: |

Customer |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

A valid Customer |

|

Dependencies: |

A valid Customer |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | APBILLITEM_VENDORID |

|

UI Field Name: |

Supplier |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

A valid supplier. |

|

Dependencies: |

A valid supplier. |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | APBILLITEM_EMPLOYEEID |

|

UI Field Name: |

Employee |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

A valid Employee |

|

Dependencies: |

A valid Employee |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | APBILLITEM_ITEMID |

|

UI Field Name: |

Item |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

A valid Item |

|

Dependencies: |

A valid Item |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | APBILLITEM_CLASSID |

|

UI Field Name: |

Class |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

A valid Class |

|

Dependencies: |

A valid Class |

|

Required: |

No |

|

Editable: |

Yes |

Required fields when importing AP supplier invoices

Some columns of an import template are required fields. If these fields are left blank, your import will fail. Be sure to enter information for all required fields.

-

BILL_NO (not required, but recommended)

-

VENDOR_ID

-

CREATED_DATE

-

DUE_DATE

-

BASECURR: Required for shared multi-entity companies with multiple base currencies.

-

EXCH_RATE_DATE: Not required if you provide the EXCHANGE_RATE

-

TAXSOLUTIONID: This field only applies to companies subscribed to the Taxes application.

-

LINE_NO

-

ACCT_NO

-

AMOUNT: Not required for if your company is subscribed to the Taxes application and INCLUSIVE is set to T.

-

TAX_LINE_NO: This field only applies to companies subscribed to the Taxes application.

-

TAX_DETAILID: This field only applies to companies subscribed to the Taxes application.

-

TOTALTRXAMOUNT: This field only applies to companies subscribed to the Taxes application.