CSV import: General Ledger journal entries

Import General Ledger journal entry information into Intacct with a CSV file.

You can now import information into this area of Sage Intacct with the new import service.

Get started with your import by reviewing these examples of what a successful import file looks like. You can download a current template for your company, or take a quick training course to ensure success.

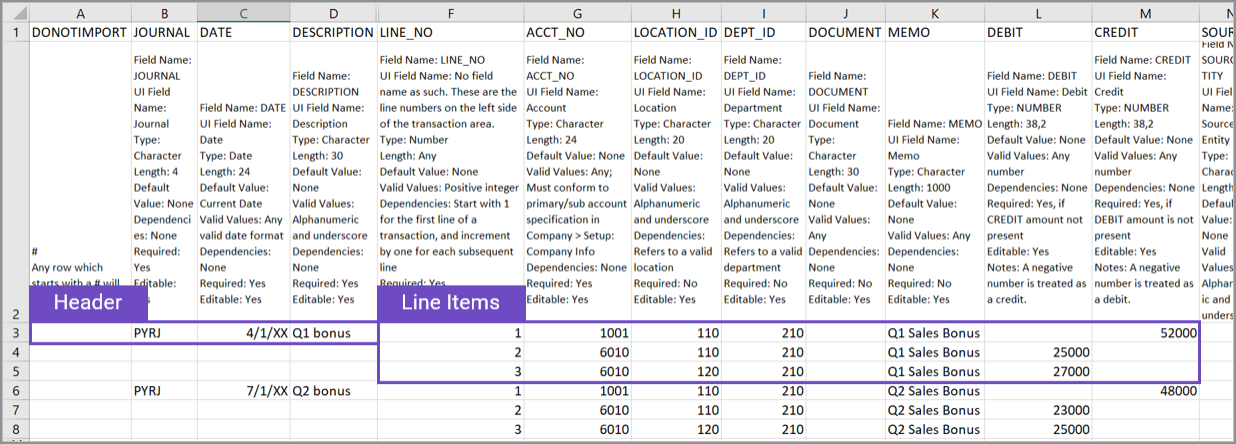

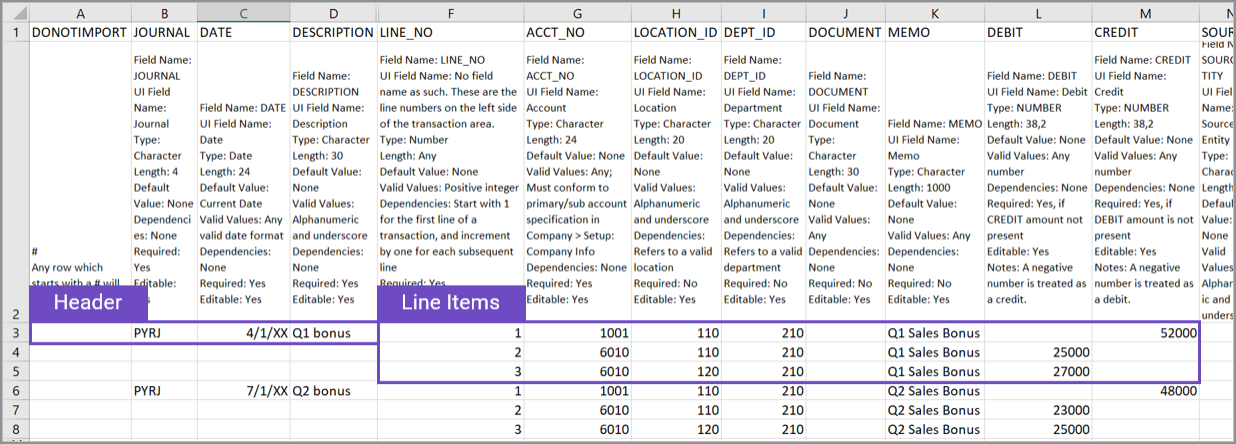

All journal entries must have header info, and each header can have multiple line items associated with it.

Header fields apply to the entire transaction and include fields such as the transaction date, journal, and a description about the line items.

Line items are the details of the journal entry and include fields such as General Ledger accounts, and amounts. If you have dimensions in use, such as Location or Department, these are also included in the line item rows.

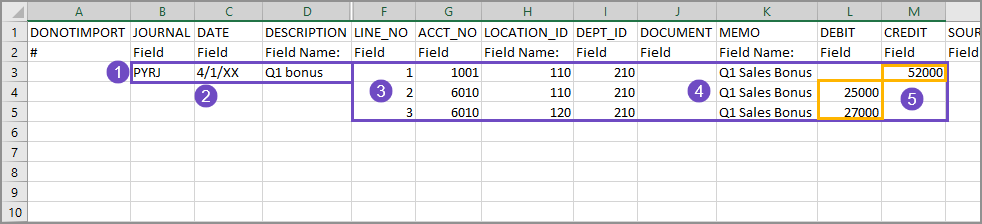

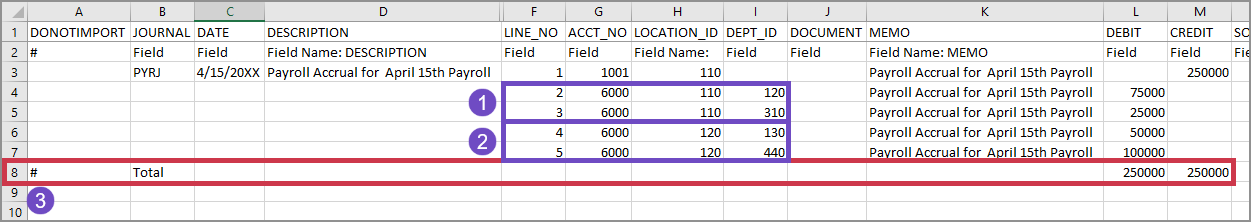

Enter the first journal entry

Let's enter the first journal entry and line items. Select images to make them bigger.

-

The header fields in this example are:

-

The journal ID.

The ID must match exactly to the journal ID in Intacct.

-

The date of the entry.

-

A description of the entry.

The description applies to the whole transaction, and has a 30 character limit.

Lines 4 and 5 do not have header information because the header information in line 3 applies to the whole transaction

-

-

The dates in the file are in the same format as the date format that you select when you import the file into Intacct.

-

The line numbers for each line item in this journal entry are sequentially numbered, starting from 1, within the LINE_NO column.

-

A memo is entered for each line item.

-

The debits and the credits balance.

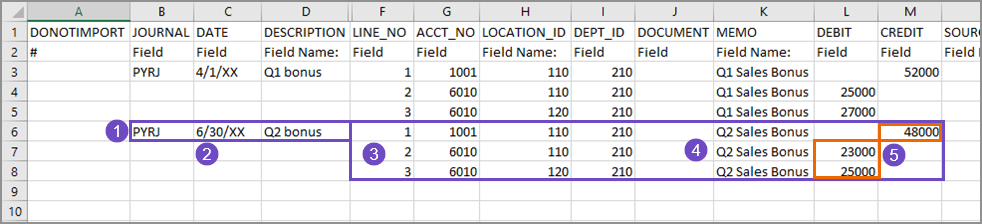

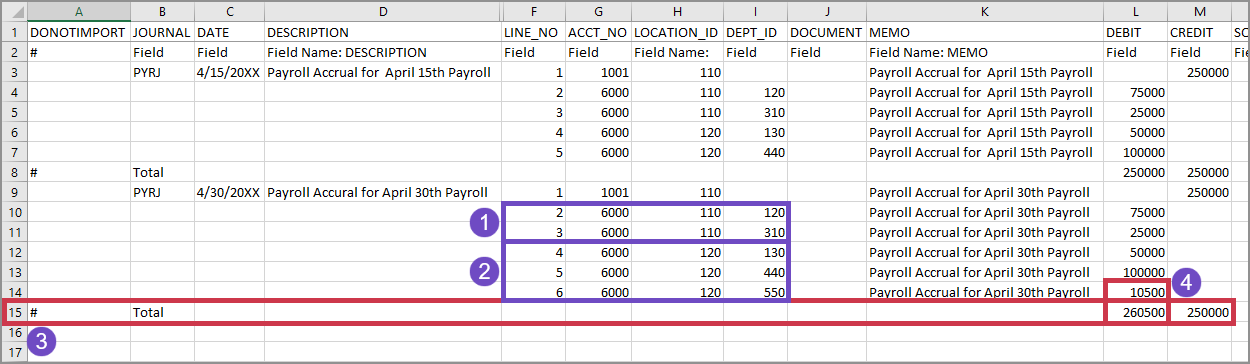

Enter the second journal entry

The second journal entry is put on line 6 of the spreadsheet, after the last entry of the previous journal entry.

-

The header fields contain the journal name, the date of the entry, and a description of the journal entry.

Lines 7 and 8 do not have header information because the header information in line 6 applies to the whole transaction.

-

The dates in the file are in the same format as the date format that you select when you import the file into Intacct.

-

The line numbers (LINE_NO column) for the line items of this journal entry start over at 1, and are also numbered sequentially.

-

A memo has been entered for each line item.

-

The debits and the credits balance.

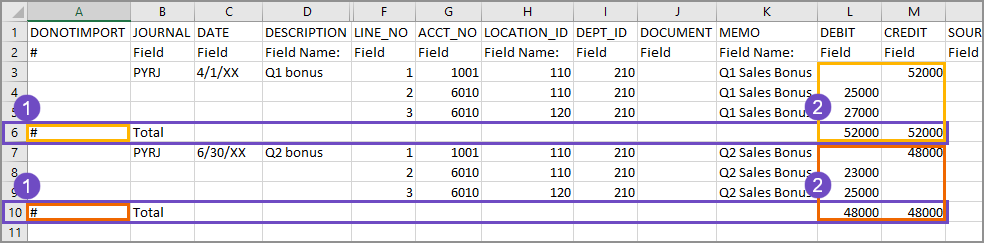

Check your work with DONOTIMPORT

It can be helpful to add additional rows to the template to do calculations or analysis on the data.

For example, because journal entries must balance it can be helpful to add a row to calculate the totals for the line items.

-

A Total row has been added for the first journal entry.

The # sign in the DONOTIMPORT column tells Intacct to ignore information in this row during import. The # sign must be the first character in the row. -

Calculations in the Debit and the Credit columns confirm that the debits match the credits for both journal entries.

Tips

When adding data to the import template:

-

Make sure you’re using the General Ledger Journal Entries import template for General Ledger Journal Entries.

-

Verify that the header of the journal entry is only entered one time for each journal entry.

-

General Ledger journal entries must balance.

Statistical journal entries do not need to balance.

Learn more about importing General Ledger journal entries.

Learn more about journal entries.

When entering dimension information in a journal entry, you must have a separate line for each dimension combination. In the example below, a journal entry for payroll has been added. Dimensions used in this journal entry are: Location (LOCATION_ID) and Department (DEPT_ID).

-

Line items 2 and 3 have the same Location dimension, but have different Department dimensions. The dimension combination creates a separate line for each combination.

-

Line item 2: Location 110 + Department 120

-

Line item 3: Location 110 + Department 310

-

-

Line items 4 and 5 also have the same Location dimension, which is different from line items 2 and 3, and have different Department dimensions.

-

Line item 4: Location 120 + Department 130

-

Line item 5: Location 120 + Department 440

-

-

A commented out (#) row has been added to double check that the debits and credits are balanced.

In the example above, a second payroll journal entry has been added.

-

Line items 2 and 3 have the same Location dimension, but have different Department dimensions. The dimension combination creates a separate line for each combination.

-

Line item 2: Location 110 + Department 120

-

Line item 3: Location 110 + Department 310

-

-

Line items 4, 5, and 6 also have the same Location dimension, which is different from line items 2 and 3. All Department dimensions are also different, but this time there's also a new Department.

-

Line item 4: Location 120 + Department 130

-

Line item 5: Location 120 + Department 440

-

Line item 6: Location 120 + Department 550

-

-

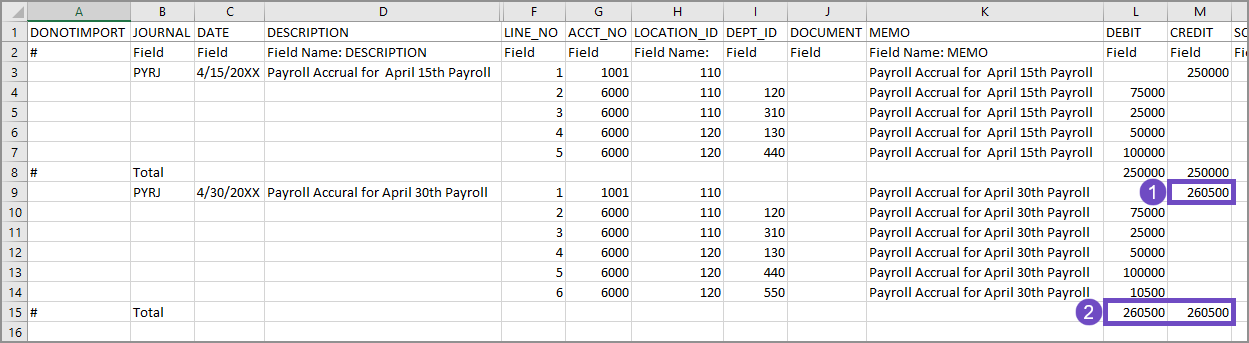

A commented out (#) row has been added to double check that the debits and credits are balanced.

-

The addition of line item 6 in this journal entry has made the debits and the credits not match. The journal entry must be edited before it can be imported, or the import will fail. All journal entry debits and credits must be balanced for the journal entry file to be imported.

In the example above, line item 1 has been updated to reflect the addition of a new department at an existing location.

-

Line item 1 contains the credits against which the rest of the line items are balanced. It's been updated to reflect the addition of a new department at an existing location.

-

The Debits and Credits are balanced. The journal entry file can now have more journal entries added, or be imported into Intacct.

Did you know?

When you download an import template from the Company Setup Checklist, the dimensions that are active in your company are automatically added to the import template.

Learn more about the Company Setup Checklist.

Learn more about journal entries.

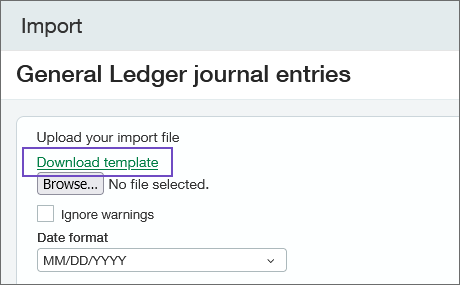

Download the journal entry import template

Download the journal entry import template from the Company Setup Checklist or directly from an import page. It's important to download a fresh template because they’re customized to your company's configuration, including dimensions, and they’re updated regularly.

You can download import templates from the following places.

- Import pages for a specific type of journal entry. For example, to download the template for standard journal entries:

- Go to General Ledger > All > Journal entries.

- Select Import.

- Select Download template.

- Go to General Ledger > All > Journal entries.

- Select Import transactions.

- Select Download template.

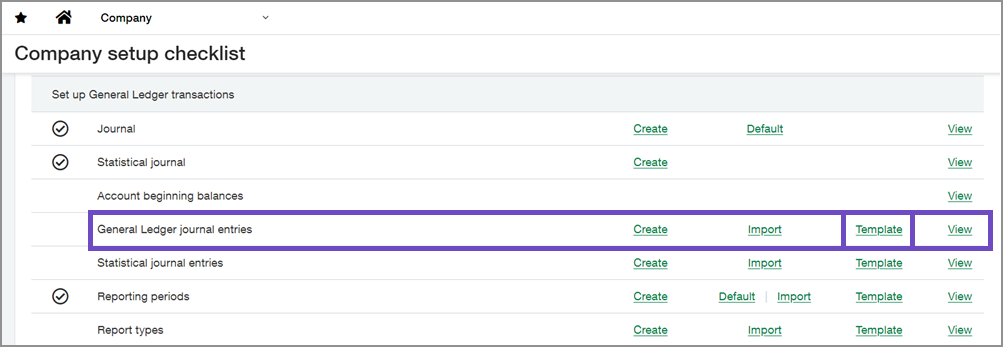

- The Company Setup Checklist:

- Go to Company > Setup > Configuration > Import data.

The Company Setup Checklist opens. You’ll find a list of areas that you can import information into Intacct. - Find the Set up General Ledger transactions section and select Template on the General Ledger journal entries line.

- Go to Company > Setup > Configuration > Import data.

Avoid common journal entry import errors

To ensure a smooth import, Intacct recommends starting with a limited, representative set of General Ledger journal entry information.

This initial import serves as a valuable trial run, allowing you to verify data compatibility with the template format. You’ll be able to identify any potential formatting inconsistencies, and solidify your understanding of the import process.

By testing with a smaller sample, you mitigate risks associated with large-scale imports and gain valuable insights for a successful full-scale data import.

When importing data into Intacct, the more complex the import, the smaller the import should be.

The above examples of journal entries are not complex: there are 12 columns of data, 2 headers and 3 line items for each header. This journal entry import has a high probability of being successful because it’s straight forward and does not contain hundreds or thousands of lines.

However, if we expanded the import to include 30 columns of data, with 50 headers that have 10 to 20 line items each, this is considered a complex import. The information that's imported into Intacct depends on both the existing information in Intacct being correct and it being correctly referenced in the import file. If the journal ID is incorrect for 40 of the 50 header lines in the import file, the import will fail.

Limiting the number of lines in the CSV file to 5,000 or fewer helps to ensure that your import uploads correctly. On the other hand, if you’re only importing 4 columns of data, 10,000 lines or more could easily be imported.

The complexity of your data impacts the ability of Sage Intacct to import your data

-

Do not change the column headers.

-

Hide columns for easy data entry, as needed.

-

Use initial caps only.

-

Begin entering data on row 3 of the template, after the column header and description rows.

-

Make sure all dates use the same format.

When you import your CSV file into Intacct, you select a date format. The date format that you select must match the format in the import file. -

Format all the cells as text to avoid errors.

Applying other types of formats to the cells can be helpful when adding data to the template, but it can cause errors when importing. -

Remove or comment out (using the # sign) any extra rows.

Blank rows between records or transactions can cause errors. -

Do not include symbols in the Debit and Credit columns.

Currency or other symbols in the Debit or Credit columns will cause an import error.

Review the Common CSV import errors for things to keep in mind when entering data.

Before importing your file, review your data.

- Make sure that all the required information is entered.

Check the description row for information about the required fields. If a required field is left blank, the import will fail. -

Make sure that the required information is correct.

Required fields must contain the ID of the related record, such as the account number for a General Ledger account. The title of the account is not the account number.

The data entered in the CSV file must match what's in Intacct exactly.

-

Check for any formatting errors.

Do not use commas in any text.

Training

Sage University provides training that you can take at your own pace. These free training classes are tailored to the first-time data importer.

Tips, tricks, and troubleshooting

When importing data into a multi-currency environment:

-

Make sure all currencies and custom exchange rate types in the import file are present in Intacct before importing.

-

Enter a currency value in the import file, even if the transaction is in the base currency.

-

If a template has both a transaction currency and a location, the currency value is the transaction currency.

If the currency value is empty, Intacct will use the specified location's base currency.

Import scenarios

-

Current rate: Fill in the Currency and Exchange rate date fields. Intacct calculates the value based on these fields.

-

Custom exchange rate type: Fill in the Currency, Exchange rate type, and Exchange rate date fields. Intacct calculates the value based on these fields.

-

Rate from outside Intacct: Fill in the Currency, Exchange rate date (for reference), and Exchange rate fields. Intacct calculates the amount based on these values, if the values are in a non-base currency.

The following list is a simplified overview of how to enter data in a CSV file for successful import into Intacct.

Download a template:

-

Templates are available in the Company Setup Checklist or in the import dialogue in certain areas of Intacct.

-

Templates are customized to your company's configuration, including dimensions.

-

Templates are updated regularly.

Add your data:

-

Read the description for each of the column headers.

-

Do not change the column headers.

-

Enter data into the blank cells under the header and header description rows.

-

Use initial caps only.

-

Make sure all dates use the same format.

When you import into Intacct, you select a date format. The date format that you select must match the format in the import file. -

Format all the cells as text to avoid errors.

Applying other types of formats to the cells can be helpful when adding data to the template, but it can cause errors when importing. -

Remove or comment out (use the # sign) any extra rows.

Blank rows between records or transactions can cause errors. -

Save the file as

<your-file-name>.csvafter entering your data.

Make sure to save as a plain CSV and not any of the other CSV formats.

Review your data:

-

Make sure that all the required information is entered.

Check the description row for information about the required fields. If a required field is left blank, the import will fail. -

Make sure that the required information is correct.

Required fields must contain the ID of the related record, such as the account number for a General Ledger account.

The data entered must match what's in Intacct exactly.

-

Check for any formatting errors.

Do not use commas in any text. -

Validate the data against the business logic of Intacct.

Additional tips:

-

Remove all commas from your CSV file.

-

You can change the order of the columns, as needed.

-

You can add additional columns to your template. The additional columns will not be imported into Intacct. However, it can be useful to keep notes about line items in the CSV file.

-

You can hide columns for easy data entry.

Learn more about formatting CSV files for import.

When importing General Ledger journal entries, the CSV file's line item number defines the import order. To make reconciliation after import easier, here are a few tips when entering journal entries:

-

The line number in a CSV file determines the order of line item imported for General Ledger journal entries.

-

Grouping debits and corresponding credits together in the CSV makes reconciliation easier after you import.

-

The LINE_NO column is crucial for maintaining the order of the line items, and determining how entries appear in a journal.

-

Enter the information in the CSV file as you do in a regular journal entry for post-import clarity.

Learn more about journal entry line numbers.

The following are the required fields for General Ledger statistical journal entries.

| Field Name: | DESCRIPTION |

|---|---|

|

UI Field Name: |

Description |

|

Type: |

Character |

|

Length: |

80 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | JOURNAL |

|

UI Field Name: |

Journal |

|

Type: |

Character |

|

Length: |

4 |

|

Default Value: |

None |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | DATE |

|

UI Field Name: |

Date |

|

Type: |

Date |

|

Length: |

24 |

|

Default Value: |

Current date |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | LINE_NO |

|

UI Field Name: |

No field name as such. These are the line numbers on the left side of the transaction area. |

|

Type: |

Number |

|

Length: |

Any |

|

Default Value: |

None |

|

Valid Values: |

Positive integer |

|

Dependencies: |

Start with 1 for the first line of a transaction, and increment by one for each subsequent line. |

|

Required: |

Yes |

|

Editable: |

No |

| Field Name: | ACCT_NO |

|

UI Field Name: |

Account |

|

Type: |

Character |

|

Length: |

24 |

|

Default Value: |

None |

|

Valid Values: |

Any; must conform to the primary/sub account specification in the Company Information page (go to Company > Setup > Company. |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | STATE |

|

UI Field Name: |

State |

|

Type: |

Character |

|

Valid Values: |

Draft, Posted |

|

Required: |

Yes |

Learn more about fields for General Ledger statistical journal entry import.

Required fields for General Ledger journal entry import

The following are the required fields for General Ledger journal entries.

The field definitions in your template explain what type of information is required for each field, and how to enter valid information. It's always a good idea to read the field definitions before making entries.

You can reorder the columns of your CSV file for ease of use. However, the column header must contain the field name exactly as it appears in the original template.

If you downloaded a template from the Company Setup Checklist or an object list page, your template contains the headers and dimensions that are specific to your company. The headers in a standard template might not contain field definitions specific to your company.

To import dimension values, enter information in the appropriate dimension column of the import spreadsheet. Otherwise, no information appears for that dimension.

If you relabeled any dimensions (see Terminology for more information), your dimension name does not appear in the CSV template, but the original Intacct dimension name does.

| Field Name: |

JOURNAL |

|---|---|

|

UI Field Name: |

Journal |

|

Type: |

Character |

|

Length: |

4 |

|

Default Value: |

None |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | DATE |

|

UI Field Name: |

Date |

|

Type: |

Date |

|

Length: |

24 |

|

Default Value: |

Current Date |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

|

Note: |

Typically the next day after you close your old accounting system and start a new set of books in Intacct. If you do not enter a date, the default is today. Be careful when entering the beginning date. For example, if you want to print comparative financial statements, enter a date as of 2 fiscal years ago. Then, make journal entries for the ending GL balances for all the periods between your standing balance and the date you begin using Intacct.

If you’re uploading historical transactions, be sure that your starting balances CONTAIN these uploaded transactions, and set the date to that date. If you set the wrong starting date for your GL balances, you can clear the transactions using the Company Setup Checklist and start again. |

| Field Name: | DESCRIPTION |

|

UI Field Name: |

Description |

|

Type: |

Character |

|

Length: |

80 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore. |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | TAXSOLUTIONID - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Tax solution |

|

Type: |

Character |

|

Length: |

100 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore. |

|

Dependencies: |

For VAT and GST tax solutions, refers to a valid VAT or GST tax solution. |

|

Required: |

Yes, only if your organization is configured for multiple tax jurisdictions and you’re importing from the top level. |

|

Editable: |

No |

|

Note: |

Only applicable if Inbound or Outbound tax implications |

| Field Name: | LINE_NO |

|

UI Field Name: |

No field name as such. These fields are the line numbers on the left side of the transaction area. |

|

Type: |

Number |

|

Length: |

Any |

|

Default Value: |

None |

|

Valid Values: |

Positive integer |

|

Dependencies: |

Start with 1 for the first line of a transaction, and increment by 1 for each subsequent line. Also must be unique per journal entry and per journal. For example, Summary 1 contains line numbers 1-20, Summary 2 contains line numbers 1-44, and so on. |

|

Required: |

Yes |

|

Editable: |

No |

| Field Name: | ACCT_NO |

|

UI Field Name: |

Account |

|

Type: |

Character |

|

Length: |

24 |

|

Default Value: |

None |

|

Valid Values: |

Any; must conform to the primary/sub account specification in Company > Setup: Company Info |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | DEBIT |

|

UI Field Name: |

Debit |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Any number |

|

Dependencies: |

The uploaded file must contain a number in either the DEBIT or CREDIT field. For example, if you do not have a debit amount, you must have a credit. You can import negative numbers for either debit or credit. In this case, a negative debit amount will be treated as a credit, and a negative credit amount will be treated as a debit. |

|

Required: |

Yes, if the CREDIT amount is not present. |

|

Editable: |

Yes |

|

Notes: |

A negative number is treated as a credit. |

| Field Name: | CREDIT |

|

UI Field Name: |

Credit |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Any number |

|

Dependencies: |

None |

|

Required: |

Yes, if the DEBIT amount is not present. |

|

Editable: |

Yes |

|

Notes: |

A negative number is treated as a debit. |

| Field Name: | EXCH_RATE_DATE |

|

UI Field Name: |

Exchange Rate Date |

|

Type: |

Date |

|

Length: |

10 |

|

Default Value: |

Today |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

None |

|

Required: |

Yes, unless you provide the EXCHANGE_RATE. |

|

Editable: |

Yes |

|

Notes: |

Use only in multi-currency companies. This field determines the exchange rate as of this date. |

| Field Name: | TAX_LINE_NO - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

No field name as such. These fields are the incrementing numbers for the tax lines specific to line items. |

|

Type: |

Number |

|

Length: |

4 |

|

Default Value: |

None |

|

Valid Values: |

Positive integer |

|

Dependencies: |

For VAT and GST tax solutions, start with 1 for the first tax line of a line item, and increment by 1 for each subsequent line. |

|

Required: |

Yes, only if there are Inbound or Outbound tax implications and there are multiple taxes for the line. |

|

Editable: |

No |

| Field Name: | TAX_DETAILID - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Tax detail |

|

Type: |

Character |

|

Length: |

100 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore. |

|

Dependencies: |

For VAT or GST tax solutions, refers to a valid tax detail ID. |

|

Required: |

Yes, only if there are Inbound or Outbound tax implications. |

|

Editable: |

Yes |

|

Notes: |

Specify both a tax detail (TAX_DETAILID) and the amount of the tax (TAX_AMOUNT). |

| Field Name: | TAX_AMOUNT - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Transaction tax |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Any number |

|

Dependencies: |

Used for VAT or GST tax solutions |

|

Required: |

Yes, only if there are Inbound or Outbound tax implications. |

|

Editable: |

Yes |

|

Notes: |

Specify both a tax detail (TAX_DETAILID) and the amount of the tax (TAX_AMOUNT). |

All standard fields for General Ledger journal entry import

| Field Name: | DONOTIMPORT |

|---|---|

|

# |

Any row that starts with # is ignored during import. |

| Field Name: |

JOURNAL |

|

UI Field Name: |

Journal |

|

Type: |

Character |

|

Length: |

4 |

|

Default Value: |

None |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | DATE |

|

UI Field Name: |

Date |

|

Type: |

Date |

|

Length: |

24 |

|

Default Value: |

Current Date |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

|

Note: |

Typically the next day after you close your old accounting system and start a new set of books in Intacct. If you do not enter a date, the default is today. Be careful when entering the beginning date. For example, if you enter a date as of 2 fiscal years ago because you want to be able to print comparative financial statements, you must then make Journal entries for the ending GL balances for all the periods between your standing balance and the date you actually begin using Intacct.

If you are uploading historical transactions, be sure that your starting balances CONTAIN these uploaded transactions, and set the date to that date. If you set the wrong starting date for your GL balances, you can clear the transactions using the Company Setup Checklist and start again. |

| Field Name: | REVERSEDATE |

|

UI Field Name: |

Reverse Date |

|

Type: |

Date |

|

Length: |

24 |

|

Default Value: |

Current Date |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes |

|

Note: |

Usually the reverse date is the transaction date plus one day; however, you can input any other date. |

| Field Name: | DESCRIPTION |

|

UI Field Name: |

Description |

|

Type: |

Character |

|

Length: |

80 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | REFERENCE_NO |

|

UI Field Name: |

Reference Number |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Any. |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

N/A |

|

Note: |

You cannot have duplicate numbers within any company. In multi-entity companies that use multiple currencies, two entity companies can use the same number. |

| Field Name: | TAXIMPLICATIONS - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Tax implications |

|

Type: |

Character |

|

Length: |

25 |

|

Default Value: |

None |

|

Valid Values: |

None, Inbound, Outbound |

|

Dependencies: |

For VAT or GST tax solutions |

|

Required: |

No |

|

Editable: |

Yes |

|

Note: |

If left blank, defaults to None. |

| Field Name: | TAXSOLUTIONID - This field only applies to companies subscribed to the Taxes application. |

| UI Field Name: | Tax solution |

| Type: | Character |

| Length: | 100 |

| Default Value: | None |

| Valid Values: | Alphanumeric and underscore |

| Dependencies: | For VAT and GST tax solutions; refers to a valid VAT or GST tax solution |

|

Required: |

Yes, only if your organization is configured for multiple tax jurisdictions and you are importing from the top level. |

| Editable: | No |

| Note: | Only applicable if Inbound or Outbound tax implications |

| Field Name: | TAXVENDORID - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Vendor |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Refers to a valid vendor |

|

Dependencies: |

For VAT or GST tax solutions |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Only applicable if Inbound tax implications |

| Field Name: | TAX_CUSTOMERID - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Customer |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Refers to a valid customer ID |

|

Dependencies: |

For VAT or GST tax solutions |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Only applicable if Outbound tax implications |

| Field Name: | TAX_CONTACTID - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Contact |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

|

|

Valid Values: |

Refers to a valid contact ID |

|

Dependencies: |

For VAT or GST tax solutions |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Only applicable if Inbound or Outbound tax implications; overrides the vendor pay-to Contact ID or the customer ship-to Contact ID for VAT reporting purposes |

| Field Name: | LINE_NO |

|

UI Field Name: |

No field name as such. These are the line numbers on the left side of the transaction area. |

|

Type: |

Number |

|

Length: |

Any |

|

Default Value: |

None |

|

Valid Values: |

Positive integer |

|

Dependencies: |

Start with 1 for the first line of a transaction, and increment by one for each subsequent line. Also must be unique per journal entry and per journal. For example, Summary 1 might contain line numbers 1-20, Summary 2 might contain line numbers 1-44, and so on. |

|

Required: |

Yes |

|

Editable: |

No |

| Field Name: | ACCT_NO |

|

UI Field Name: |

Account |

|

Type: |

Character |

|

Length: |

24 |

|

Default Value: |

None |

|

Valid Values: |

Any; must conform to primary/sub account specification in Company > Setup: Company Info |

|

Dependencies: |

None |

|

Required: |

Yes |

|

Editable: |

Yes |

| Field Name: | LOCATION_ID |

|

UI Field Name: |

Location |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

Refers to a valid location |

|

Required: |

No |

|

Editable: |

Yes |

| Note: | Because GL Transactions contain fields for both department and location, you can enter as many unique GL transaction department/location combinations as you want. |

| Field Name: | DEPT_ID |

|

UI Field Name: |

Department |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

Refers to a valid department |

|

Required: |

No |

|

Editable: |

Yes |

| Note: | Because GL Transactions contain fields for both department and location, you can enter as many unique GL transaction department/location combinations as you want. |

| Field Name: | DOCUMENT |

|

UI Field Name: |

Document |

|

Type: |

Character |

|

Length: |

30 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes |

| Note: | Optionally include a document number for your reference. |

| Field Name: | MEMO |

|

UI Field Name: |

Memo |

|

Type: |

Character |

|

Length: |

1000 |

|

Default Value: |

None |

|

Valid Values: |

Any |

|

Dependencies: |

The uploaded file must contain a number in either the DEBIT or CREDIT field. For example, if you do not have a debit amount, you must have a credit. You can import negative numbers for either, in which case a negative debit amount is treated as a credit, and a negative credit is treated as a debit. |

|

Required: |

No |

|

Editable: |

Yes |

| Field Name: | DEBIT |

|

UI Field Name: |

Debit |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Any number |

|

Dependencies: |

The uploaded file must contain a number in either the DEBIT or CREDIT field. For example, if you do not have a debit amount, you must have a credit. You can import negative numbers for either, in which case a negative debit amount is treated as a credit, and a negative credit is treated as a debit. |

|

Required: |

Yes, if CREDIT amount is not present. |

|

Editable: |

Yes |

|

Notes: |

A negative number is treated as a credit. |

| Field Name: | CREDIT |

|

UI Field Name: |

Credit |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Any number |

|

Dependencies: |

None |

|

Required: |

Yes, if DEBIT amount is not present |

|

Editable: |

Yes |

|

Notes: |

A negative number is treated as a debit. |

| Field Name: | SOURCEENTITY |

|

UI Field Name: |

Source Entity |

|

Type: |

Character |

|

Length: |

20 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

Refers to a valid location |

|

Required: |

Only when the option to auto-create inter-entity transactions is enabled for journal entries and the journal entry is not balanced by location. |

|

Editable: |

Yes |

| Field Name: | CURRENCY |

|

UI Field Name: |

Currency |

|

Type: |

Character |

|

Length: |

3 |

|

Default Value: |

Base Currency |

|

Valid Values: |

Any defined currency, such as USD or EUR; blank denotes base currency |

|

Dependencies: |

Must

reference a previously defined currency. To define a currency,

go to |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Use only in multi-currency companies. This field defines the transaction currency. If no field is defined here, Intacct uses base currency. |

| Field Name: | EXCH_RATE_DATE |

|

UI Field Name: |

Exchange Rate Date |

|

Type: |

Date |

|

Length: |

10 |

|

Default Value: |

Today |

|

Valid Values: |

Any valid date format |

|

Dependencies: |

None |

|

Required: |

Yes, unless you provide the EXCHANGE_RATE |

|

Editable: |

Yes |

|

Notes: |

Use only in multi-currency companies. This field determines the exchange rate as of this date. |

| Field Name: | EXCH_RATE_TYPE_ID |

|

UI Field Name: |

Exchange Rate Type |

|

Type: |

Character |

|

Length: |

40 |

|

Default Value: |

Intacct Daily Rate, unless a custom exchange rate is defined as the default |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

Must reference a previously defined exchange rate type |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Use only in multi-currency companies. Defines an optional custom exchange rate type. The Intacct Daily Rate is used if no rate is defined here. |

| Field Name: | EXCHANGE_RATE |

|

UI Field Name: |

Exchange Rate |

|

Type: |

Number |

|

Length: |

17, not including decimal point |

|

Default Value: |

Defaults to the exchange rate of the CURRENCY on the EXCH_RATE_DATE for the EXCH_RATE_TYPE. |

|

Valid Values: |

Positive integers |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

Yes |

|

Notes: |

Use only in multi-currency companies. Overrides the default exchange rate, which is the product of the CURRENCY, EXCH_RATE_DATE, and EXCH_RATE_TYPE. |

| Field Name: | STATE |

|

UI Field Name: |

State |

|

Type: |

Character |

|

Length: |

6 |

|

Valid Values: |

Draft, Posted |

|

Required: |

No |

|

Editable: |

Only if the State is Draft. |

|

Notes: |

This field is case-sensitive. It defaults to Posted if you enter anything other than Draft (such as DRAFT) or if you leave the field blank. |

| Field Name: | ALLOCATION_ID |

|

UI Field Name: |

Allocation |

|

Type: |

Character |

|

Length: |

50 |

|

Default Value: |

None |

|

Valid Values: |

An existing valid Allocation |

|

Dependencies: |

None |

|

Required: |

No |

|

Editable: |

No |

| Field Name: | TAX_LINE_NO - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

No field name as such. These are the incrementing numbers for the tax lines specific to line items. |

|

Type: |

Number |

|

Length: |

4 |

|

Default Value: |

None |

|

Valid Values: |

Positive integer |

|

Dependencies: |

For VAT and GST tax solutions; start with 1 for the first tax line of a line item, and increment by one for each subsequent line. |

|

Required: |

Yes, only if there are Inbound or Outbound tax implications and there are multiple taxes for the line. |

|

Editable: |

No |

| Field Name: | TAX_DETAILID - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Tax detail |

|

Type: |

Character |

|

Length: |

100 |

|

Default Value: |

None |

|

Valid Values: |

Alphanumeric and underscore |

|

Dependencies: |

For VAT or GST tax solutions; refers to a valid tax detail ID. |

|

Required: |

Yes, only if there are Inbound or Outbound tax implications. |

|

Editable: |

Yes |

|

Notes: |

Specify both a tax detail (TAX_DETAILID) and the amount of the tax (TAX_AMOUNT). |

| Field Name: | TAX_AMOUNT - This field only applies to companies subscribed to the Taxes application. |

|

UI Field Name: |

Transaction tax |

|

Type: |

Number |

|

Length: |

38,2 |

|

Default Value: |

None |

|

Valid Values: |

Any number |

|

Dependencies: |

For VAT or GST tax solutions |

|

Required: |

Yes, only if there are Inbound or Outbound tax implications. |

|

Editable: |

Yes |

|

Notes: |

Specify both a tax detail (TAX_DETAILID) and the amount of the tax (TAX_AMOUNT). |

| Field Name: | GLENTRY_PROJECTID |

|

UI Field Name: |

Project |

|

Type: |

Character |

|

Length: |

20 |

|

Dependencies: |

A valid Project |

|

Required: |

No |

| Field Name: | GLENTRY_CUSTOMERID |

|

UI Field Name: |

Customer |

|

Type: |

Character |

|

Length: |

20 |

|

Dependencies: |

A valid Customer |

|

Required: |

No |

| Field Name: | GLENTRY_VENDORID |

|

UI Field Name: |

Vendor |

|

Type: |

Character |

|

Length: |

20 |

|

Dependencies: |

A valid Vendor. |

|

Required: |

No |

| Field Name: | GLENTRY_EMPLOYEEID |

|

UI Field Name: |

Employee |

|

Type: |

Character |

|

Length: |

20 |

|

Dependencies: |

A valid Employee. |

|

Required: |

No |

|

Field Name: |

GLENTRY_ITEMID |

|

UI Field Name: |

Item |

|

Type: |

Character |

|

Length: |

20 |

|

Dependencies: |

A valid Item. |

|

Required: |

No |

|

Field Name: |

GLENTRY_CLASSID |

|

UI Field Name: |

Class |

|

Type: |

Character |

|

Length: |

20 |

|

Dependencies: |

A valid Class. |

|

Required: |

No |