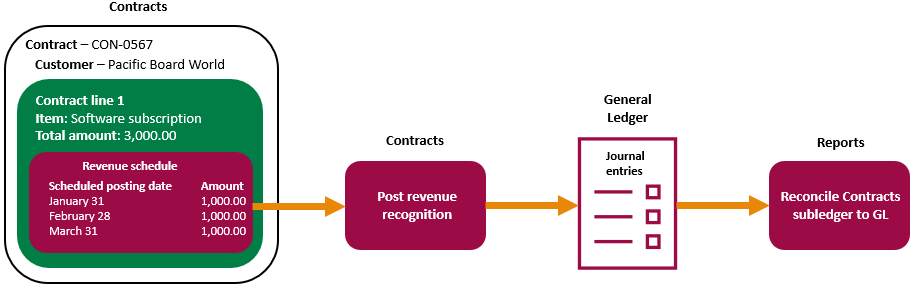

Contract revenue recognition workflow

A contract line represents the product or service that you are providing to a customer in a contract. When you add a contract line to a contract, you enter dates, pricing, and specify a revenue template. The revenue template defines the rules for how to schedule the revenue. Intacct then generates a revenue schedule for the contract line based on the defined criteria.

You can post revenue manually or Intacct can post it automatically on the scheduled posting date, depending on the revenue template settings. The revenue recognition posting process picks up the revenue schedule amounts for the contract line as of the given date. It creates journal entries in the applicable revenue journal that debit the applicable Deferred Revenue account and credit the applicable Sales Revenue account.

Per you business process, you can then reconcile the Contracts subledger to the General Ledger. The Contracts subledger reports can show the journal balances for the unbilled, billed, and paid values for Accounts Receivable, Deferred Revenue, and Sales Revenue.

The revenue recognition process is generally the same. When you post the revenue, you'll post revenue to journal 1 and then post to journal 2. When you reconcile, you'll need to make sure you are using the values for the correct revenue journal when running the reports.

In order to be ASC 606 compliant, companies are required to disclose the state of contracts (or category of contract) as having either recognized revenue greater than cash collected (contract asset), or recognized revenue less than cash collected (contract liability). Contracts is designed so your financial statements can potentially separate out each line item of each contract into the various GL accounts when revenue is in a particular state.

Unbilled Deferred Revenue acts as a contra account to Unbilled AR in the asset section of the balance sheet so that the unbilled accounts have no effect on the balance sheet until Unbilled Sales Revenue is recognized. That event reduces Unbilled Deferred Revenue, so Unbilled AR only appears on the balance sheet when Unbilled Sales Revenue is posted. This correctly shows unbilled AR only when unbilled revenue is recognized.

When payment is received prior to revenue recognition, the amounts may need to be recorded as a contract liability. You can analyze the status of Paid Deferred Revenue, Paid Sales Revenue accounts, and Unbilled Sales Revenue and Unbilled will show the net contract asset/liability positions.

The Billed AR, Billed Deferred Revenue, and Billed Sales Revenue accounts are for amounts that are neither unbilled nor paid.

Learn more about the Contracts accounting flow.